Introduction

The exchange rate between the US dollar (USD) and the British pound (GBP) is one of the most closely watched currency pairs in the global financial market. It plays a pivotal role in international trade, investment, and tourism, and its fluctuations can have significant implications for businesses, individuals, and economies around the world. In this comprehensive guide, we delve into the intricacies of the dollar to pound British exchange rate, exploring its key drivers, macroeconomic factors, and practical applications.

Understanding Exchange Rates

An exchange rate is the rate at which one currency can be exchanged for another. It is typically expressed as the number of units of one currency required to purchase one unit of another currency. In the case of the dollar to pound British exchange rate, the notation used is GBP/USD, indicating the number of US dollars required to buy one British pound. For example, an exchange rate of 1.2 GBP/USD means that it costs 1.2 US dollars to purchase one British pound.

Factors Influencing the Dollar to Pound British Exchange Rate

Numerous factors can influence the dollar to pound British exchange rate, including:

Economic Growth: The economic growth rates of the United States and the United Kingdom are key drivers of the exchange rate. A stronger economy typically leads to a higher demand for its currency, resulting in a stronger exchange rate.

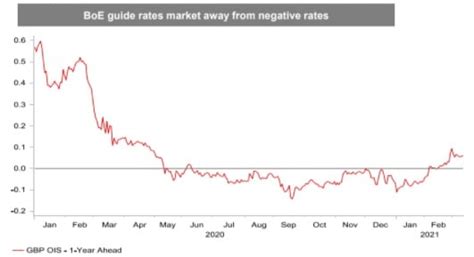

Interest Rates: Interest rate differentials between the two countries can also impact the exchange rate. Higher interest rates in one country attract foreign capital inflows, strengthening the currency’s value.

Inflation: Inflation rates measure the rate of price increases in an economy. Higher inflation can erode the value of a currency, leading to a weaker exchange rate.

Political and Economic Stability: Political stability, economic policies, and investor sentiment can influence the demand for a currency and, consequently, its exchange rate.

Global Economic Conditions: Global economic conditions, such as recessions or economic downturns, can also impact the exchange rate by affecting trade and investment flows.

Practical Applications of the Dollar to Pound British Exchange Rate

The dollar to pound British exchange rate has numerous practical applications, including:

International Trade: Businesses and individuals engaged in international trade need to convert their currencies to facilitate transactions. The exchange rate determines the cost of imported goods and the value of exported products.

Currency Exchange: Tourists and travelers need to exchange their currencies to purchase goods and services. The exchange rate affects the purchasing power of their money abroad.

Investment: Investors seeking global diversification allocate funds across different currencies, and the exchange rate influences the returns on their investments.

Remittances: Individuals sending money across borders need to consider the exchange rate to determine the amount of money their recipients receive.

Historical Trends and Forecasts

The historical trend of the dollar to pound British exchange rate has been volatile, with periods of both appreciation and depreciation. The rate reached its highest point in 1985 at 2.45 GBP/USD, while its lowest point was 1.05 GBP/USD in 2008 during the global financial crisis. Forecasts for the future of the exchange rate vary, with some analysts predicting a strengthening pound and others anticipating a weaker pound in the coming years.

Impact of the Dollar to Pound British Exchange Rate

Businesses: Fluctuations in the exchange rate can impact businesses involved in international trade by affecting their costs, revenues, and profit margins.

Individuals: The exchange rate affects the cost of travel, purchases, and remittances, influencing individuals’ purchasing power.

Economies: Exchange rate fluctuations can impact economic growth, inflation, and trade balances. A stronger currency can boost exports but make imports more expensive.

How to Track and Monitor the Dollar to Pound British Exchange Rate

Numerous platforms and services provide real-time updates on the dollar to pound British exchange rate, including:

Currency Converter Websites: Websites like xe.com and oanda.com offer currency conversion tools and up-to-date exchange rates.

News and Financial Media: Major news outlets and financial publications report on exchange rate movements and provide commentary on economic factors influencing them.

Mobile Applications: Mobile apps like Google Currency and Currency Converter Plus allow users to track exchange rates on their smartphones.

Conclusion

The dollar to pound British exchange rate is a complex and multifaceted variable that plays a significant role in international trade, investment, and travel. By understanding the factors influencing the exchange rate and its practical applications, businesses, individuals, and investors can make informed decisions that optimize their outcomes. As the global economy continues to evolve, the dollar to pound British exchange rate will remain a key indicator of economic conditions and geopolitical dynamics.