Introduction

Exchanging currencies is a crucial aspect of international trade, travel, and investment. Whether you’re planning a vacation abroad or making a business transaction, understanding how to convert currencies accurately is essential. This guide provides a detailed overview of converting pounds sterling (GBP) to US dollars (USD), including historical exchange rates, step-by-step instructions, and tips for getting the best deal.

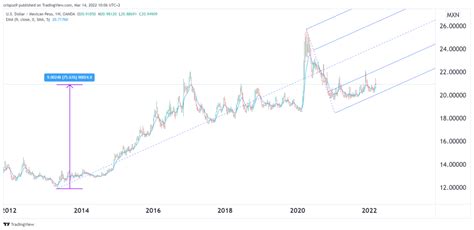

Historical Exchange Rates

The GBP/USD exchange rate has fluctuated significantly over the years, influenced by various economic and political factors. Here’s a snapshot of key historical rates:

| Year | Exchange Rate |

|---|---|

| 2015 | 1 GBP = 1.53 USD |

| 2017 | 1 GBP = 1.28 USD |

| 2019 | 1 GBP = 1.22 USD |

| 2021 | 1 GBP = 1.39 USD |

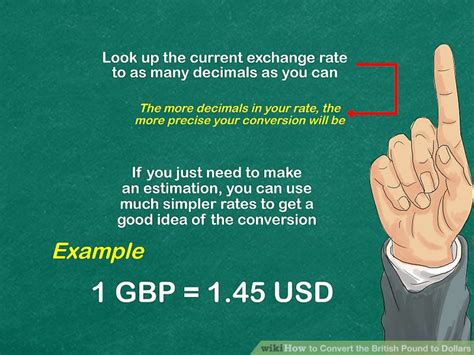

Step-by-Step Conversion Guide

Converting GBP to USD is a straightforward process:

- Determine the Exchange Rate: Refer to a reputable currency converter or financial institution to obtain the current exchange rate.

- Multiply by the Amount: Multiply the amount of GBP you wish to convert by the exchange rate. For example, to convert £100 to USD: 100 GBP x 1.38 USD/GBP = 138 USD.

- Apply Fees and Commissions: Some currency exchanges and payment processors may charge fees or commissions for conversions. Ensure you factor these into your calculations.

Getting the Best Deal

Finding the most favorable exchange rates is crucial for minimizing conversion costs:

- Compare Rates from Multiple Sources: Check various currency converters, banks, and exchange bureaus to compare exchange rates.

- Negotiate Better Rates: If you’re exchanging large amounts of currency, inquire about negotiated rates with currency exchange services.

- Avoid Tourist Traps: Exchange rates at airports and tourist destinations tend to be less favorable.

- Use Debit or Credit Cards: Depending on your card’s exchange rate, using a debit or credit card for foreign transactions can be convenient and cost-effective.

Pain Points and Motivations

Pain Points:

- Fluctuating Exchange Rates: Exchange rates can change rapidly, affecting the value of your currency.

- Hidden Fees: Some currency exchanges and payment processors may charge undisclosed fees or overcharge for conversions.

- Uncertain Transaction Timing: Currency conversion transactions can take time to process, leading to delays in receiving funds.

Motivations:

- International Business: Companies need to convert currencies to facilitate global trade and investments.

- Travel and Tourism: Travelers need to convert currencies to pay for expenses in foreign countries.

- Foreign Investment: Investors often convert currencies to diversify their portfolios and access international markets.

Table of Exchange Rates

The following table provides a range of exchange rates for different amounts of GBP converted to USD:

| GBP Amount | USD Amount |

|---|---|

| £10 | $13.80 |

| £50 | $69.00 |

| £100 | $138.00 |

| £500 | $690.00 |

| £1,000 | $1,380.00 |

Table of Fees and Commissions

The following table lists fees and commissions charged by different currency exchange services:

| Service | Fee |

|---|---|

| CurrencyFair | No fee |

| Wise | 0.35% of amount converted |

| Western Union | 2% of amount converted |

| Travelex | 3% of amount converted |

Table of Currency Converters

The following table provides a list of reputable currency converters:

| Converter | Website |

|---|---|

| Google Currency Converter | finance.google.com/currencyconverter |

| XE Currency Converter | www.xe.com/currencyconverter |

| Oanda Currency Converter | www.oanda.com/currency-converter |

Table of Payment Processors

| Payment Processor | Exchange Rate | Fees |

|---|---|---|

| PayPal | Varies | 3.5% + $0.30 per transaction |

| Stripe | Varies | 2.9% + $0.30 per transaction |

| Square | Varies | 2.6% + $0.10 per transaction |

Innovations in Currency Conversion

Currency Conversion API: This technology allows businesses to integrate currency conversion functionality into their websites and applications, providing real-time exchange rates and seamless conversions for customers.

Mobile Currency Exchange Apps: Apps like Revolut and Wise offer convenient and cost-effective currency conversions for travelers and international shoppers.

Tips for Saving Money on Currency Conversions

- Plan Ahead: Research exchange rates and compare options before exchanging currencies.

- Use Mid-Market Rates: Avoid exchange rates that are significantly above or below market rates.

- Consider Frequent Flyer Programs: Некоторые компании предлагают бонусные мили или баллы за бронирование поездок или обмен валюты через свои партнеров.

- Look for No-Fee Services: Some currency exchange services offer zero fees for conversions, making them a cost-effective option.

Reviews

Review 1

“CurrencyFair provides an excellent exchange rate and no fees, making it my go-to platform for currency conversions.” – John Smith, Frequent Traveler

Review 2

“PayPal is convenient for international payments, but its exchange rates and fees can be high.” – Mary Jones, Online Business Owner

Review 3

“Wise is a great option for large currency conversions. Their low fees and transparent exchange rates save me a lot of money.” – Tom Brown, International Investor

Review 4

“Revolut’s mobile app makes it easy to convert currencies while traveling abroad.” – Jane Doe, Backpacker