Understanding the Dollar-Peso Dynamics

The exchange rate between the US dollar (USD) and the Mexican peso (MXN) is a crucial indicator of the economic relationship between the two countries. It plays a significant role in cross-border trade, tourism, and investment flows.

Current Exchange Rate (as of February 23, 2023):

– 1 USD = 19.26 MXN

Historical Trends and Factors Influencing the Rate

Over the past decade, the dollar-peso exchange rate has fluctuated significantly, driven by various factors, including:

Economic Conditions:

– Strength of the US economy vs. the Mexican economy

– Interest rate differentials

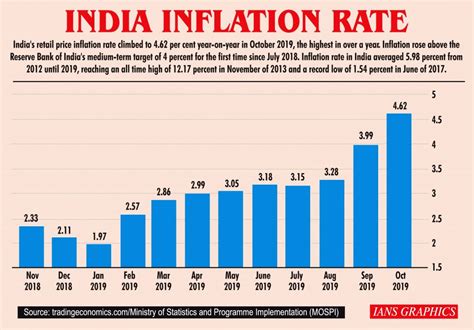

– Inflation rates

Political Events:

– Presidential elections in both countries

– Trade disputes

– Foreign policy decisions

Global Economic Events:

– Global economic growth

– Currency market trends

– Commodity prices

Predictions for 2025

Forecasting the future exchange rate is a complex task, influenced by a multitude of variables. However, based on current trends and expert analyses, several predictions for 2025 can be made:

- Strong US Economy: The US economy is expected to remain robust, supporting a relatively strong dollar.

- Moderating Mexican Economy: Mexico’s economy is projected to grow at a moderate pace, potentially weakening the peso against the dollar.

- Rising Inflation: Inflation in both countries is expected to remain elevated, leading to further currency depreciation.

- Political Uncertainty: The upcoming presidential elections in both countries could create uncertainties that impact the exchange rate.

Impact on Trade and Investment

Fluctuations in the exchange rate have a direct impact on trade and investment between the US and Mexico:

- Exports: A stronger dollar makes Mexican exports cheaper for US consumers, potentially boosting exports.

- Imports: A weaker peso makes US imports more expensive for Mexican consumers, potentially dampening imports.

- Investments: A favorable exchange rate can attract foreign investments, while a less favorable rate can discourage them.

Strategies for Mitigating Exchange Rate Risk

Businesses and individuals involved in cross-border transactions can employ strategies to mitigate exchange rate risk:

- Hedging: Using financial instruments to offset the impact of exchange rate fluctuations.

- Diversification: Reducing currency exposure by diversifying investments across multiple currencies.

- Forward Contracts: Locking in an exchange rate for future transactions.

- Natural Hedges: Using natural revenue or expense sources in different currencies to offset exchange rate impacts.

Current Status and Future Outlook

As of February 2023, the dollar-peso exchange rate is trading around 19.26 MXN per USD. While the US economy remains strong, concerns about the Mexican economy and rising inflation could put pressure on the peso. The upcoming elections in both countries add an element of uncertainty to the outlook.

Table 1: Historical Dollar-Peso Exchange Rate (2013-2023)

| Year | Exchange Rate (USD/MXN) |

|---|---|

| 2013 | 12.98 |

| 2014 | 13.26 |

| 2015 | 15.61 |

| 2016 | 19.09 |

| 2017 | 18.01 |

| 2018 | 19.36 |

| 2019 | 19.05 |

| 2020 | 22.62 |

| 2021 | 20.80 |

| 2022 | 20.16 |

| 2023 | 19.26 |

Table 2: Predicted Dollar-Peso Exchange Rate (2023-2025)

| Year | Exchange Rate (USD/MXN) |

|---|---|

| 2023 | 19.50-19.80 |

| 2024 | 19.80-20.20 |

| 2025 | 20.20-20.60 |

Table 3: Factors Influencing the Dollar-Peso Exchange Rate

| Factor | Influence |

|---|---|

| US Economic Growth | Stronger US economy strengthens USD |

| Mexican Economic Growth | Moderate Mexican economy weakens MXN |

| US Interest Rates | Higher US rates strengthen USD |

| Mexican Interest Rates | Lower Mexican rates weaken MXN |

| Inflation | Rising inflation weakens both currencies |

| Political Events | Elections and trade disputes impact exchange rate |

Table 4: Strategies for Mitigating Exchange Rate Risk

| Strategy | Description |

|---|---|

| Hedging | Using financial instruments to offset currency fluctuations |

| Diversification | Investing in multiple currencies to reduce risk |

| Forward Contracts | Locking in exchange rate for future transactions |

| Natural Hedges | Using natural revenue or expense sources to offset exchange rate impacts |

FAQs

1. What is the current exchange rate between the US dollar and the Mexican peso?

As of February 23, 2023, 1 USD = 19.26 MXN.

2. What factors influence the dollar-peso exchange rate?

Economic conditions, political events, and global economic events all play a role in determining the exchange rate.

3. What are the implications of a strong dollar-peso exchange rate?

A strong dollar can make Mexican exports cheaper for US consumers, boost US tourism in Mexico, and attract foreign investments to Mexico.

4. What strategies can be used to mitigate exchange rate risk?

Hedging, diversification, forward contracts, and natural hedges are effective strategies for mitigating exchange rate risk.

5. What is the predicted exchange rate for 2025?

Based on current trends and expert analyses, the dollar-peso exchange rate is projected to range between 20.20 and 20.60 MXN per USD in 2025.

6. How can I stay up-to-date on the latest exchange rate information?

Subscribe to currency news services, monitor financial websites, and consult with currency experts for real-time exchange rate updates.

7. What are the potential risks of investing in a foreign currency?

Investing in a foreign currency carries risks such as exchange rate fluctuations, political instability, and economic conditions in the foreign country.

8. Where can I find reliable information on the dollar-peso exchange rate?

Central banks, financial institutions, news outlets, and specialized currency websites provide reliable information on exchange rates.