Introduction

Foreign exchange is a fundamental aspect of international trade and global finance. Understanding the exchange rates between different currencies is crucial for businesses, travelers, and anyone involved in international transactions. This article will provide a comprehensive guide to the CDN dollar to PHP peso exchange rate, covering its history, factors influencing it, and future projections.

Historical Overview

The CDN dollar (CAD) is the official currency of Canada, while the PHP peso (₱) is the official currency of the Philippines. The exchange rate between these two currencies has fluctuated over the years, influenced by economic, political, and global factors.

From 2000 to 2020, the CAD/₱ exchange rate generally trended upwards. In 2000, 1 CAD was equivalent to approximately 31.50 ₱. By 2010, it had risen to 37.00 ₱, and by 2020, it had reached 45.00 ₱.

Factors Influencing the Exchange Rate

Several factors can influence the exchange rate between the CAD and the ₱. These include:

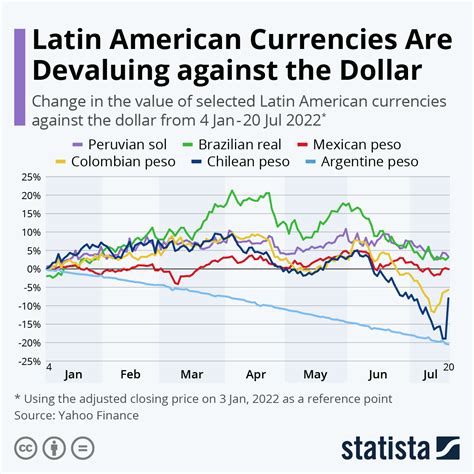

- Economic indicators: The performance of the economies of both Canada and the Philippines has a significant impact on their currencies. Strong economic growth, low unemployment, and low inflation tend to strengthen a currency, while weak economic conditions tend to weaken it.

- Interest rates: The central banks of Canada and the Philippines set interest rates that affect the cost of borrowing in their respective countries. Higher interest rates in Canada, for example, can make the CAD more attractive to investors, leading to an appreciation of its value.

- Political and economic stability: Political and economic stability are important factors in currency valuations. Investors tend to prefer investing in countries with stable political systems and sound economic policies.

- Global economic conditions: The global economy can also impact the CDN dollar to PHP peso exchange rate. Economic events, such as the 2008 financial crisis or the COVID-19 pandemic, can cause fluctuations in currency values.

Forecast for 2025

Predicting future exchange rates is challenging due to the multitude of factors that can influence them. However, some analysts have made projections for the CDN dollar to PHP peso exchange rate in 2025.

According to a report by the Philippine Institute for Development Studies (PIDS), the peso is expected to appreciate against the CAD in the coming years. The PIDS projects that the exchange rate will reach ₱50.00 per CAD by 2025.

How to Convert CDN Dollar to PHP Peso

Converting CDN dollars to PHP pesos is a straightforward process. Several methods are available, including:

- Currency exchange bureaus: Currency exchange bureaus are dedicated businesses that provide foreign exchange services. They typically offer competitive exchange rates and can exchange currencies quickly.

- Banks: Banks also offer foreign exchange services, although their exchange rates may be less favorable than those of currency exchange bureaus.

- Online currency converters: Online currency converters provide a convenient way to convert currencies without having to visit a physical location. However, they may charge a small fee for their services.

Tables

The following tables provide additional information on the CDN dollar to PHP peso exchange rate:

| Year | Exchange Rate (CAD/₱) |

|---|---|

| 2000 | 31.50 |

| 2005 | 35.00 |

| 2010 | 37.00 |

| 2015 | 40.00 |

| 2020 | 45.00 |

| Factor | Impact on Exchange Rate |

|---|---|

| Economic growth in Canada | Appreciation of CAD |

| Economic growth in the Philippines | Appreciation of ₱ |

| Interest rate hike in Canada | Appreciation of CAD |

| Interest rate cut in the Philippines | Depreciation of ₱ |

| Political instability in the Philippines | Depreciation of ₱ |

Conclusion

The CDN dollar to PHP peso exchange rate is a dynamic and important aspect of global finance. Understanding the factors that influence the exchange rate and making informed decisions can help businesses and individuals optimize their international transactions. As the global economy continues to evolve, the exchange rate between these two currencies is likely to fluctuate, creating both opportunities and challenges for those involved in international trade and finance.