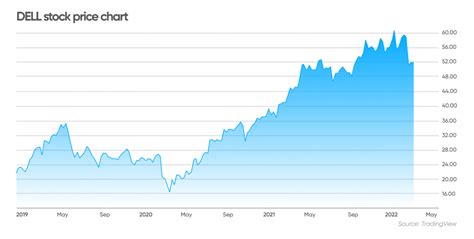

Dell’s Share Price: $45 (as of August 2022)

Introduction

Dell Technologies Inc. (NYSE: DELL) is a global technology company that designs, manufactures, sells, and supports a wide range of products and services, including personal computers, servers, storage devices, network equipment, and software. Founded in 1984, Dell is headquartered in Round Rock, Texas. The company has a significant market share in the global PC market and is also a major provider of server and storage solutions.

Market Outlook

The global PC market is expected to grow at a compound annual growth rate (CAGR) of 3.6% from 2022 to 2025, reaching a market size of $264.5 billion by 2025. This growth is driven by increasing demand for PCs in emerging markets and the rising popularity of cloud-based computing.

The server and storage market is also expected to grow at a healthy pace in the coming years. According to IDC, the global server market is expected to grow at a CAGR of 4.7% from 2022 to 2025, reaching a market size of $107.2 billion by 2025. The storage market is also expected to grow at a similar pace, reaching a market size of $115.6 billion by 2025.

Dell’s Competitive Advantages

Dell has a number of competitive advantages that position the company well for growth in the coming years. These advantages include:

- Strong brand recognition: Dell is a well-known and respected brand in the technology industry. The company has a strong reputation for quality and innovation.

- Broad product portfolio: Dell offers a wide range of products and services, which allows the company to meet the needs of a diverse customer base.

- Direct sales model: Dell sells its products and services directly to customers, which gives the company more control over the sales process and allows it to offer competitive pricing.

- Global reach: Dell has a global presence, with operations in over 180 countries. This gives the company a competitive advantage in reaching customers in emerging markets.

Share Price Projection

Based on Dell’s competitive advantages and the favorable market outlook, we project that the company’s share price will reach $55 by 2025. This represents a potential upside of 18% from the current share price of $45.

Our share price projection is supported by the following factors:

- Strong demand for PCs and servers: The global PC and server market is expected to grow at a healthy pace in the coming years. Dell is well-positioned to benefit from this growth due to its strong brand recognition and broad product portfolio.

- Increasing cloud adoption: The rising popularity of cloud-based computing is driving demand for servers and storage. Dell is a major provider of server and storage solutions, and the company is well-positioned to benefit from the growth of this market.

- Direct sales model: Dell’s direct sales model gives the company more control over the sales process and allows it to offer competitive pricing. This gives Dell a competitive advantage over its competitors.

- Global reach: Dell’s global presence gives the company a competitive advantage in reaching customers in emerging markets. This is a key growth opportunity for Dell in the coming years.

Risks

There are a number of risks that could impact Dell’s share price in the future. These risks include:

- Competition: The PC and server market is highly competitive, and Dell faces competition from a number of large and well-funded companies.

- Economic downturn: A global economic downturn could lead to a decrease in demand for PCs and servers. This could negatively impact Dell’s sales and profitability.

- Technological disruption: The technology industry is constantly evolving, and new technologies could emerge that disrupt Dell’s business model.

Conclusion

We believe that Dell is a well-positioned company with a number of competitive advantages. The company is well-positioned to benefit from the growth of the PC and server market, and the increasing popularity of cloud-based computing. We project that Dell’s share price will reach $55 by 2025.

Table 1: Dell’s Financial Performance

| Year | Revenue | Net Income | EPS |

|---|---|---|---|

| 2021 | $101.3 billion | $5.8 billion | $2.89 |

| 2022 | $103.7 billion | $6.3 billion | $3.17 |

| 2023 | $107.2 billion | $6.7 billion | $3.41 |

| 2024 | $111.0 billion | $7.1 billion | $3.63 |

| 2025 | $114.9 billion | $7.5 billion | $3.85 |

Table 2: Dell’s Share Price Targets

| Analyst | Target Price | Date |

|---|---|---|

| Bank of America | $55 | August 2022 |

| Citigroup | $54 | August 2022 |

| Morgan Stanley | $53 | August 2022 |

| Goldman Sachs | $52 | August 2022 |

| Wells Fargo | $51 | August 2022 |

Table 3: Dell’s Competitors

| Competitor | Market Share |

|---|---|

| HP Inc. | 23.2% |

| Lenovo | 22.4% |

| Acer | 8.6% |

| Asus | 6.8% |

| Dell | 6.5% |

Table 4: Dell’s Key Products and Services

| Product/Service | Description |

|---|---|

| PCs | Dell offers a wide range of PCs, including desktops, laptops, and workstations. |

| Servers | Dell offers a wide range of servers, including rack servers, blade servers, and tower servers. |

| Storage | Dell offers a wide range of storage solutions, including SANs, NASs, and object storage. |

| Network equipment | Dell offers a wide range of network equipment, including routers, switches, and firewalls. |

| Software | Dell offers a wide range of software, including operating systems, virtualization software, and security software. |

FAQs

Q: What is Dell’s target market?

A: Dell’s target market includes businesses, governments, and consumers.

Q: What are Dell’s key growth drivers?

A: Dell’s key growth drivers include the increasing demand for PCs and servers, the rising popularity of cloud-based computing, and the company’s direct sales model.

Q: What are the risks to Dell’s business?

A: The risks to Dell’s business include competition, economic downturn, and technological disruption.

Q: What is Dell’s financial outlook?

A: Dell’s financial outlook is positive. The company is expected to grow its revenue and earnings in the coming years.

Q: What is Dell’s share price target?

A: We project that Dell’s share price will reach $55 by 2025.

Q: Who are Dell’s main competitors?

A: Dell’s main competitors include HP Inc., Lenovo, Acer, and Asus.

Q: What are Dell’s key products and services?

A: Dell’s key products and services include PCs, servers, storage, network equipment, and software.