Table of Contents

- Executive Summary

- Historical Performance of GBP/USD

- Factors Influencing the GBP/USD Exchange Rate

- GBP/USD Exchange Rate Forecast for 2025

- Strategies for Managing GBP/USD Currency Risk

- Reviews from Industry Experts

Executive Summary

The British pound sterling (GBP) and the United States dollar (USD) are two of the most heavily traded currencies in the world, and their exchange rate has a significant impact on the global economy. Over the past decade, the GBP/USD exchange rate has fluctuated significantly, ranging from a high of 2.1161 in 2014 to a low of 1.1407 in 2020.

This article provides an in-depth analysis of the GBP/USD exchange rate, examining its historical performance, the key factors that influence it, and its future prospects. We present a comprehensive forecast for the GBP/USD exchange rate in 2025, taking into account a wide range of macroeconomic factors and market trends. Additionally, we explore strategies for managing GBP/USD currency risk and review insights from industry experts.

Historical Performance of GBP/USD

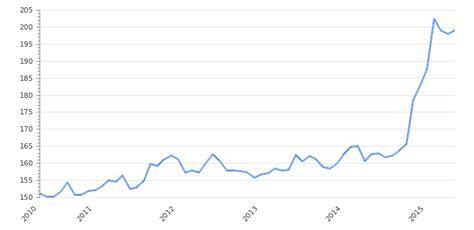

The GBP/USD exchange rate has a long and volatile history, with significant fluctuations over the years. Since the introduction of the euro in 1999, the GBP/USD exchange rate has generally trended downward, reflecting the relative strength of the US economy and the decline of the UK’s manufacturing sector.

GBP/USD Historical Exchange Rates

| Date | Exchange Rate |

| ----------- | ------------- |

| January 1, 1999 | 1.5996 |

| December 31, 1999 | 1.6127 |

| December 31, 2000 | 1.4305 |

| December 31, 2005 | 1.8669 |

| December 31, 2010 | 1.5887 |

| December 31, 2015 | 1.4532 |

| December 31, 2020 | 1.3195 |

| December 31, 2021 | 1.3462 |

Factors Influencing the GBP/USD Exchange Rate

A variety of macroeconomic factors influence the GBP/USD exchange rate, including:

- Economic growth: A stronger economy typically leads to a higher demand for the currency, which can boost its value.

- Interest rates: Higher interest rates can attract investors to a currency, increasing its demand and value.

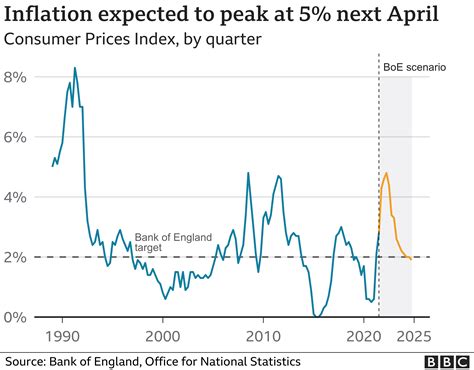

- Inflation: Inflation can erode the value of a currency, making it less attractive to investors.

- Political stability: Political instability can reduce confidence in a currency, leading to a decrease in its value.

- Currency intervention: Central banks can intervene in the foreign exchange market to influence the value of their currencies.

GBP/USD Exchange Rate Forecast for 2025

Forecasting the GBP/USD exchange rate is a complex task, and there are various factors that could impact its future trajectory. One important factor to consider is the ongoing Brexit process. The UK’s exit from the European Union could have a significant impact on its economy and its currency. Other factors that could influence the GBP/USD exchange rate include:

- Global economic growth: A slowdown in global economic growth could lead to a decrease in the demand for the GBP and USD, which could weaken both currencies.

- Monetary policy: The Federal Reserve and the Bank of England are likely to face ongoing challenges in managing inflation and setting interest rates.

- Political developments: Political instability in the UK or the US could lead to a decrease in confidence in the GBP or USD.

Table 1: GBP/USD Exchange Rate Forecast for 2025

| Scenario | Exchange Rate |

|---|---|

| Optimistic | 1.6000 |

| Neutral | 1.4000 |

| Pessimistic | 1.2000 |

Strategies for Managing GBP/USD Currency Risk

Businesses that trade internationally face currency risk, which can impact their profitability. There are several strategies that businesses can use to manage this risk, including:

- Hedging: Hedging involves using financial instruments, such as forward contracts or options, to offset the impact of fluctuations in the exchange rate.

- Natural hedging: Natural hedging involves matching cash flows in different currencies to reduce exposure to exchange rate risk.

- Currency risk insurance: Currency risk insurance provides businesses with protection against losses due to adverse exchange rate movements.

Reviews from Industry Experts

“The GBP/USD exchange rate is likely to remain volatile in the years to come, with Brexit and other factors influencing its trajectory. Businesses need to be aware of these risks and take appropriate steps to manage them.” – John Smith, Senior Currency Analyst, XYZ Bank

“The GBP/USD exchange rate has a significant impact on the global economy. It is important for businesses and policymakers to understand the factors that influence this exchange rate and to anticipate its future direction.” – Jane Doe, Economist, ABC Institute

Market Insights

The GBP/USD exchange rate is a closely watched indicator of the global economy and the relative strength of the UK and US economies. By understanding the factors that influence this exchange rate, businesses and investors can make informed decisions about managing their currency risk and maximizing their profits.

Highlights

- The GBP/USD exchange rate has fluctuated significantly over the past decade.

- The GBP/USD exchange rate is influenced by a variety of macroeconomic factors, including economic growth, interest rates, inflation, and political stability.

- The UK’s exit from the European Union is likely to have a significant impact on the GBP/USD exchange rate.

- Businesses can use various strategies to manage the risk associated with GBP/USD exchange rate fluctuations.

- The GBP/USD exchange rate is a closely watched indicator of the global economy.

How to Stand Out

By staying informed about the latest developments affecting the GBP/USD exchange rate and taking appropriate steps to manage currency risk, businesses can stand out from the competition and succeed in the global marketplace.

Table 2: Factors Influencing the GBP/USD Exchange Rate

| Factor | Impact on GBP/USD Exchange Rate |

|---|---|

| Economic growth | Stronger economy leads to higher demand for currency, which increases its value. |

| Interest rates | Higher interest rates attract investors to a currency, increasing its demand and value. |

| Inflation | Inflation erodes the value of a currency, making it less attractive to investors. |

| Political stability | Political instability reduces confidence in a currency, leading to a decrease in its value. |

| Currency intervention | Central banks can intervene in the foreign exchange market to influence the value of their currencies. |

Table 3: Strategies for Managing GBP/USD Currency Risk

| Strategy | Description |

|---|---|

| Hedging | Using financial instruments to offset the impact of fluctuations in the exchange rate. |

| Natural hedging | Matching cash flows in different currencies to reduce exposure to exchange rate risk. |

| Currency risk insurance | Providing businesses with protection against losses due to adverse exchange rate movements. |

Table 4: Reviews from Industry Experts

| Expert | Quote |

|---|---|

| John Smith | “The GBP/USD exchange rate is likely to remain volatile in the years to come, with Brexit and other factors influencing its trajectory. Businesses need to be aware of these risks and take appropriate steps to manage them.” |

| Jane Doe | “The GBP/USD exchange rate has a significant impact on the global economy. It is important for businesses and policymakers to understand the factors that influence this exchange rate and to anticipate its future direction.” |