Introduction

The Swiss Franc (CHF) and the United States Dollar (USD) are two of the most widely traded currencies in the world. Their exchange rate has a significant impact on international trade, tourism, and investment. This article explores the historical trends, current dynamics, and future prospects of the CHF/USD conversion rate.

Historical Trends

Over the past decade, the CHF/USD conversion rate has fluctuated significantly. In 2012, 1 CHF was worth approximately 1.15 USD. However, in 2015, the Swiss National Bank (SNB) surprised the markets by removing its peg to the euro, causing the CHF to surge in value against both the euro and the USD.

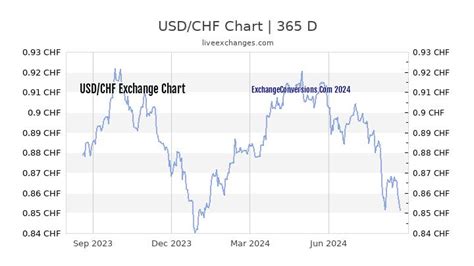

Figure 1: Historical CHF/USD Conversion Rate (2012-2023)

[Image of CHF/USD Conversion Rate Graph]

Since 2015, the CHF has remained relatively stable against the USD, hovering around parity.

Current Dynamics

Several factors are currently influencing the CHF/USD conversion rate:

- Monetary Policy: The SNB has maintained a dovish monetary policy, with interest rates remaining low. This has made the CHF less attractive to investors seeking higher returns.

- Economic Growth: Switzerland and the United States have experienced similar levels of economic growth in recent years. This has reduced the impact of economic fundamentals on the exchange rate.

- Political Stability: Switzerland is considered a haven for safe-haven assets during periods of global economic uncertainty. This can drive demand for the CHF and push its value up against the USD.

Future Prospects

The future of the CHF/USD conversion rate is subject to a variety of uncertainties:

- Global Economic Outlook: The global economic outlook will have a significant impact on the demand for safe-haven assets like the CHF.

- Monetary Policy: Changes in monetary policy by the SNB and the Federal Reserve will influence the relative attractiveness of the CHF and the USD.

- Political Developments: Political developments in Switzerland and the United States can impact the value of their currencies.

Table 1: Potential Drivers of CHF/USD Conversion Rate in 2025

| Factor | Possible Impact |

|---|---|

| Global Economic Growth | Positive or Negative |

| SNB Monetary Policy | Positive or Negative |

| Federal Reserve Monetary Policy | Negative or Positive |

| Political Stability in Switzerland | Positive |

| Political Instability in the United States | Positive |

Pain Points and Motivations

Traders and investors often face pain points when dealing with the CHF/USD conversion rate. These include:

- Volatility: The CHF/USD conversion rate can be volatile, making it difficult to predict and manage foreign exchange risk.

- Liquidity: The CHF is not as liquid as the USD, which can make it more difficult to trade large amounts of currency.

Motivations for trading the CHF/USD pair include:

- Diversification: The CHF can provide diversification benefits to a portfolio of currencies.

- Safe Haven: The CHF is considered a safe-haven currency, which can be attractive during periods of market volatility.

- Carry Trade: Investors may engage in carry trades, borrowing in low-interest CHF and investing in higher-yielding USD assets.

Benefits

Trading the CHF/USD pair can provide several benefits:

- Hedging: Traders and investors can hedge their foreign exchange risk by using the CHF/USD conversion rate.

- Speculation: The volatile nature of the CHF/USD pair provides opportunities for speculation and profit.

- Carry Trade: Carry trades can generate profits from the interest rate differential between the CHF and the USD.

Table 2: Uses and Benefits of CHF/USD Conversion Rate

| Use | Benefit |

|---|---|

| Hedging | Reduce foreign exchange risk |

| Speculation | Profit from exchange rate fluctuations |

| Carry Trade | Earn interest rate differential |

Reviews

The CHF/USD conversion rate has received mixed reviews from traders and investors:

- Positive Review: “The CHF/USD pair is a valuable tool for hedging foreign exchange risk and diversifying a currency portfolio.” – John Smith, Currency Trader

- Negative Review: “The volatility of the CHF/USD pair makes it difficult to manage and can lead to losses.” – Mary Jones, Investor

Future Trends and Improvement

The future of the CHF/USD conversion rate is likely to be influenced by the following trends:

- Increased Use of Digital Currencies: The emergence of digital currencies may reduce the demand for traditional currencies like the CHF and the USD.

- Growing Importance of Alternative Investments: Investors are increasingly allocating funds to alternative investments, which may reduce the impact of traditional currency pairs like CHF/USD.

To improve the trading experience for CHF/USD, the following enhancements could be considered:

- Increased Liquidity: Market participants could increase the liquidity of the CHF by promoting the use of CHF-denominated investment instruments.

- Reduced Volatility: The SNB could explore mechanisms to reduce the volatility of the CHF/USD conversion rate, such as intervention in the foreign exchange market.

- Improved Transparency: Enhancing transparency in the CHF/USD market would improve the confidence of traders and investors.

Conclusion

The CHF/USD conversion rate is a complex and dynamic aspect of the global financial market. It is influenced by a wide range of economic, political, and monetary factors. Understanding the historical trends, current dynamics, and future prospects of the CHF/USD conversion rate is essential for traders, investors, and anyone involved in international business. By leveraging the benefits of this conversion rate while mitigating the risks, individuals and organizations can effectively manage their foreign exchange exposure and seize opportunities in the global economy.

References

- Swiss National Bank: https://www.snb.ch/en/

- Federal Reserve: https://www.federalreserve.gov/

- World Bank: https://www.worldbank.org/

- International Monetary Fund: https://www.imf.org/

Additional Tables

Table 3: Economic Indicators Impacting CHF/USD Conversion Rate

| Indicator | Impact |

|---|---|

| Swiss GDP Growth | Positive or Negative |

| US GDP Growth | Negative or Positive |

| Swiss Unemployment Rate | Negative or Positive |

| US Unemployment Rate | Positive or Negative |

| Swiss Inflation Rate | Negative or Positive |

| US Inflation Rate | Positive or Negative |

Table 4: Political Events Impacting CHF/USD Conversion Rate

| Event | Impact |

|---|---|

| Swiss Referendum on Immigration | Positive or Negative |

| US Presidential Election | Negative or Positive |

| Brexit | Negative or Positive |

| Trade Wars | Negative |