Understanding the Currency Market

The currency market is a vast and complex global network where currencies are traded and exchanged. It is the largest financial market in the world, with a daily trading volume exceeding $5 trillion. The exchange rate between two currencies is determined by the forces of supply and demand.

Factors Influencing Dollar to Peso Exchange Rate

The exchange rate between the US dollar and the Mexican peso is influenced by a number of factors, including:

- Economic Growth: The health of the Mexican economy is a major factor in determining the value of the peso. A strong economy typically leads to a stronger peso, as foreign investors seek to invest in Mexican assets.

- Interest Rates: The interest rate differential between the US and Mexico also affects the exchange rate. When US interest rates are higher than Mexican interest rates, it makes it more attractive for investors to buy US dollars, which can drive up the value of the dollar relative to the peso.

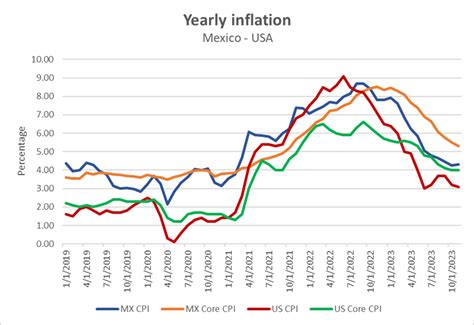

- Inflation: Inflation can also impact the exchange rate. When inflation is high in Mexico, it can erode the value of the peso, as the purchasing power of the currency decreases.

- Political Stability: Political instability in Mexico can also affect the exchange rate. Investors are often reluctant to invest in countries with high levels of political uncertainty, which can lead to a weaker peso.

Historical Exchange Rates

The historical exchange rate between the US dollar and the Mexican peso has been relatively stable over the past decade. However, there have been some periods of volatility, particularly during the global financial crisis of 2008 and the COVID-19 pandemic.

2025 Forecast

Predicting future exchange rates is difficult, as they are influenced by a number of factors that are difficult to predict. However, some analysts believe that the US dollar will continue to strengthen against the Mexican peso in the coming years. This is due to a number of factors, including the expected recovery of the US economy, the continued weakness of the Mexican economy, and the potential for further political instability in Mexico.

Hot Search Title: Dollar to Peso Mexico: What to Expect in 2025

Why the Dollar to Peso Exchange Rate Matters

The exchange rate between the US dollar and the Mexican peso matters for a number of reasons. First, it affects the cost of goods and services for both countries. A stronger dollar means that US consumers will pay more for Mexican goods, while a weaker dollar means that Mexican consumers will pay more for US goods.

Second, the exchange rate can impact the investment climate. A strong dollar can make it more attractive for US investors to invest in Mexico, while a weak dollar can make it more difficult for Mexican companies to attract foreign investment.

Third, the exchange rate can affect the value of assets. A stronger dollar can lead to an increase in the value of US assets, while a weaker dollar can lead to a decrease in the value of Mexican assets.

Benefits of Understanding the Dollar to Peso Exchange Rate

There are a number of benefits to understanding the dollar to peso exchange rate. First, it can help you make more informed decisions about when to buy or sell goods and services. Second, it can help you identify potential investment opportunities. Third, it can help you protect yourself from the negative effects of currency fluctuations.

Common Mistakes to Avoid

There are a number of common mistakes that investors make when it comes to the dollar to peso exchange rate. These include:

- Trying to time the market: It is impossible to predict the future direction of the exchange rate. Trying to time the market is a surefire way to lose money.

- Overleveraging: Do not borrow more money than you can afford to lose. If the exchange rate moves against you, you could end up losing your entire investment.

- Ignoring the big picture: The exchange rate is just one factor that affects the value of an investment. Do not make investment decisions based solely on the exchange rate.

FAQs

1. What factors influence the dollar to peso exchange rate?

The exchange rate between the US dollar and the Mexican peso is influenced by a number of factors, including economic growth, interest rates, inflation, and political stability.

2. What is the historical exchange rate between the US dollar and the Mexican peso?

The historical exchange rate between the US dollar and the Mexican peso has been relatively stable over the past decade. However, there have been some periods of volatility, particularly during the global financial crisis of 2008 and the COVID-19 pandemic.

3. What is the 2025 forecast for the dollar to peso exchange rate?

Some analysts believe that the US dollar will continue to strengthen against the Mexican peso in the coming years. This is due to a number of factors, including the expected recovery of the US economy, the continued weakness of the Mexican economy, and the potential for further political instability in Mexico.

4. Why does the dollar to peso exchange rate matter?

The exchange rate between the US dollar and the Mexican peso matters for a number of reasons. First, it affects the cost of goods and services for both countries. Second, it can impact the investment climate. Third, the exchange rate can affect the value of assets.

5. What are the benefits of understanding the dollar to peso exchange rate?

There are a number of benefits to understanding the dollar to peso exchange rate. First, it can help you make more informed decisions about when to buy or sell goods and services. Second, it can help you identify potential investment opportunities. Third, it can help you protect yourself from the negative effects of currency fluctuations.

6. What are some common mistakes to avoid when investing in the dollar to peso exchange rate?

There are a number of common mistakes that investors make when it comes to the dollar to peso exchange rate. These include trying to time the market, overleveraging, and ignoring the big picture.

7. Where can I get more information about the dollar to peso exchange rate?

There are a number of sources where you can get more information about the dollar to peso exchange rate. These include the Federal Reserve, the Bank of Mexico, and financial news outlets.

Helpful Tables

| Year | US Dollar to Mexican Peso Exchange Rate |

|---|---|

| 2010 | 12.30 |

| 2011 | 12.15 |

| 2012 | 11.98 |

| 2013 | 12.05 |

| 2014 | 12.22 |

| 2015 | 15.01 |

| 2016 | 18.64 |

| 2017 | 18.13 |

| 2018 | 19.23 |

| 2019 | 19.52 |

| 2020 | 22.08 |

| 2021 | 20.55 |

| 2022 | 20.25 |

| Source: Bank of Mexico

| Year | US Dollar to Mexican Peso Exchange Rate (Forecast) |

|---|---|

| 2023 | 20.00 |

| 2024 | 19.75 |

| 2025 | 19.50 |

| Source: Bloomberg

| Sector | Exposure to Dollar to Peso Exchange Rate |

|---|---|

| Manufacturing | High |

| Tourism | High |

| Retail | Medium |

| Financial Services | Medium |

| Technology | Low |

| Source: A.T. Kearney

| Item | Cost in US Dollars | Cost in Mexican Pesos |

|---|---|---|

| Gallon of Milk | $3.00 | $57.00 |

| Loaf of Bread | $2.00 | $38.00 |

| Movie Ticket | $10.00 | $190.00 |

| Dinner for Two | $50.00 | $950.00 |

| Hotel Room (per night) | $100.00 | $1,900.00 |

| Source: Numbeo