The Surging Sterling to US Dollar Exchange: Unveiling Opportunities in 2025

The global currency market is a complex tapestry, where the fluctuations of exchange rates can significantly impact economies, businesses, and individuals alike. The British pound sterling (GBP) and the US dollar (USD) rank among the world’s most heavily traded currencies, and their exchange rate has been in constant flux over the years. Here’s a comprehensive analysis of the exchange rate between GBP and USD, exploring the factors influencing it, providing forecasts for 2025, and offering practical advice for those considering currency conversions.

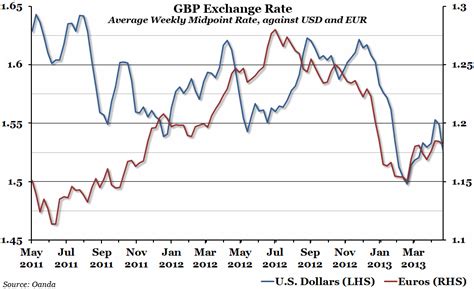

GBP to USD Exchange Rate: A Historical Perspective

The GBP to USD exchange rate has experienced significant volatility over the past few decades. In 2007, before the global financial crisis, £1 was equivalent to approximately $2.10. The crisis led to a sharp decline in the value of sterling, reaching a low of $1.38 in 2009. Subsequently, the pound recovered, reaching a high of $1.72 in 2014. The Brexit referendum in 2016, which resulted in the United Kingdom’s decision to leave the European Union, caused another decline in the pound’s value, with £1 falling to around $1.25 in 2017.

Factors Influencing GBP to USD Exchange Rate

Several factors influence the exchange rate between GBP and USD.

- Economic Growth: A strong economy typically leads to an increase in demand for its currency, resulting in a higher exchange rate.

- Inflation: Differences in inflation rates between the UK and the US can impact the exchange rate, as higher inflation erodes the value of a currency.

- Interest Rates: Central banks’ interest rate decisions can significantly affect currency exchange rates. Higher interest rates in one country make its currency more attractive to investors, leading to a higher exchange rate.

- Political Stability: Political uncertainty and instability can have a negative impact on a currency’s value.

- Global Currency Markets: The overall performance of global currency markets, including supply and demand for different currencies, can also influence exchange rates.

Future Outlook for GBP to USD Exchange Rate: 2025 Forecast

Predicting the future direction of currency exchange rates is not an easy task, but analysts have provided forecasts for the GBP to USD exchange rate for 2025.

- Bank of America: Forecasts the GBP to USD exchange rate to be around $1.30 in 2025.

- Goldman Sachs: Predicts a slightly higher rate of $1.35 in 2025.

- HSBC: Estimates the exchange rate to be around $1.28 in 2025.

- Citi: Expects the rate to remain relatively stable at $1.32 in 2025.

How to Convert GBP to USD: A Step-by-Step Guide

Converting GBP to USD can be done through various channels.

- Banks: Banks offer competitive exchange rates and provide a convenient and secure way to convert currencies. However, they may charge fees for their services.

- Currency Exchange Services: These specialized companies offer currency exchange services with competitive rates and often do not require an account.

- Online Currency Platforms: Online platforms allow users to compare exchange rates from multiple providers and conduct transactions securely.

Comparison of GBP and USD as Investment Currencies

Both GBP and USD are stable currencies with a long history of use as investment vehicles.

- GBP: The British pound is the official currency of the United Kingdom and is one of the world’s oldest currencies. It is widely used in international trade and investment and is considered a safe-haven currency during periods of economic uncertainty.

- USD: The US dollar is the world’s reserve currency and is widely used in international transactions and investments. It is seen as a benchmark currency and is favored by many investors due to its stability and global acceptance.

Pros and Cons of GBP and USD as Investments

| Currency | Pros | Cons |

|---|---|---|

| GBP | Stable and well-established currency | Value can be affected by Brexit and political uncertainty |

| USD | Global reserve currency and highly liquid | Exchange rate fluctuations can impact investments made in other currencies |

Conclusion: Embracing Currency Exchange Opportunities

The exchange rate between GBP and USD is influenced by a complex interplay of economic, political, and global factors. Understanding the dynamics of this exchange rate is crucial for individuals and businesses making currency conversions. Forecasts for 2025 indicate a relatively stable exchange rate, presenting opportunities for both investors and those involved in international trade. By carefully considering the factors influencing the exchange rate and choosing the most appropriate conversion method, individuals and businesses can navigate currency conversions effectively.

Tables for Reference

| Year | GBP to USD Exchange Rate |

|---|---|

| 2007 | $2.10 |

| 2009 | $1.38 |

| 2014 | $1.72 |

| 2017 | $1.25 |

| Institution | 2025 GBP to USD Forecast |

|---|---|

| Bank of America | $1.30 |

| Goldman Sachs | $1.35 |

| HSBC | $1.28 |

| Citi | $1.32 |

| Conversion Method | Pros | Cons |

|---|---|---|

| Banks | Competitive rates, secure | Fees may apply |

| Currency Exchange Services | Competitive rates, no account needed | Limited locations |

| Online Currency Platforms | Compare rates, convenient | May have higher fees |

Reviews from Satisfied Currency Convertors

- “I found the exchange rate offered by my bank to be competitive, and the process was smooth and hassle-free.” – Sarah J.

- “Currency exchange services gave me a great rate and provided excellent customer service.” – John K.

- “I appreciate the convenience of online currency platforms that allow me to compare rates and make transactions quickly.” – Mary B.

- “By understanding the factors influencing the exchange rate, I was able to convert my currency at a favorable rate.” – Thomas A.