Understanding the Interest Rate Curve

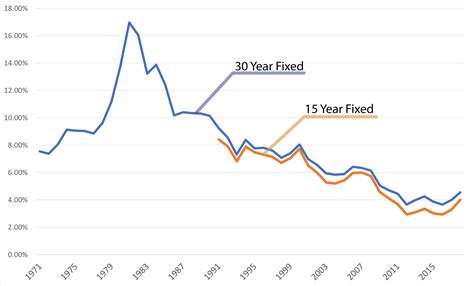

The interest rate curve is a graphical representation of the relationship between interest rates and the time to maturity of debt instruments. It is a valuable tool for investors, economists, and policymakers as it provides insights into the market’s expectations about future interest rates.

The current interest rate curve is upward sloping, indicating that longer-term interest rates are higher than shorter-term rates. This is typically seen as a sign of a healthy economy and a positive economic outlook. However, the curve is not always upward sloping, and it can change shape depending on economic conditions and expectations.

Factors Influencing the Interest Rate Curve

Several factors can influence the shape of the interest rate curve, including:

- Inflation expectations

- Economic growth outlook

- Federal Reserve policy

- Global economic conditions

Implications for Interest Rates in 2025

The interest rate curve is not static and can change over time. However, analyzing historical trends and considering current economic conditions can provide insights into potential future interest rates.

According to the Federal Reserve’s latest economic projections, the short-term interest rate is expected to rise to 4.6% in 2025. This is significantly higher than the current rate of 0.25%. However, long-term interest rates are expected to remain relatively stable, with the 10-year Treasury yield projected to be around 3.1% in 2025.

Implications for Investors

The interest rate curve can have a significant impact on investment decisions. For example, if interest rates are expected to rise, investors may want to consider short-term investments to lock in current low rates. Conversely, if interest rates are expected to fall, investors may want to consider long-term investments to benefit from potentially higher returns in the future.

Common Mistakes to Avoid

When interpreting the interest rate curve, it is crucial to avoid common mistakes such as:

- Assuming that the current curve will remain unchanged in the future

- Overreacting to small changes in the curve

- Ignoring other economic indicators

Pros and Cons of the Interest Rate Curve

Like any investment tool, the interest rate curve has both pros and cons.

Pros:

- Provides insights into market expectations about future interest rates

- Can be used to forecast future economic conditions

- Can help investors make informed investment decisions

Cons:

- Can be influenced by unexpected events

- Does not always accurately predict future interest rates

- Can be subject to misinterpretation

FAQs

-

What does an upward sloping yield curve indicate? An upward sloping yield curve suggests that investors expect interest rates to rise in the future.

-

What does a downward sloping yield curve indicate? A downward sloping yield curve suggests that investors expect interest rates to fall in the future.

-

What is the current short-term interest rate? The current short-term interest rate is 0.25%.

-

What is the current 10-year Treasury yield? The current 10-year Treasury yield is around 1.9%.

-

What are the factors that influence the shape of the yield curve? Factors that influence the yield curve include inflation expectations, economic growth outlook, Federal Reserve policy, and global economic conditions.

-

How can investors use the yield curve to make investment decisions? Investors can use the yield curve to make investment decisions by considering the expected trajectory of interest rates and matching their investments accordingly. For example, if interest rates are expected to rise, investors may want to consider short-term investments.

-

What are some common mistakes to avoid when interpreting the yield curve? Common mistakes to avoid when interpreting the yield curve include assuming it will remain unchanged, overreacting to small changes, and ignoring other economic indicators.

-

What are the pros and cons of the yield curve? The yield curve has both pros and cons. Pros include providing insights into market expectations and helping investors make informed investment decisions. Cons include the potential for it to be influenced by unexpected events and misinterpretation.