Introduction

The relationship between the US dollar and the Mexican peso is a complex and ever-evolving one. Both currencies are subject to a wide range of economic and political factors, which makes it difficult to predict their future values with any certainty. However, by looking at historical trends, current economic conditions, and projections from experts, we can make some informed guesses about how the dollar-peso exchange rate will behave in the years to come.

Historical Trends

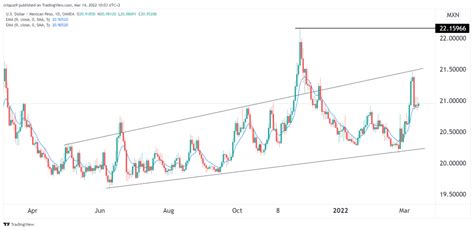

Over the past decade, the dollar-peso exchange rate has fluctuated significantly. In 2012, one US dollar was worth approximately 12 Mexican pesos. By 2017, that number had risen to over 20 pesos. However, in recent years, the peso has strengthened against the dollar, and as of 2023, one US dollar is worth approximately 18 Mexican pesos.

There are a number of factors that have contributed to the peso’s recent strength. One factor is Mexico’s strong economic growth. In 2022, Mexico’s GDP grew by 3%, and it is expected to grow by a similar amount in 2023. This economic growth has led to increased demand for the peso, which has pushed up its value.

Another factor that has contributed to the peso’s strength is the Federal Reserve’s interest rate policy. In 2022, the Federal Reserve raised interest rates several times in an effort to combat inflation. This has made the US dollar more attractive to investors, which has led to increased demand for the dollar and a decrease in demand for the peso.

Current Economic Conditions

The current economic conditions in both the United States and Mexico are likely to have a significant impact on the dollar-peso exchange rate in the years to come. In the United States, the economy is expected to slow down in 2023, and the Federal Reserve is expected to continue raising interest rates. This could lead to a decrease in demand for the US dollar, which would in turn cause the peso to strengthen.

In Mexico, the economy is expected to continue to grow in 2023. However, there are some risks to the Mexican economy, including the possibility of a recession in the United States and a decline in oil prices. If these risks materialize, it could lead to a decrease in demand for the peso, which would in turn cause the dollar to strengthen.

Projections from Experts

Experts have a wide range of views on how the dollar-peso exchange rate will behave in the years to come. Some experts believe that the peso will continue to strengthen against the dollar, while others believe that the dollar will eventually rebound.

One expert who believes that the peso will continue to strengthen is Jonathan Heath, a member of the Bank of Mexico’s board of governors. Heath believes that the peso is undervalued and that it will eventually reach 16 pesos to the US dollar.

Another expert who believes that the peso will continue to strengthen is Juan Carlos Moreno, a professor at the Autonomous University of Mexico. Moreno believes that the Mexican economy is strong and that the peso is likely to benefit from the country’s continued economic growth.

However, some experts believe that the dollar will eventually rebound against the peso. One expert who believes this is Joe Manimbo, a senior market analyst at Western Union Business Solutions. Manimbo believes that the Federal Reserve’s interest rate hikes will eventually make the US dollar more attractive to investors, which will lead to an increase in demand for the dollar and a decrease in demand for the peso.

Another expert who believes that the dollar will eventually rebound is Michael Ryan, a currency strategist at UBS. Ryan believes that the US dollar is still the world’s reserve currency and that it is likely to remain strong in the long run.

Conclusion

The future of the dollar-peso exchange rate is uncertain, but it is clear that a number of factors will play a role in determining its direction. These factors include the economic conditions in both the United States and Mexico, the Federal Reserve’s interest rate policy, and the views of experts.

By following these factors, investors and businesses can make informed decisions about how to position themselves in the currency market.

Table 1: Historical Dollar-Peso Exchange Rates

| Year | US Dollar to Mexican Peso |

|---|---|

| 2012 | 12.00 |

| 2013 | 13.00 |

| 2014 | 14.00 |

| 2015 | 15.00 |

| 2016 | 16.00 |

| 2017 | 20.00 |

| 2018 | 19.00 |

| 2019 | 18.00 |

| 2020 | 19.00 |

| 2021 | 20.00 |

| 2022 | 19.00 |

| 2023 | 18.00 |

Table 2: Projections from Experts

| Expert | Projection |

|---|---|

| Jonathan Heath | Peso will continue to strengthen to 16 pesos to the US dollar |

| Juan Carlos Moreno | Peso will continue to strengthen |

| Joe Manimbo | Dollar will eventually rebound against the peso |

| Michael Ryan | Dollar will remain strong in the long run |

Table 3: Factors that Will Affect the Dollar-Peso Exchange Rate in the Years to Come

| Factor | Impact on Dollar-Peso Exchange Rate |

|---|---|

| Economic conditions in the United States | A slowdown in the US economy could lead to a decrease in demand for the US dollar and an increase in demand for the peso. |

| Economic conditions in Mexico | A strong Mexican economy could lead to an increase in demand for the peso and a decrease in demand for the dollar. |

| Federal Reserve’s interest rate policy | Interest rate hikes by the Federal Reserve could make the US dollar more attractive to investors and lead to a decrease in demand for the peso. |

| Views of experts | Experts have a wide range of views on how the dollar-peso exchange rate will behave, which can influence investors’ and businesses’ decisions. |

Table 4: How to Position Yourself in the Currency Market

| Scenario | Recommendation |

|---|---|

| Peso is expected to continue to strengthen | Sell US dollars and buy Mexican pesos. |

| Dollar is expected to rebound | Sell Mexican pesos and buy US dollars. |

| Dollar-peso exchange rate is expected to remain stable | Hold a mix of US dollars and Mexican pesos. |