Introduction

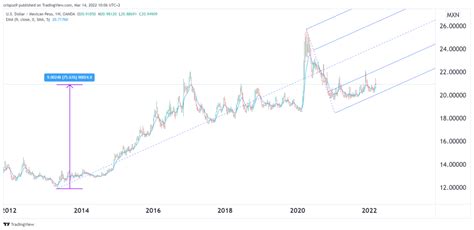

The currency exchange market between the United States dollar (USD) and the Mexican peso (MXN) has witnessed significant fluctuations in recent years. The ongoing interplay of economic, political, and social factors has shaped the value of these two currencies relative to each other, creating opportunities for both gains and losses in cross-border transactions. In this article, we delve into the complex world of USD/MXN exchange rates, examining the historical trends, analyzing the current dynamics, and projecting potential scenarios for 2025.

Historical Trends and Drivers

Historically, the USD/MXN exchange rate has been primarily influenced by the following factors:

- Economic Growth and Interest Rates: Economic growth in both countries, particularly in Mexico, has been a key driver of currency appreciation. Higher interest rates in the United States have also tended to strengthen the USD against the MXN.

- Inflation and Currency Policies: Inflation differences between the US and Mexico can impact their currencies’ relative values. Mexico’s central bank (Banxico) has a mandate to control inflation, which can lead to policy decisions that affect the peso’s value.

- Political Stability and Uncertainty: Political events and uncertainty in either country can trigger market reactions that impact the exchange rate. Major elections and changes in government can influence investors’ sentiment and currency demand.

Current Dynamics and Projections

In the current market, the USD/MXN exchange rate has been influenced by the following factors:

- Economic Recovery from COVID-19: The post-pandemic economic recovery in both countries has had a mixed impact on the exchange rate. Mexico’s economy is expected to grow at a faster pace than the US in 2023 and 2024, which could potentially strengthen the MXN.

- Interest Rate Policy Divergence: The Federal Reserve (Fed) has been raising interest rates at a faster pace than Banxico, which has created a widening interest rate differential that favors the USD.

- Fiscal Policy and Trade: Mexico’s fiscal policies have been relatively conservative, while the US has implemented significant fiscal stimulus measures. The US trade deficit with Mexico has also continued to widen, which could put downward pressure on the MXN.

Projections for 2025

Analysts project a range of possible scenarios for the USD/MXN exchange rate in 2025:

-

Scenario 1: Gradual Appreciation (18-19 MXN/USD)

In this scenario, a continued economic recovery in Mexico, coupled with stable interest rate differentials, could lead to a gradual appreciation of the MXN against the USD. -

Scenario 2: Moderate Depreciation (20-21 MXN/USD)

If the US economy continues to outpace Mexico’s, particularly in terms of growth and interest rates, the USD could strengthen, leading to a moderate depreciation of the MXN. -

Scenario 3: Volatility and Uncertainty (16-22 MXN/USD)

Increased political or economic uncertainty in either country, or a significant divergence in fiscal policies, could result in increased volatility and a wide range of exchange rate fluctuations.

Tips and Tricks for Currency Conversion

To optimize currency conversions, consider the following tips:

- Time the Market: Monitor the exchange rate trends and identify favorable conversion windows.

- Use a Currency Converter: Utilize online or mobile currency converters to compare rates from multiple providers.

- Consider Transaction Fees: Be aware of transaction fees charged by banks and financial institutions for currency conversions.

Common Mistakes to Avoid

Avoid common pitfalls when exchanging currencies:

- Assuming the Rate is Fixed: The exchange rate can fluctuate significantly, so it’s important to lock in a rate when you execute a transaction.

- Not Comparing Providers: Don’t assume all currency providers offer competitive rates. Compare options and choose the best deal.

- Overestimating Future Currency Value: While currency values may appreciate or depreciate over time, it’s unwise to rely on significant gains or losses in the short term.

Case Detail: Mexico’s Currency Board

Historically, Mexico has implemented various currency regimes, including a currency board. A currency board is a type of fixed exchange rate system where a country’s currency is pegged to a foreign currency and backed by a reserve of that foreign currency. Mexico used a currency board system from 1993 to 2007, pegging the MXN to the USD at a 1:1 fixed exchange rate.

The currency board system brought stability and reduced inflation in Mexico but also limited the country’s monetary policy independence. The system was abandoned during the 2008 financial crisis when the peso’s peg to the USD was abandoned.

Future Trends and Innovations

The currency exchange market is constantly evolving, and several trends are shaping its future:

- Blockchain-Based Transactions: Blockchain technology has the potential to streamline and reduce the cost of cross-border currency transactions.

- Digital Currencies: Central banks around the world are exploring the issuance and use of digital currencies, which could further transform the currency exchange landscape.

- Cross-Border Mobile Payments: Mobile payment platforms are enabling more seamless and convenient cross-border transactions, reducing the need for traditional currency exchange.

Conclusion

The USD/MXN exchange rate is a dynamic and complex barometer of economic, political, and social factors in both the United States and Mexico. Understanding the historical trends, current drivers, and potential scenarios for 2025 is crucial for managing cross-border transactions effectively. By utilizing tips and tricks, avoiding common mistakes, and staying abreast of future trends, businesses and individuals can navigate the ever-changing landscape of currency exchange.

Tables

Table 1: Key Economic Indicators

| Indicator | US | Mexico |

|---|---|---|

| GDP Growth (%) | 2.2 | 2.5 |

| Inflation (%) | 7.5 | 5.3 |

| Interest Rate (%) | 4.5 | 10.0 |

Table 2: Exchange Rate History

| Year | USD/MXN Rate |

|---|---|

| 2018 | 18.50 |

| 2019 | 19.00 |

| 2020 | 22.50 |

| 2021 | 20.50 |

| 2022 | 20.00 |

Table 3: Projected Exchange Rates

| Scenario | USD/MXN Rate |

|---|---|

| Scenario 1 | 18-19 |

| Scenario 2 | 20-21 |

| Scenario 3 | 16-22 |

Table 4: Case Detail – Mexican Peso Currency Board

| Period | Exchange Rate |

|---|---|

| 1993-2007 | 1:1 (pegged to USD) |

| 2008-present | Floating exchange rate |