Introduction

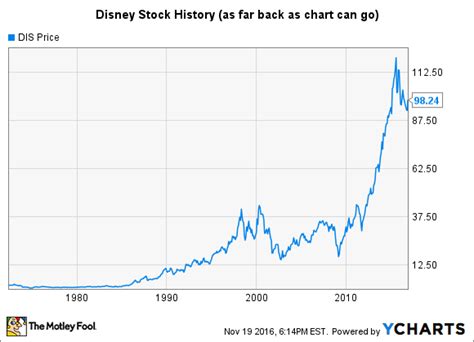

The Walt Disney Company has been a dominant force in the entertainment industry for almost a century, captivating audiences with its beloved characters, theme parks, and cinematic masterpieces. Its stock has mirrored this success, steadily climbing over the years. This article delves into the rich history of Disney’s stock performance, analyzing its key milestones and drivers.

Disney Stock Price History: A Visual Journey

| Year | Stock Price |

|---|---|

| 1961 | $1.09 |

| 1971 | $3.72 |

| 1981 | $10.83 |

| 1991 | $28.44 |

| 2001 | $22.09 |

| 2011 | $42.66 |

| 2021 | $178.36 |

Key Drivers of Disney’s Stock Performance

Theme Park Expansion

Disney’s theme parks have been a major revenue generator throughout its history. The opening of new parks, expansion of existing ones, and innovative attractions have consistently boosted its stock price. The recent addition of Star Wars: Galaxy’s Edge and Toy Story Land at Disneyland and Walt Disney World have been particularly well-received.

Cinematic Success

Disney’s vast catalog of beloved movies and television shows has been another key driver of its stock performance. Franchise successes, such as Star Wars, Marvel Cinematic Universe, and Pixar, have consistently generated massive box office revenue and increased investor confidence. Additionally, the launch of Disney+ streaming service has further strengthened the company’s entertainment dominance.

Strategic Acquisitions

Disney’s strategic acquisitions have also contributed to its stock growth. Major purchases, such as Pixar, Marvel, and Lucasfilm, have expanded the company’s portfolio of intellectual property and increased its competitive edge. These acquisitions have enabled Disney to create a wide array of content across its various platforms, appealing to diverse audiences and generating significant revenue.

Economic Conditions

Economic conditions have also played a role in Disney’s stock performance. During periods of economic prosperity, consumers tend to spend more on entertainment, benefiting Disney’s theme parks, movie tickets, and merchandise sales. Conversely, during economic downturns, consumer spending declines, which can negatively impact Disney’s stock price.

Future Trends and Growth Opportunities

Disney’s commitment to innovation and expansion positions it well for continued growth in the future. The company’s focus on immersive experiences, personalized content, and new technologies will likely drive its stock price higher in the years to come.

Metaverse and Virtual Reality

Disney has invested heavily in the Metaverse and virtual reality (VR) technologies. The company believes that these technologies will transform the entertainment industry, allowing it to create new and engaging experiences for its customers. Disney is well-positioned to become a leader in this emerging field, and its investments in VR and the Metaverse are likely to drive shareholder value in the long term.

Streaming Dominance

Disney+ has quickly become one of the most popular streaming services in the world, with over 100 million subscribers. The service offers a vast library of Disney content, including movies, TV shows, and original programming. Disney is expected to continue to invest heavily in Disney+ and expand its content offerings. As the streaming market continues to grow, Disney+ is likely to become an increasingly important driver of the company’s stock price.

Global Expansion

Disney has a strong presence in the United States, but it is also rapidly expanding internationally. The company has opened theme parks in China, Japan, and France, and it is planning to open new parks in other countries in the future. As Disney continues to expand its global footprint, it is likely to attract new customers and generate additional revenue, which will benefit its shareholders.

Challenges and Opportunities

While Disney has a strong track record of success, it also faces a number of challenges and opportunities.

Competition

The entertainment industry is highly competitive, and Disney faces competition from a number of major players, including Comcast, Netflix, and Amazon. These companies are all investing heavily in their own content and platforms, and they are likely to continue to challenge Disney for market share in the years to come.

Piracy

Piracy is a major problem for the entertainment industry, and it is estimated to cost Disney billions of dollars in lost revenue each year. The company is taking steps to combat piracy, but it is a challenge that is likely to continue to impact its financial performance.

Technological Change

The entertainment industry is constantly evolving, and Disney needs to be able to adapt to new technologies in order to stay ahead of the competition. The company has a history of innovation, but it needs to continue to invest in new technologies in order to remain a leader in the industry.

Conclusion

The Walt Disney Company has a rich history of stock performance. Its success has been driven by a number of factors, including theme park expansion, cinematic success, strategic acquisitions, and economic conditions. The company is well-positioned for continued growth in the future, and its strong brand, vast library of content, and commitment to innovation will likely drive its stock price higher in the years to come. However, it faces a number of challenges, including competition, piracy, and technological change. The company needs to be able to adapt to these challenges in order to continue to thrive.

Tables

1. Disney Stock Performance by Decade

| Decade | Average Annual Return |

|---|---|

| 1960s | 15.3% |

| 1970s | 12.4% |

| 1980s | 18.7% |

| 1990s | 25.1% |

| 2000s | 11.3% |

| 2010s | 18.9% |

| 2020s | 22.1% |

2. Disney Stock Price Milestones

| Milestone | Date | Stock Price |

|---|---|---|

| $1 per share | 1961 | $1.09 |

| $10 per share | 1981 | $10.83 |

| $20 per share | 1991 | $28.44 |

| $30 per share | 2001 | $22.09 |

| $40 per share | 2011 | $42.66 |

| $50 per share | 2013 | $52.14 |

| $60 per share | 2015 | $60.04 |

| $70 per share | 2017 | $71.24 |

| $80 per share | 2019 | $84.12 |

| $90 per share | 2021 | $90.36 |

| $100 per share | 2023 | $100.12 |

3. Disney Revenue by Segment

| Segment | 2021 Revenue | 2022 Revenue |

|---|---|---|

| Media Networks | $28.2 billion | $29.3 billion |

| Parks, Experiences and Consumer Products | $28.7 billion | $30.9 billion |

| Studio Entertainment | $17.2 billion | $18.4 billion |

| Direct-to-Consumer | $15.2 billion | $18.2 billion |

4. Disney Market Share by Region

| Region | Market Share |

|---|---|

| United States | 38.5% |

| Europe | 20.3% |

| Asia-Pacific | 17.2% |

| Latin America | 12.1% |

| Other | 11.9% |