Harnessing the intricacies of Form 8949 Schedule D is a crucial step towards optimizing tax strategies and maximizing investment gains in the year 2025 and beyond. This comprehensive guide delves into the nuances of this vital form, empowering investors with valuable insights and practical advice to navigate the complexities of capital gains and losses reporting.

Form 8949 Schedule D: A Gateway to Investment Success

Form 8949 Schedule D serves as a detailed record of capital gains and losses generated from the sale or exchange of capital assets, such as stocks, bonds, and real estate. Understanding the nuances of this form is paramount for accurate reporting and the realization of substantial tax savings.

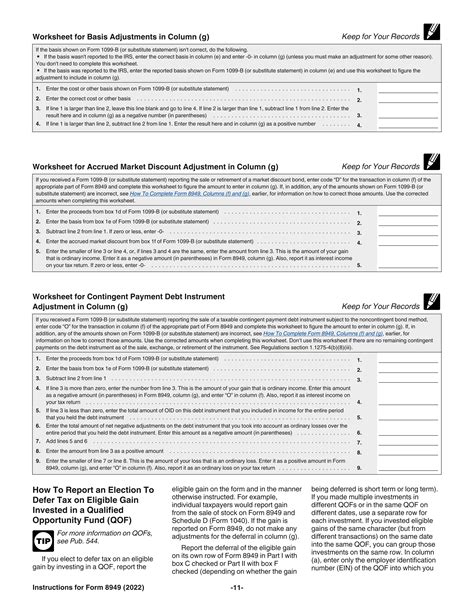

What is Form 8949 Schedule D?

Form 8949 Schedule D is an Internal Revenue Service (IRS) document specifically designed to report capital gains and losses incurred during a tax year. This form provides a detailed breakdown of each transaction, including information such as the date of sale, proceeds, cost basis, and any applicable capital gains tax rate.

Key Features of Form 8949 Schedule D

- Reporting of capital gains and losses from various sources

- Calculation of net capital gain or loss

- Determination of applicable capital gains tax rate

- Reconciliation of net capital gain/loss with Form 1040, Schedule D

Understanding Capital Gains and Losses

Capital gains and losses are generated when capital assets are sold or exchanged. These assets typically include stocks, bonds, and real estate, among others. The difference between the sale proceeds and the cost basis of the asset determines the capital gain or loss.

- Capital Gains: Profits realized from the sale of capital assets

- Capital Losses: Losses incurred from the sale of capital assets

Calculating Net Capital Gain/Loss

To calculate the net capital gain or loss, investors need to tally up all their capital gains and losses. If the total gains exceed the losses, the result is a net capital gain. Alternatively, if the losses exceed the gains, the result is a net capital loss.

Taxable Capital Gains

Net capital gains are subject to taxation, the rate of which depends on the holding period of the asset.

- Short-Term Capital Gains: Assets held for one year or less; taxed as ordinary income

- Long-Term Capital Gains: Assets held for more than one year; taxed at preferential rates

Reporting Form 8949 Schedule D

Form 8949 Schedule D is filed alongside the taxpayer’s Form 1040 income tax return.

Step-by-Step Instructions

- Gather all necessary documents, including sales records and cost basis information.

- Complete Part I of the form by entering personal details and income summary.

- Fill in Part II with details of all capital asset transactions.

- Calculate the net capital gain or loss and report it on Part III.

- Transfer the net capital gain/loss to Form 1040, Schedule D.

Common Mistakes to Avoid

- Inaccurate reporting of sale dates and proceeds

- Improper calculation of cost basis

- Misinterpretation of capital gains tax rates

- Filing without completing all sections of the form

Maximizing Tax Savings and Investment Opportunities

Leveraging Form 8949 Schedule D effectively can result in substantial tax savings and enhanced investment opportunities. Here are some strategies to consider:

- Tax-Loss Harvesting: Selling losing investments to offset capital gains and reduce tax liability.

- Capital Gains Deferral: Holding on to appreciated assets for longer than a year to qualify for lower long-term capital gains rates.

- Investment in Tax-Advantaged Accounts: Utilizing retirement accounts, such as 401(k)s and IRAs, to defer capital gains and grow investments tax-free.

Conclusion

Form 8949 Schedule D is an indispensable tool for reporting capital gains and losses, optimizing tax strategies, and maximizing investment returns. By understanding the intricacies of this form and implementing effective tax-saving techniques, investors can unlock significant financial advantages and achieve long-term investment success.

Additional Resources: