Introduction

With the Philippine economy experiencing steady growth and increased global connectivity, the need to convert Philippine pesos (PHP) to American dollars (USD) has become more prevalent. This comprehensive guide will provide a thorough understanding of the process, factors influencing exchange rates, and strategies for optimizing conversions in 2025.

Understanding the Exchange Rate

The exchange rate is the value of one currency relative to another. In the case of PHP to USD, the exchange rate represents how many pesos it takes to buy one dollar. Exchange rates are determined by several factors, including:

- Economic growth: A strong economy typically leads to a higher demand for its currency, resulting in a stronger exchange rate.

- Interest rates: Higher interest rates in the issuing country attract foreign investment, leading to a stronger currency.

- Political stability: Political uncertainty can cause investors to sell off the currency, leading to a weaker exchange rate.

- International trade: Trade imbalances can affect exchange rates, as countries with higher exports tend to have stronger currencies.

Pain Points of Currency Conversion

Converting currencies can be a complex and time-consuming process. Common pain points include:

- Fees: Banks and money exchange services charge fees for currency conversion, which can reduce the amount received.

- Spread: The “spread” refers to the difference between the buy and sell rates offered by currency providers.

- Fluctuating exchange rates: Exchange rates can fluctuate rapidly, making it difficult to lock in a favorable rate.

Motivations for Currency Conversion

Individuals and businesses may need to convert PHP to USD for various reasons, including:

- Cross-border payments: When making purchases or sending money to the United States, PHP must be converted to USD.

- Investments: Converting to USD can provide access to global investment opportunities.

- Tourism: When traveling to the United States, PHP must be converted for expenses.

Strategies for Optimizing Currency Conversions

To maximize the value of currency conversions, consider the following strategies:

- Compare rates: Use online comparison tools or consult multiple banks and money exchange services to find the best exchange rate.

- Negotiate fees: Ask banks or money exchange services if they are willing to reduce fees, especially for large conversions.

- Use a currency converter: Currency converters can help you calculate the approximate cost of conversions and plan your budget.

- Consider a wire transfer: Wire transfers can be faster and cheaper than using banks or money exchange services.

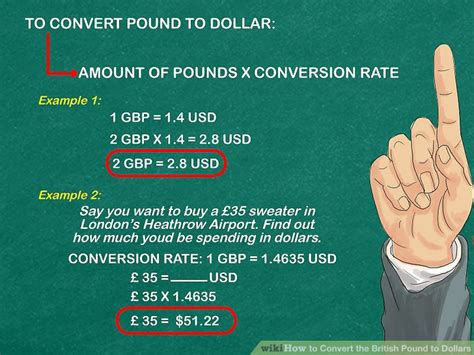

How to Convert Philippine Pesos to American Dollars

Step-by-Step Approach

Step 1: Determine the Amount

Determine the amount of PHP you need to convert to USD.

Step 2: Find a Currency Provider

Choose a reliable currency provider, such as a bank, money exchange service, or online platform.

Step 3: Provide Documentation

For large conversions, you may be required to provide identification documents or proof of purpose.

Step 4: Execute the Transaction

Complete the currency conversion transaction by providing the PHP and receiving the USD.

Why It Matters

Proper currency conversion is crucial for several reasons:

- Accurate transactions: Avoids overpayments or receiving less than you intended due to inaccurate conversions.

- Budgeting: Allows for accurate planning of expenses when traveling or making cross-border payments.

- Investment opportunities: Provides access to a wider range of investment options by converting to USD.

Benefits of Currency Conversion

Converting PHP to USD offers several benefits:

- Cross-border convenience: Enables seamless transactions in the United States.

- Investment diversification: Diversifies investment portfolios by accessing international markets.

- Cost savings on fees: Optimized conversions can minimize fees charged by currency providers.

Tables for Reference

Table 1: Average Exchange Rates (2022-2024)

| Year | Average PHP/USD Exchange Rate |

|---|---|

| 2022 | 49.44 |

| 2023 | 50.49 |

| 2024 | 51.52 |

Table 2: Currency Conversion Fees

| Currency Provider | Fees |

|---|---|

| Bank A | 5% up to PHP 5,000 3% over PHP 5,000 |

| Bank B | 2.5% flat fee |

| Money Exchange Service C | 1% up to PHP 10,000 0.5% over PHP 10,000 |

Table 3: Advantages and Disadvantages of Currency Providers

| Currency Provider | Advantages | Disadvantages |

|---|---|---|

| Bank | Secure, established Wide network |

Fees may be higher |

| Money Exchange Service | Convenient, quick Lower fees |

May have limited availability |

| Online Platform | Easy to use, real-time rates Low fees |

Could be less secure |

Table 4: Tips for Optimizing Currency Conversions

| Tip | Description |

|---|---|

| Track exchange rates | Monitor fluctuations to identify favorable conversion times. |

| Use a currency conversion app | Get real-time rates and calculate conversions easily. |

| Consider using a currency specialist | Seek professional advice for large or complex conversions. |

Conclusion

Converting Philippine pesos to American dollars is an essential process for individuals and businesses engaged in cross-border transactions or seeking investment opportunities. Understanding the factors influencing exchange rates, optimizing conversion strategies, and selecting the right currency provider are key to maximizing the value of conversions. By following the comprehensive guidance provided in this article, individuals can navigate the process effectively and make informed decisions when converting PHP to USD in 2025 and beyond.