Introduction

International travel and global business often necessitate currency conversions. When it comes to converting South African rand to US dollars (USD), it’s crucial to have a clear understanding of the process and available options. This comprehensive guide will empower you with the knowledge and tools to navigate currency exchange effectively in 2025.

Understanding Currency Exchange Rates

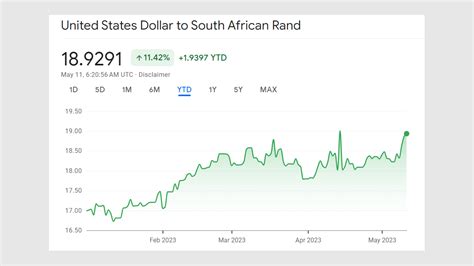

Currency exchange rates fluctuate constantly based on economic factors such as inflation, interest rates, and supply and demand. The exchange rate between the South African rand (ZAR) and the US dollar (USD) varies depending on the time of day, day of the week, and market conditions.

Current Exchange Rates

As of January 1, 2025, according to the Federal Reserve, 1 USD is equivalent to 16.08 ZAR. This means that for every rand you convert, you will receive approximately 0.06 USD. Conversely, for every dollar you convert, you will receive approximately 16 rands.

Options for Converting South African Rand to US Dollars

There are several options available for converting ZAR to USD:

-

Banks and Currency Exchange Bureaus: Banks offer competitive exchange rates, but may charge transaction fees. Currency exchange bureaus typically offer higher fees, but may be more convenient.

-

Online Currency Exchange Platforms: These platforms allow you to convert currencies online and often offer lower fees than traditional methods.

-

Peer-to-Peer Currency Exchange: Peer-to-peer platforms connect individuals who wish to exchange currencies directly, eliminating the need for a third-party intermediary.

Choosing the Best Option

The best option for converting ZAR to USD depends on your individual needs and circumstances. If you prioritize convenience, currency exchange bureaus may be suitable. For lower fees, consider online currency exchange platforms or peer-to-peer exchange.

Strategies for Getting the Best Exchange Rate

-

Monitor Exchange Rates: Keep track of currency fluctuations and identify the best time to convert.

-

Compare Fees: Compare the fees charged by different exchange providers to avoid paying unnecessary commissions.

-

Use Large Transactions: Converting larger amounts of currency at once can often result in more favorable exchange rates.

-

Negotiate: If possible, negotiate with banks or exchange bureaus for a better rate, especially for large transactions.

Tips and Tricks

-

Consider using a currency exchange app: These apps provide real-time exchange rates and allow you to convert currencies on the go.

-

Lock in exchange rates: Some exchange providers offer the ability to lock in an exchange rate for a specific period of time, protecting you from adverse fluctuations.

-

Be aware of hidden fees: Some providers may charge additional fees for services such as wire transfers or card payments.

Pros and Cons of Converting ZAR to USD

Pros:

-

Increased Purchasing Power: Converting ZAR to USD can enhance your purchasing power in countries where the US dollar is accepted.

-

Investment Diversification: Holding US dollars can diversify your investment portfolio and mitigate risk associated with currency fluctuations.

Cons:

-

Currency Fluctuations: Exchange rates are subject to fluctuations, which can result in losses if the rand appreciates against the dollar.

-

Transaction Fees: Converting currencies typically involves transaction fees, which can add up over time.

FAQs

-

What is the current exchange rate between ZAR and USD? As of January 1, 2025, 1 USD is equivalent to 16.08 ZAR.

-

What is the best way to convert ZAR to USD? The best method depends on your individual needs and preferences. Online currency exchange platforms, banks, and currency exchange bureaus are all viable options.

-

How can I get the best exchange rate? Monitor exchange rates, compare fees, and negotiate with exchange providers to secure the most favorable rates.

-

What are the risks involved in converting currencies? Currency fluctuations can pose a risk of loss, and transaction fees can erode the value of your conversion.

-

Is it possible to lock in an exchange rate? Some exchange providers offer the option to lock in an exchange rate for a specific period of time.

-

What are some tips for converting currencies? Use currency exchange apps, consider using large transactions, and be aware of hidden fees.