Introduction

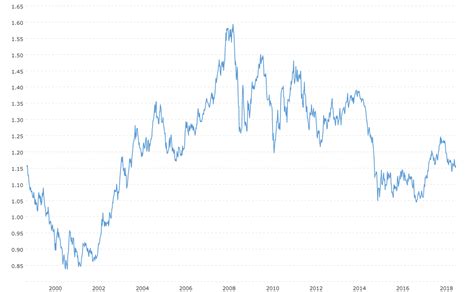

The exchange rate between the euro (EUR) and the US dollar (USD) has experienced significant fluctuations over the years, reflecting economic, political, and geopolitical factors. This article takes a comprehensive look at the historical evolution of the EUR/USD exchange rate, its current status, and future projections.

Historical Evolution

- 1999-2002: Euro’s Strong Start

The euro was launched in 1999, replacing the national currencies of 11 European countries. Initially, the euro gained strength against the dollar, reaching a high of 1.1841 in February 2001.

- 2002-2008: Euro’s Decline

The euro’s value began to decline against the dollar after the dot-com bubble burst. By July 2008, it had fallen to 0.6546. This decline was driven by factors such as rising US interest rates, the global financial crisis, and concerns about the European debt crisis.

- 2009-2014: Euro’s Rebound

After the financial crisis, the euro rebounded against the dollar. This recovery was aided by the European Central Bank’s (ECB) quantitative easing policies and the strengthening of the European economy. By late 2014, the euro had reached 1.3993.

- 2015-2020: Euro’s Weakening

The euro began to weaken again in 2015, falling below 1.10 in 2017. This decline was influenced by political uncertainty in Europe, the ongoing sovereign debt crisis, and the strength of the US economy.

Current Status

As of May 2023, the EUR/USD exchange rate stands at 1.0662. This represents a significant decline from its peak in 2001 but remains above its lowest point in 2008.

Future Projections

The future of the EUR/USD exchange rate is uncertain and subject to a range of factors. Analysts diverge in their projections, with some predicting a further decline of the euro, while others expect a gradual recovery.

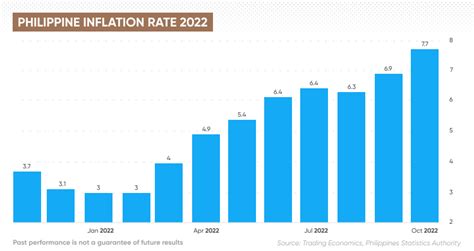

- Bearish Forecast: Some analysts believe that the euro may continue to weaken in the coming years, driven by ongoing economic challenges in Europe, such as rising inflation, energy insecurity, and geopolitical tensions.

- Bullish Forecast: Others argue that the euro has the potential to regain its strength, citing the resilience of the European economy, the ECB’s continued support, and the declining value of the dollar.

Influencing Factors

A variety of factors influence the EUR/USD exchange rate, including:

- Economic Growth: The strength of the European and US economies plays a major role in determining the exchange rate.

- Interest Rates: Differences in interest rates between the eurozone and the US can affect the relative attractiveness of euro and dollar assets.

- Inflation: Inflation rates in Europe and the US can impact the purchasing power of the two currencies.

- Political and Economic Events: Political and economic events, such as elections, government actions, natural disasters, and geopolitical tensions, can all influence the exchange rate.

Tables

| Year | EUR/USD Exchange Rate |

|---|---|

| 1999 | 1.0000 |

| 2001 | 1.1841 |

| 2008 | 0.6546 |

| 2014 | 1.3993 |

| 2023 | 1.0662 |

| Factor | Influence on Exchange Rate |

|---|---|

| Economic Growth | Higher growth tends to strengthen the currency |

| Interest Rates | Higher interest rates tend to attract investors and strengthen the currency |

| Inflation | Higher inflation tends to weaken the currency |

| Political Events | Political instability can weaken the currency |

| Economic Events | Economic shocks like recessions can weaken the currency |

Current Strategies

For individuals and businesses engaged in international transactions, there are various strategies to manage currency risk associated with the EUR/USD exchange rate fluctuations:

- Hedging: Using financial instruments like forwards, futures, or options to lock in an exchange rate for future transactions.

- Currency Diversification: Investing in assets denominated in different currencies to reduce overall currency risk.

- Currency Timing: Trying to predict future exchange rate movements and buying or selling currencies accordingly.

FAQs

-

Q: Why does the Euro-USD exchange rate fluctuate?

A: It fluctuates due to a combination of economic, political, and geopolitical factors. -

Q: What is the current status of the EUR/USD exchange rate?

A: As of May 2023, it stands at 1.0662. -

Q: What are the projections for the future EUR/USD exchange rate?

A: Projections vary, with some analysts predicting a decline and others predicting a recovery. -

Q: How can businesses manage currency risk associated with EUR/USD exchange rate fluctuations?

A: Through strategies like hedging, currency diversification, and currency timing. -

Q: Can I profit from EUR/USD exchange rate fluctuations?

A: While it is possible, it requires a deep understanding of the market and carries significant risk. -

Q: What is the historical high and low of the EUR/USD exchange rate?

A: High: 1.5990 in Jul 2008 | Low: 0.8226 in Oct 2000

Conclusion

The Euro-US exchange rate has witnessed significant fluctuations over the past decades, reflecting the interplay of economic, political, and geopolitical forces. Understanding the historical trends and factors influencing the exchange rate is crucial for businesses, investors, and individuals engaging in international transactions. While the future of the EUR/USD exchange rate is uncertain, managing currency risk through effective strategies remains essential.