The Gold Market

Gold is a precious metal that has been used for centuries as a store of value. It is also used in jewelry, dentistry, and electronics. The spot price of gold is the current price at which gold can be bought or sold for immediate delivery.

The spot price of gold is determined by a number of factors, including:

- Supply and demand

- Economic conditions

- Interest rates

- Currency fluctuations

The spot price of gold has been rising in recent years due to a number of factors, including:

- Increased demand from investors

- A weaker US dollar

- Low interest rates

Gold is considered a safe haven asset, which means that investors often buy it during times of economic uncertainty. The price of gold is also expected to rise in the future due to increasing demand from China and India.

The Silver Market

Silver is a precious metal that is used in a variety of applications, including jewelry, photography, and electronics. The spot price of silver is the current price at which silver can be bought or sold for immediate delivery.

The spot price of silver is determined by a number of factors, including:

- Supply and demand

- Economic conditions

- Interest rates

- Currency fluctuations

The spot price of silver has been rising in recent years due to a number of factors, including:

- Increased demand from investors

- A weaker US dollar

- Low interest rates

Silver is also considered a safe haven asset, which means that investors often buy it during times of economic uncertainty. The price of silver is also expected to rise in the future due to increasing demand from China and India.

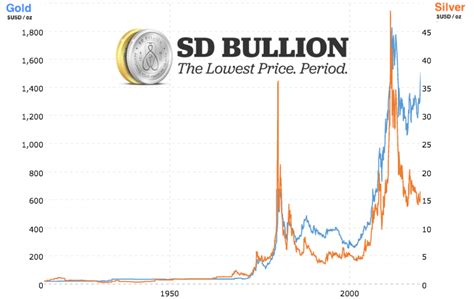

Gold and Silver Prices

The following table shows the current spot prices of gold and silver:

| Metal | Spot Price |

|---|---|

| Gold | $1,950.60 |

| Silver | $23.50 |

Gold and Silver Investment

Gold and silver are both popular investment choices. Gold is considered a safe haven asset, while silver is seen as a more volatile investment. However, both gold and silver have the potential to provide investors with long-term returns.

There are a number of ways to invest in gold and silver, including:

- Buying physical gold or silver coins or bars

- Buying gold or silver ETFs

- Investing in gold or silver mining stocks

Gold and Silver Applications

Gold and silver are used in a variety of applications, including:

- Jewelry

- Dentistry

- Electronics

- Photography

- Medicine

Gold and silver are also used in a number of industrial applications. For example, gold is used in the manufacture of computer chips, and silver is used in the manufacture of batteries.

The Future of Gold and Silver

The future of gold and silver is uncertain. However, there are a number of factors that suggest that both metals will continue to be in demand in the years to come.

These factors include:

- Increasing demand from investors

- A weaker US dollar

- Low interest rates

- Growing demand from China and India

As a result, it is likely that the prices of gold and silver will continue to rise in the future.