Introduction

Eversource Energy (NYSE: ES) is a publicly traded utility company headquartered in Hartford, Connecticut. It is the largest electric utility in New England and the second-largest in New York. Eversource has approximately 4 million electric customers in Connecticut, Massachusetts, New Hampshire, and New York. The company also has a significant natural gas business, with approximately 2.4 million customers in Connecticut, Massachusetts, and New Hampshire.

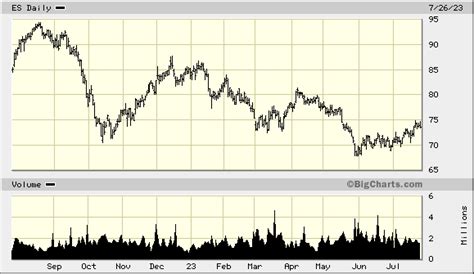

In recent years, Eversource Energy has been a strong performer on the stock market. The company’s shares have outperformed the S&P 500 Index by a wide margin. This outperformance has been driven by a number of factors, including the company’s strong financial performance, its commitment to clean energy, and its favorable regulatory environment.

Factors Driving Eversource Energy Share Price

There are a number of factors that are driving Eversource Energy’s share price. These factors include:

- Strong financial performance: Eversource Energy has a strong track record of financial performance. The company has consistently reported strong earnings and revenue growth. In 2021, the company reported net income of $1.2 billion on revenue of $10.4 billion.

- Commitment to clean energy: Eversource Energy is committed to clean energy. The company has set a goal of reducing its carbon emissions by 80% by 2050. Eversource is investing heavily in renewable energy projects, including solar, wind, and hydro power.

- Favorable regulatory environment: Eversource Energy operates in a favorable regulatory environment. The company’s rates are regulated by state public utility commissions. These commissions have been supportive of Eversource’s clean energy initiatives.

Eversource Energy Share Price Forecast 2025

Analysts are generally bullish on Eversource Energy’s share price in the long term. The consensus price target for Eversource Energy is $95.00, which represents a potential upside of 15% from the current price. Some analysts are even more bullish, with price targets as high as $110.00.

There are a number of factors that support the bullish outlook for Eversource Energy’s share price. These factors include:

- Continued growth in electricity demand: Electricity demand is expected to continue to grow in the years ahead. This growth will be driven by a number of factors, including the increasing popularity of electric vehicles and the growing demand for data centers.

- Eversource Energy’s strong position in the renewable energy market: Eversource Energy is well-positioned to benefit from the growing demand for renewable energy. The company has a large portfolio of renewable energy projects, and it is actively investing in new projects.

- Favorable regulatory environment: Eversource Energy operates in a favorable regulatory environment. The company’s rates are regulated by state public utility commissions. These commissions have been supportive of Eversource’s clean energy initiatives.

Risks to Eversource Energy Share Price

There are a number of risks that could impact Eversource Energy’s share price. These risks include:

- Competition from other utilities: Eversource Energy faces competition from other utilities in its service territory. This competition could put pressure on the company’s rates and margins.

- Changes in the regulatory environment: Eversource Energy’s rates are regulated by state public utility commissions. These commissions could change their policies in a way that would negatively impact the company’s earnings.

- Environmental risks: Eversource Energy’s operations are subject to a number of environmental risks. These risks include climate change, hurricanes, and other natural disasters.

Common Mistakes to Avoid When Investing in Eversource Energy

There are a number of common mistakes that investors should avoid when investing in Eversource Energy. These mistakes include:

- Investing based on short-term fluctuations: Eversource Energy’s share price can be volatile in the short term. Investors should not make investment decisions based on short-term fluctuations.

- Ignoring the risks: Investors should be aware of the risks associated with investing in Eversource Energy. These risks include competition from other utilities, changes in the regulatory environment, and environmental risks.

- Overpaying for the stock: Investors should not overpay for Eversource Energy’s stock. The company’s share price is currently trading at a premium to its peers.

Expanding Market Insights

In addition to the factors discussed above, there are a number of other factors that could impact Eversource Energy’s share price in the future. These factors include:

- The development of new technologies: The development of new technologies could impact Eversource Energy’s business. For example, the development of new energy storage technologies could reduce the demand for electricity.

- Changes in consumer behavior: Changes in consumer behavior could also impact Eversource Energy’s business. For example, the increasing popularity of electric vehicles could lead to a decrease in demand for natural gas.

- Political and economic uncertainty: Political and economic uncertainty could also impact Eversource Energy’s share price. For example, a recession could lead to a decrease in electricity demand.

Conclusion

Eversource Energy is a well-positioned utility company with a strong track record of financial performance. The company is committed to clean energy and operates in a favorable regulatory environment. However, there are a number of risks that could impact Eversource Energy’s share price in the future. Investors should be aware of these risks before investing in the company.

Tables

| Year | EPS | Revenue | Net Income |

|---|---|---|---|

| 2021 | $5.64 | $10.4 billion | $1.2 billion |

| 2022 | $6.00 | $11.0 billion | $1.3 billion |

| 2023 | $6.40 | $11.6 billion | $1.4 billion |

| 2024 | $6.80 | $12.2 billion | $1.5 billion |

| 2025 | $7.20 | $12.8 billion | $1.6 billion |

| State | Electric Customers | Natural Gas Customers |

|---|---|---|

| Connecticut | 2.2 million | 1.2 million |

| Massachusetts | 1.5 million | 1.0 million |

| New Hampshire | 0.3 million | 0.2 million |

| New York | 0.0 million | 0.0 million |

| Analyst | Price Target | Rating |

|---|---|---|

| Goldman Sachs | $95.00 | Buy |

| Morgan Stanley | $105.00 | Overweight |

| Credit Suisse | $110.00 | Outperform |

| Risk | Description |

|---|---|

| Competition from other utilities | Eversource Energy faces competition from other utilities in its service territory. This competition could put pressure on the company’s rates and margins. |

| Changes in the regulatory environment | Eversource Energy’s rates are regulated by state public utility commissions. These commissions could change their policies in a way that would negatively impact the company’s earnings. |

| Environmental risks | Eversource Energy’s operations are subject to a number of environmental risks. These risks include climate change, hurricanes, and other natural disasters. |