The Dow Jones Industrial Average: A Majestic Mark of Market Performance

The Dow Jones Industrial Average (DJIA) stands as a paramount indicator of the United States stock market’s health, tracking the performance of 30 blue-chip companies. Its enduring significance stems from its ability to encapsulate the overall sentiment of the market and provide valuable insights into economic trends.

Key Components of the Dow Jones Industrial Average

The DJIA comprises an exclusive group of companies that represent a diverse range of industries, including:

- Technology

- Finance

- Healthcare

- Industrials

- Consumer Goods

Each constituent company’s stock price is adjusted to reflect its weight in the index, ensuring that larger companies have a more significant impact on the DJIA’s value.

Real-Time Dow Jones Industrial Average: Monitoring the Market’s Pulse

The Dow Jones Industrial Average is a dynamic indicator that fluctuates constantly in response to market events and news. Real-time data provides investors with up-to-the-second updates on the index’s performance, enabling them to make informed trading decisions.

Benefits of Real-Time Dow Jones Industrial Average Data:

- Timely Market Information: Track the latest price movements and gain immediate insights into market conditions.

- Informed Decision-Making: Use real-time data to assess potential opportunities and risks before executing trades.

- Enhanced Risk Management: Monitor fluctuations in the DJIA to adjust positions and protect investments.

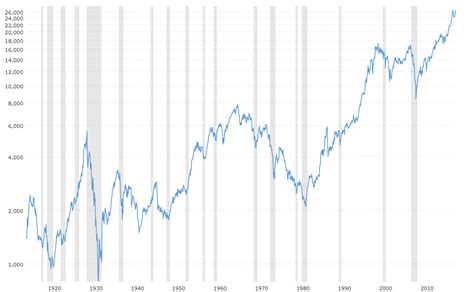

Historical Performance of the Dow Jones Industrial Average

Over its long history, the Dow Jones Industrial Average has demonstrated remarkable resilience and growth. The index has weathered economic downturns, geopolitical crises, and technological advancements, consistently reaching new highs.

Recent Historical Milestones:

- 2020: The DJIA plunged by over 30% due to the COVID-19 pandemic, but subsequently recovered strongly.

- 2022: The DJIA reached an all-time high of over 36,000, fueled by the post-pandemic economic recovery.

- 2023: The DJIA experienced volatility amid ongoing geopolitical tensions and rising inflation.

Projections for the Dow Jones Industrial Average in 2025

Financial analysts have provided varying projections for the Dow Jones Industrial Average in 2025. Some predict continued growth, while others anticipate market corrections.

Expert Projections:

- Goldman Sachs: Dow Jones Industrial Average to reach 40,000 by 2025.

- Morgan Stanley: Conservative estimate of 35,000, with potential for higher levels.

- Deutsche Bank: Dow Jones Industrial Average to face headwinds, with a target of 32,000.

Strategies for Investing in the Dow Jones Industrial Average

Investors can access the Dow Jones Industrial Average through various investment vehicles, including:

Exchange-Traded Funds (ETFs): Track the DJIA’s performance without the need to purchase individual stocks.

Index Funds: Offer diversified exposure to the companies in the DJIA.

Direct Investment: Purchase the stocks of individual DJIA constituents, but requires careful stock selection.

Tips for Dow Jones Industrial Average Investing:

- Diversify Portfolio: Spread investments across different sectors and asset classes to mitigate risk.

- Monitor Market Trends: Keep abreast of economic data and global events that can impact the DJIA.

- Consider Long-Term Horizon: The Dow Jones Industrial Average has historically performed well over extended periods.

The Future of the Dow Jones Industrial Average: Innovation and Expansion

The Dow Jones Industrial Average is expected to remain a cornerstone of market analysis in the years to come. However, technological advancements and evolving market dynamics may shape its future:

Emerging Technologies: Data analytics and artificial intelligence (AI) could enhance the DJIA’s predictive power.

Global Expansion: Inclusion of international companies in the DJIA could reflect the growing interconnectedness of the global economy.

Sustainability Measures: The DJIA may evolve to incorporate environmental, social, and governance (ESG) factors.

Conclusion

The Dow Jones Industrial Average is a timeless barometer of the U.S. stock market, providing invaluable insights into market conditions and economic trends. Real-time data empowers investors to monitor fluctuations and make informed decisions. By understanding the historical performance, projections, and strategies for investing in the Dow Jones Industrial Average, investors can capitalize on its potential to generate long-term returns. As the market landscape continues to evolve, the Dow Jones Industrial Average will remain a constant, adapting to new challenges and opportunities to serve as a beacon of market health.

Tables

Table 1: Historical Dow Jones Industrial Average Performance

| Year | Index Value |

|---|---|

| 1980 | 965.15 |

| 1990 | 2,999.75 |

| 2000 | 11,722.98 |

| 2010 | 11,577.51 |

| 2020 | 26,616.71 |

| 2022 | 36,796.66 |

Table 2: Key Dow Jones Industrial Average Constituents

| Company | Sector |

|---|---|

| Apple | Technology |

| Goldman Sachs | Finance |

| Boeing | Industrials |

| UnitedHealth Group | Healthcare |

| Nike | Consumer Goods |

Table 3: Dow Jones Industrial Average Projections for 2025

| Analyst | Projection |

|---|---|

| Goldman Sachs | 40,000 |

| Morgan Stanley | 35,000 |

| Deutsche Bank | 32,000 |

Table 4: Strategies for Investing in the Dow Jones Industrial Average

| Strategy | Description |

|---|---|

| ETF Investment | Track the DJIA’s performance without purchasing individual stocks. |

| Index Funds | Gain diversified exposure to the companies in the DJIA. |

| Direct Investment | Purchase the stocks of individual DJIA constituents, but requires careful stock selection. |