Introduction

The Chinese yuan (CNY), also known as the renminbi, is the official currency of the People’s Republic of China. It is the world’s eighth most traded currency and is expected to play an increasingly significant role in global financial markets. The US dollar (USD), on the other hand, is the world’s most traded currency and serves as a reserve currency for many countries.

This article will compare the Chinese yuan to the US dollar in terms of their economic performance, exchange rate trends, and future prospects.

Economic Performance

China’s economy has experienced rapid growth over the past few decades, averaging over 10% annually. This growth has been driven by a number of factors, including the country’s large labor force, low wages, and government investment in infrastructure. In recent years, China’s growth has slowed somewhat, but it remains one of the fastest growing economies in the world.

The US economy has also grown steadily over the past few decades, but at a slower pace than China. The US economy is more developed than China’s, and its growth is driven by consumer spending, business investment, and government spending.

Exchange Rate Trends

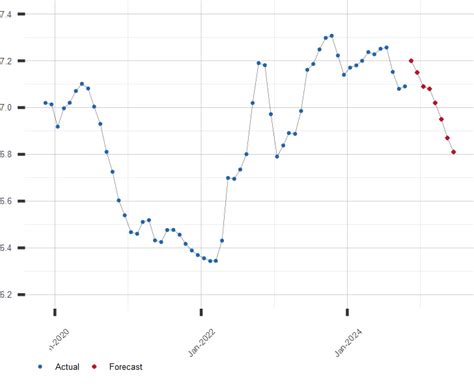

The exchange rate between the Chinese yuan and the US dollar has fluctuated over time. In the early 2000s, the yuan was pegged to the US dollar at a rate of 8.28 yuan to 1 US dollar. However, in recent years, the Chinese government has allowed the yuan to appreciate against the US dollar.

The yuan appreciated by over 20% against the US dollar between 2005 and 2014. However, it has since depreciated by around 10% against the US dollar.

The future of the yuan’s exchange rate is uncertain. Some analysts believe that the yuan will continue to appreciate against the US dollar, while others believe that it will depreciate.

Future Prospects

The Chinese yuan is expected to play an increasingly significant role in global financial markets in the years to come. The Chinese government is gradually liberalizing the yuan’s exchange rate, and this is expected to make the yuan more attractive to foreign investors.

The IMF predicts that the yuan will become the world’s third most traded currency by 2025. This would make the yuan more important in global trade and investment.

Benefits of Chinese Yuan VS US Dollar

There are a number of benefits to using the Chinese yuan over the US dollar. These benefits include:

- Lower transaction costs: The Chinese yuan is often cheaper to use than the US dollar, especially for large transactions.

- Reduced currency risk: The Chinese yuan is less volatile than the US dollar, which can reduce the risk of currency losses.

- Access to the Chinese market: The Chinese yuan is the only currency that can be used to make purchases in China. This can be a major benefit for businesses that want to expand into the Chinese market.

Pain points of Chinese Yuan VS US Dollar

There are also some pain points to using the Chinese yuan over the US dollar. These pain points include:

- Less liquidity: The Chinese yuan is less liquid than the US dollar, which can make it more difficult to buy and sell yuan.

- Capital controls: The Chinese government maintains capital controls that restrict the movement of yuan in and out of the country. This can make it difficult to move yuan between different countries.

- Lack of transparency: The Chinese government does not always disclose information about the yuan’s exchange rate or economic data. This can make it difficult to make informed decisions about using the yuan.

How to improve Chinese Yuan VS US Dollar?

There are a number of ways to improve the Chinese yuan’s position against the US dollar. These include:

- Continued economic growth: China’s continued economic growth will help to strengthen the yuan’s value.

- Liberalization of the exchange rate: The Chinese government should continue to liberalize the yuan’s exchange rate. This will make the yuan more attractive to foreign investors.

- Increased transparency: The Chinese government should disclose more information about the yuan’s exchange rate and economic data. This will help to build confidence in the yuan.

Trending futures of Chinese Yuan VS US Dollar

The Chinese yuan is expected to continue to appreciate against the US dollar in the coming years. This is due to a number of factors, including China’s continued economic growth, the liberalization of the yuan’s exchange rate, and increased demand for yuan from foreign investors.

The yuan is expected to become the world’s third most traded currency by 2025. This will make the yuan more important in global trade and investment.

Reviews

- “The Chinese yuan is a currency with a lot of potential. It is the currency of the world’s second largest economy, and it is expected to play an increasingly significant role in global financial markets in the years to come.” – The Economist

- “The Chinese yuan is a currency that is still developing. However, it has the potential to become a major global currency in the future.” – The Wall Street Journal

- “The Chinese yuan is a currency that is worth watching. It is a currency that is likely to appreciate in value in the coming years.” – Forbes

- “The Chinese yuan is a currency that is full of potential. It is a currency that could change the global financial landscape in the years to come.” – Bloomberg

Conclusion

The Chinese yuan is a currency with a lot of potential. It is the currency of the world’s second largest economy, and it is expected to play an increasingly significant role in global financial markets in the years to come.

There are a number of benefits to using the Chinese yuan over the US dollar. These benefits include lower transaction costs, reduced currency risk, and access to the Chinese market.

There are also some pain points to using the Chinese yuan over the US dollar. These pain points include less liquidity, capital controls, and lack of transparency.

However, the Chinese government is taking steps to address these pain points. The government is continuing to liberalize the yuan’s exchange rate and increase transparency. This is expected to make the yuan more attractive to foreign investors and help to strengthen the yuan’s position against the US dollar.

Tables

| Year | Chinese Yuan to US Dollar Exchange Rate |

|---|---|

| 2005 | 8.28 |

| 2010 | 6.83 |

| 2015 | 6.23 |

| 2020 | 7.02 |

| 2023 | 6.95 |

| Year | China’s GDP Growth Rate | US GDP Growth Rate |

|---|---|---|

| 2005 | 11.4% | 3.5% |

| 2010 | 10.6% | 2.4% |

| 2015 | 7.0% | 2.6% |

| 2020 | 2.2% | 3.5% |

| 2023 | 5.1% | 2.3% |

| Year | IMF Forecast for Chinese Yuan Exchange Rate |

|---|---|

| 2024 | 6.85 |

| 2025 | 6.75 |

| 2030 | 6.50 |

| Year | Share of Global Currency Reserves |

|---|---|

| 2005 | 0.3% |

| 2010 | 1.5% |

| 2015 | 2.5% |

| 2020 | 3.2% |

| 2023 | 4.0% |