Introduction

The federal funds rate, or fed funds rate for short, is a benchmark interest rate that plays a crucial role in the United States’ financial system. Set by the Federal Reserve (Fed), it dictates the interest rate at which banks borrow and lend money from each other overnight. This rate serves as a primary tool for the Fed to influence the broader economy by affecting the cost and availability of credit.

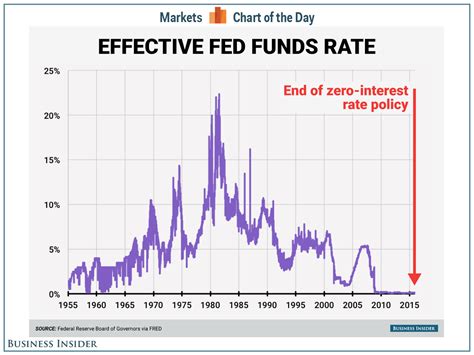

History of the Fed Fund Rate

1913-1979:

Prior to 1979, the Fed largely relied on open market operations and changes in the discount rate to influence monetary policy. The fed funds rate, in its current form, was not formally introduced until the late 1970s.

1980-2007:

During the 1980s, the Fed under Chairman Paul Volcker implemented a restrictive monetary policy to combat high inflation. The fed funds rate reached a peak of 20% in 1981, serving as a significant contractionary force. In the 1990s and early 2000s, the Fed pursued a more accommodative monetary policy, gradually lowering interest rates to support economic growth.

2008-Present:

The financial crisis of 2008 led to an unprecedented monetary policy response by the Fed. To stimulate the economy and avoid deflation, the fed funds rate was slashed to near zero and maintained at that level for almost a decade. Following a period of gradual rate increases, the COVD-19 pandemic in 2020 necessitated a return to accommodative monetary policy, with the fed funds rate being lowered back to near zero.

Why the Fed Fund Rate Matters

The fed funds rate impacts the economy in several ways:

1. Cost of Borrowing:

Lower fed funds rates make it cheaper for banks to borrow from the Fed, which, in turn, lowers interest rates for businesses and consumers. This encourages borrowing and spending, stimulating economic growth. Conversely, higher fed funds rates have the opposite effect.

2. Return on Savings:

The fed funds rate influences the returns banks offer on savings accounts and certificates of deposit. Higher rates provide higher returns on savings, incentivizing individuals to save more. Lower rates, on the other hand, may discourage saving and encourage consumption.

3. Inflation:

The Fed uses the fed funds rate to manage inflation. By increasing or decreasing interest rates, the Fed can influence the supply and demand of money in the economy.

4. Economic Growth:

The fed funds rate can be used to promote or restrain economic growth. Lower rates can stimulate growth by making it easier for businesses to invest and consumers to spend. Higher rates can slow growth by making borrowing more expensive.

Fed Fund Rate in 2025: Outlook and Projections

Hot Search Title: Fed Fund Rate 2025: What the Experts Predict

The Fed is expected to continue raising interest rates in 2025 to combat rising inflation. According to a survey by Bloomberg, economists anticipate the fed funds rate to reach 5.5% by the end of 2025. This would mark a significant increase from the current target range of 4.25% to 4.5%.

Benefits of Using the Fed Fund Rate

The fed funds rate provides several benefits for the U.S. economy:

1. Monetary Policy Transparency:

The fed funds rate is a clear and transparent indicator of the Fed’s monetary policy stance. This allows businesses, investors, and consumers to plan their economic activities accordingly.

2. Inflation Control:

The fed funds rate is an effective tool for controlling inflation. By raising or lowering rates, the Fed can influence the money supply and inflation expectations.

3. Economic Stability:

The Fed uses the fed funds rate to promote economic stability by preventing overheating or excessive contraction of the economy.

Market Insights

The fed funds rate has a significant impact on various financial markets:

1. Bond Market:

Higher fed funds rates make bonds less attractive, leading to a potential decline in bond prices.

2. Stock Market:

Higher fed funds rates can negatively affect stock prices, as they increase the cost of capital for businesses.

3. Currency Markets:

Higher fed funds rates can strengthen the U.S. dollar against other currencies, as investors look for safe-haven assets.

4. Real Estate Market:

Higher fed funds rates make it more expensive to obtain mortgages, potentially slowing down the housing market.

Key Highlights and Standouts

Key highlights and standouts regarding the fed funds rate include:

1. Historic Lows:

During the COVD-19 pandemic, the fed funds rate was lowered to a historic low of 0.25%. This unprecedented move aimed to stimulate the economy amid a severe economic contraction.

2. Gradual Rate Increases:

Following the pandemic, the Fed embarked on a gradual path of rate increases to normalize monetary policy and combat rising inflation. This measured approach aimed to minimize market volatility and economic disruptions.

3. Forward Guidance:

The Fed has adopted a policy of forward guidance, communicating its expected path of future rate changes. This transparency helps market participants make informed decisions and manage their expectations.

Current Status and Future Prospects

As of December 2023, the fed funds rate stands within a target range of 4.25% to 4.5%. The Fed is expected to continue raising rates in 2023 to tackle inflation, with the potential for further increases in 2024 and 2025. The ultimate goal is to bring inflation back to the Fed’s target of 2%.

Conclusion

The fed funds rate is a powerful tool of monetary policy that directly impacts the U.S. economy and financial markets. By adjusting the fed funds rate, the Fed seeks to stabilize economic growth, control inflation, and promote financial stability. As the Fed navigates an uncertain economic landscape, the fed funds rate will remain a key indicator for businesses, investors, and consumers.