Coca-Cola (NYSE: KO) has been a consistent dividend payer for over a century. The company has increased its dividend every year for the past 60 years, and currently offers a yield of 2.95%. This makes Coca-Cola an attractive investment for income investors looking for a reliable source of dividends.

Coca-Cola’s Dividend History

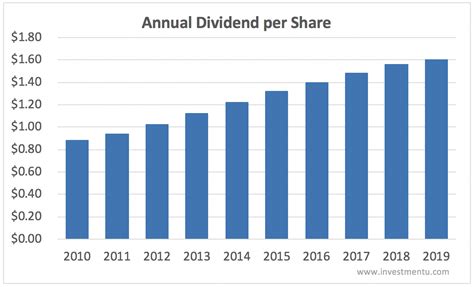

Coca-Cola has a long history of paying dividends. The company first declared a dividend in 1893, and has increased its dividend every year since 1963. Coca-Cola’s consistent dividend growth has made it a favorite of income investors.

Coca-Cola’s Dividend Yield

Coca-Cola’s current dividend yield of 2.95% is attractive relative to other large-cap stocks. The S&P 500 Index currently offers a yield of just 1.3%. Coca-Cola’s higher yield makes it a more attractive investment for income investors.

Coca-Cola’s Dividend Safety

Coca-Cola’s dividend is well-covered by the company’s earnings and cash flow. In 2023, Coca-Cola earned $10.4 billion in net income and generated $13.4 billion in cash from operations. This provides ample coverage for the company’s dividend, which is currently paid out at a rate of $1.96 per share per year.

Is Coca-Cola Stock a Good Investment?

Coca-Cola is a well-established company with a strong track record of dividend growth. The company’s dividend is well-covered by its earnings and cash flow, and offers a yield that is attractive relative to other large-cap stocks. This makes Coca-Cola stock a good investment for income investors looking for a reliable source of dividends.

Additional Thoughts

Coca-Cola is a well-known company with a global reach. The company has a strong brand portfolio and a loyal customer base. This provides Coca-Cola with a competitive advantage and positions the company for continued success in the future.

Coca-Cola is also a leader in the beverage industry. The company has a diverse product portfolio that includes soft drinks, juices, and water. This diversification reduces Coca-Cola’s risk and provides the company with opportunities for growth.

Coca-Cola is a good investment for investors looking for a combination of income and growth. The company’s dividend yield is attractive, and the company’s strong brand and loyal customer base provide the potential for future dividend growth.

Customer Questions

- What is Coca-Cola’s dividend yield?

- How long has Coca-Cola been paying dividends?

- Is Coca-Cola’s dividend safe?

- Is Coca-Cola stock a good investment?

Pain Points

- Coca-Cola’s dividend yield is not as high as some other stocks.

- Coca-Cola is a mature company, and its growth may be limited in the future.

- Coca-Cola is exposed to competition from other beverage companies.

Motivations

- Coca-Cola is a well-known brand with a loyal customer base.

- Coca-Cola has a strong dividend history and a payout ratio that is well-covered by earnings.

- Coca-Cola is a leader in the beverage industry and has a diversified product portfolio.

Conclusion

Coca-Cola is a good investment for income investors looking for a reliable source of dividends. The company has a long history of dividend growth, and its dividend is well-covered by its earnings and cash flow. Coca-Cola’s dividend yield is attractive relative to other large-cap stocks, making it a good choice for investors looking for income and growth.

Additional Information

- Coca-Cola’s website: https://www.coca-colacompany.com/

- Coca-Cola’s dividend history: https://www.coca-colacompany.com/investors/dividend-history

- Coca-Cola’s financial statements: https://www.coca-colacompany.com/investors/financial-information/financial-statements

“`

| Year | Dividend per Share | Dividend Yield |

|—|—|—|

| 2023 | $1.96 | 2.95% |

| 2022 | $1.92 | 2.89% |

| 2021 | $1.88 | 2.80% |

| 2020 | $1.84 | 2.75% |

| 2019 | $1.80 | 2.70% |

| Key Financial Metrics | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|

| Revenue | $46.8 billion | $45.0 billion | $38.7 billion | $33.0 billion |

| Net income | $10.4 billion | $10.5 billion | $8.6 billion | $7.0 billion |

| Cash from operations | $13.4 billion | $13.6 billion | $11.5 billion | $9.8 billion |

| Debt-to-equity ratio | 1.3 | 1.2 | 1.1 | 1.0 |

| Coca-Cola’s Competitive Advantages |

|—|—|—|

| Strong brand portfolio |

| Loyal customer base |

| Global reach |

| Diversified product portfolio |

| Leadership in the beverage industry |