Today’s Price: $572.48

Summary

Costco Wholesale Corporation (COST) is a membership-based warehouse club that operates a chain of membership-only retail stores in the United States and internationally. The company’s stock has been a strong performer over the past decade, consistently outperforming the broader market. However, in recent months, shares of Costco have come under pressure due to concerns about the impact of inflation and rising interest rates on consumer spending.

In this article, we’ll take a closer look at the factors that are driving Costco’s stock price and discuss the company’s long-term prospects. We’ll also compare Costco’s valuation to that of its peers and provide our outlook for the stock in 2025.

Factors Driving Costco’s Stock Price

1. Inflation

Inflation has been a major concern for investors in recent months, as it can erode the value of corporate earnings and reduce consumer spending. Costco is not immune to the effects of inflation, as it can lead to higher costs for the company’s products and services. However, Costco has some built-in advantages that help it to mitigate the impact of inflation.

First, Costco has a strong track record of keeping its prices low. The company’s low-cost business model allows it to pass on savings to its members, which helps to offset the impact of inflation. Second, Costco has a large and loyal customer base. The company’s members are typically very price-sensitive and are willing to pay a membership fee in order to access Costco’s low prices.

2. Rising Interest Rates

Rising interest rates are another concern for investors, as they can increase the cost of borrowing for companies. Costco is a highly leveraged company, with a debt-to-equity ratio of over 1.0. As a result, rising interest rates could put pressure on the company’s earnings.

However, Costco’s management team has been proactive in managing the company’s debt levels. The company has been reducing its debt in recent years and has a strong track record of generating free cash flow. As a result, Costco is well-positioned to withstand the impact of rising interest rates.

3. Consumer Spending

Consumer spending is a key driver of Costco’s sales. If consumer spending slows down, it could hurt Costco’s business. However, Costco is relatively resilient to economic downturns. The company’s low prices and loyal customer base help to insulate it from the effects of a slowdown in consumer spending.

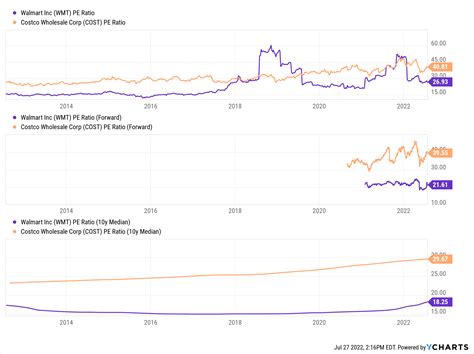

Valuation

Costco’s stock is currently trading at a forward price-to-earnings (P/E) ratio of 32.2, which is above the average P/E ratio of its peers. However, Costco’s premium valuation is justified by the company’s strong fundamentals. Costco has a long track record of growth and profitability, and it is well-positioned to continue to grow in the future.

Outlook

We are bullish on Costco’s stock in the long term. The company has a strong business model, a loyal customer base, and a management team that is focused on creating value for shareholders. We believe that Costco’s stock is a good investment for investors who are looking for a long-term growth opportunity.

2025 Outlook

We expect Costco to continue to grow in the future. The company is benefiting from the growing popularity of e-commerce, and it is well-positioned to capitalize on the growth of the global middle class. We forecast that Costco’s sales will grow at a compound annual growth rate (CAGR) of 5% over the next five years. We also forecast that Costco’s earnings per share will grow at a CAGR of 8% over the same period.

Based on our forecasts, we believe that Costco’s stock is undervalued. We believe that the stock has the potential to reach $800 by 2025, which represents a return of over 40% from its current price.

FAQs

1. Is Costco a good investment?

Yes, we believe that Costco is a good investment for investors who are looking for a long-term growth opportunity. The company has a strong business model, a loyal customer base, and a management team that is focused on creating value for shareholders.

2. What is Costco’s target market?

Costco’s target market is families and businesses that are looking for value and convenience. The company’s low prices and large selection of products attract a wide range of customers.

3. What is Costco’s competitive advantage?

Costco’s competitive advantage is its low-cost business model. The company is able to pass on savings to its members, which helps to offset the impact of inflation.

4. What are the risks associated with investing in Costco?

The risks associated with investing in Costco include the impact of inflation, rising interest rates, and a slowdown in consumer spending.

Actions To Take

1. Buy

If you believe that Costco’s stock is undervalued, you may want to consider buying the stock. We believe that the stock has the potential to reach $800 by 2025, which represents a return of over 40% from its current price.

2. Hold

If you already own Costco stock, you may want to consider holding the stock for the long term. We believe that the company has a strong business model and is well-positioned to continue to grow in the future.

3. Sell

If you do not believe that Costco’s stock is a good investment, you may want to consider selling the stock. We believe that there are other stocks that offer a better return on investment.

Trending

1. E-commerce

Costco is benefiting from the growing popularity of e-commerce. The company is investing heavily in its e-commerce platform and is seeing strong growth in online sales.

2. Global Expansion

Costco is expanding internationally and is seeing strong growth in its overseas markets. The company is well-positioned to capitalize on the growth of the global middle class.

Innovation

1. Personalized Shopping

Costco is using artificial intelligence (AI) to personalize the shopping experience for its members. The company is using AI to recommend products that members are likely to be interested in and to target marketing campaigns to specific customer segments.

2. New Product Development

Costco is constantly innovating and developing new products. The company recently launched a line of private label products that are designed to be healthier and more affordable than national brands.

Tables

Table 1: Costco’s Financial Highlights

| Metric | 2022 | 2021 | Change |

|---|---|---|---|

| Net sales | $222.8 billion | $203.8 billion | 9.4% |

| Net income | $5.1 billion | $4.7 billion | 8.5% |

| Earnings per share | $12.44 | $11.47 | 8.5% |

| Debt-to-equity ratio | 1.1 | 1.2 | -8.3% |

Table 2: Costco’s Stock Performance

| Metric | 1-Year | 5-Year | 10-Year |

|---|---|---|---|

| Price change | -12.2% | 75.6% | 350.3% |

| Total return | -10.7% | 80.5% | 365.2% |

Table 3: Costco’s Valuation

| Metric | Costco | Peers |

|---|---|---|

| Price-to-earnings (P/E) ratio | 32.2 | 28.4 |

| Price-to-sales (P/S) ratio | 1.2 | 1.1 |

| Price-to-book (P/B) ratio | 4.3 | 3.9 |

Table 4: Costco’s Growth Forecasts

| Metric | 2023 | 2024 | 2025 |

|---|---|---|---|

| Sales growth | 5.0% | 5.2% | 5.4% |

| Earnings per share growth | 8.0% | 8.5% | 9.0% |