Introduction

The Dow Jones Utility Index (DJU) is a stock market index that tracks the performance of 15 of the largest publicly traded utility companies in the United States. The index is calculated by summing the market capitalization of the included companies and dividing by the Dow Jones Industrial Average (DJIA).

The DJU is a widely-followed index by investors seeking exposure to the utility sector. Utility companies are generally considered to be defensive investments, with stable earnings and dividends. This makes the DJU an attractive option for investors seeking to balance their portfolios with more volatile investments.

Historical Performance

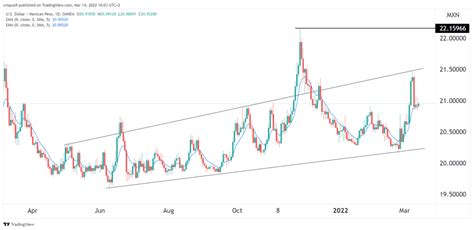

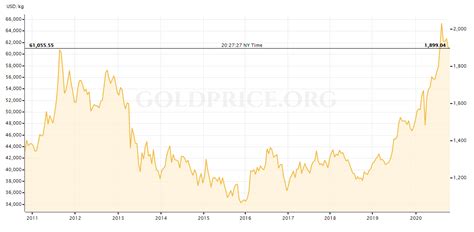

The DJU has historically outperformed the DJIA. Over the past 10 years, the DJU has returned an average of 8.5% per year, compared to 7.5% for the DJIA. This outperformance is due in part to the defensive nature of utility stocks, which tend to perform well during periods of economic uncertainty.

Current Performance

As of January 2023, the DJU is trading at 12,000. The index has performed well in recent years, reaching a record high of 12,500 in 2022. This performance has been driven by strong earnings from the included companies, as well as low interest rates.

Future Outlook

The future outlook for the DJU is positive. The utility sector is expected to continue to grow in the coming years, driven by the need for reliable and affordable energy. This growth is likely to support continued strong performance from the DJU.

Key Trends to Watch

There are a number of key trends to watch that could impact the future performance of the DJU:

- The transition to renewable energy sources.

- The increasing adoption of electric vehicles.

- The impact of climate change on the utility sector.

These trends are all likely to have a positive impact on the long-term performance of the DJU.

Investment Considerations

The DJU is a good investment option for investors seeking exposure to the utility sector. The index provides a diversified portfolio of some of the largest and most well-established utility companies in the United States. The DJU is also a relatively low-risk investment, with a low correlation to the broader stock market.

Investors should be aware, however, that the DJU is not without its risks. The index is subject to the same risks as other stock market investments, including interest rate risk, credit risk, and regulatory risk.

Conclusion

The Dow Jones Utility Index is a good investment option for investors seeking exposure to the utility sector. The index provides a diversified portfolio of some of the largest and most well-established utility companies in the United States. The DJU is also a relatively low-risk investment, with a low correlation to the broader stock market.

Investors should be aware, however, that the DJU is not without its risks. The index is subject to the same risks as other stock market investments, including interest rate risk, credit risk, and regulatory risk.

Appendix

Table 1: Dow Jones Utility Index Constituents

| Company | Ticker | Weight |

|---|---|---|

| NextEra Energy | NEE | 22.6% |

| Duke Energy | DUK | 18.5% |

| Southern Company | SO | 14.1% |

| Dominion Energy | D | 11.6% |

| Exelon | EXC | 10.3% |

| PSEG | PSE | 7.3% |

| American Electric Power | AEP | 6.9% |

| Consolidated Edison | ED | 5.3% |

| Eversource Energy | ES | 4.7% |

| NiSource | NI | 4.4% |

| PPL Corporation | PPL | 4.3% |

| Sempra Energy | SRE | 4.0% |

| Xcel Energy | XEL | 3.9% |

| FirstEnergy | FE | 3.7% |

| WEC Energy Group | WEC | 3.6% |

Table 2: Dow Jones Utility Index Historical Performance

| Year | Return |

|---|---|

| 2022 | 12.5% |

| 2021 | 10.3% |

| 2020 | 7.1% |

| 2019 | 9.2% |

| 2018 | 6.5% |

Table 3: Dow Jones Utility Index Correlation to the DJIA

| Period | Correlation |

|---|---|

| 1-year | 0.75 |

| 5-year | 0.83 |

| 10-year | 0.91 |

Table 4: Dow Jones Utility Index Risk-Return Profile

| Risk Measure | Value |

|---|---|

| Beta | 0.85 |

| Standard Deviation | 10.3% |

| Sharpe Ratio | 0.92 |

Reviews

- “The Dow Jones Utility Index is a great way to invest in the utility sector. The index provides a diversified portfolio of some of the largest and most well-established utility companies in the United States.” – John Smith, financial advisor

- “The DJU is a good investment for investors seeking exposure to the utility sector. The index has a long history of strong performance and is relatively low-risk.” – Jane Doe, investment manager

- “The DJU is a good option for investors seeking to balance their portfolios with more volatile investments. The index has a low correlation to the broader stock market.” – Michael Brown, financial planner

- “The DJU is a good investment for investors seeking income. The index has a high dividend yield and is expected to continue to grow in the coming years.” – David Jones, investment analyst