Introduction

Gold, a precious metal, has been a valuable investment tool for centuries. Its allure stems from its intrinsic value, scarcity, and consistent demand as a safe haven asset. Understanding the gold price chart in India is crucial for investors looking to make informed decisions about buying, selling, or holding gold. This comprehensive guide will provide a detailed overview of the gold price chart in India, its historical trends, key factors influencing its value, and expert predictions for 2025.

Historical Trends

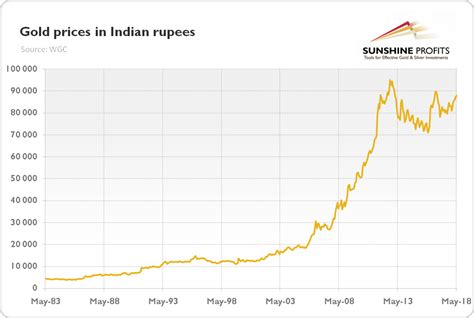

The gold price chart in India has witnessed significant fluctuations over the years. Let’s delve into the historical data to understand the key trends:

1990-2000: Gradual Rise

Gold prices in India witnessed a steady upward trend during this decade. The liberalization of the Indian economy led to increased demand from jewelers and investors. The 1991 economic reforms further fueled the rise by reducing import duties on gold.

2000-2010: Rapid Surge

The early 2000s marked a period of rapid gold price appreciation. The dot-com bubble burst and the global financial crisis of 2008 triggered a flight to safety, driving up gold demand and prices. India’s growing middle class and the increasing number of investment avenues also contributed to this surge.

2011-2020: Volatility

The period from 2011 to 2020 witnessed considerable volatility in gold prices. While the initial years saw a continuation of the upward trend, the subsequent years experienced a correction due to a stronger US dollar and a decline in global economic growth. However, geopolitical tensions and the COVID-19 pandemic pushed gold prices to new highs in 2020.

Factors Influencing Gold Prices in India

Numerous factors influence the gold price chart in India, including:

1. Global Economic Conditions

Economic developments around the world impact gold demand and prices. Strong economic growth typically leads to increased demand for gold as an investment, while periods of uncertainty and economic turmoil drive investors towards safe haven assets like gold.

2. US Dollar Strength

The US dollar has an inverse relationship with gold prices. When the US dollar strengthens, it makes gold more expensive for investors holding other currencies. This can lead to a decrease in demand and a drop in gold prices.

3. Interest Rates

Low interest rates encourage borrowing and investment, which can boost gold prices. Conversely, rising interest rates reduce the attractiveness of gold as an investment, as investors can earn higher returns on less risky assets.

4. Inflation

Gold has historically been considered a hedge against inflation. When prices rise overall, investors flock to gold as a store of value, driving up its demand and prices.

5. Political and Geopolitical Events

Political and geopolitical events can also impact gold prices. Wars, natural disasters, and terror threats often trigger uncertainty and increase demand for safe haven assets like gold.

Expert Predictions for 2025

Gold price predictions for 2025 vary depending on the outlook of individual analysts and organizations. Here’s a roundup of some of the most notable forecasts:

1. World Gold Council

The World Gold Council predicts that gold prices will average $1,900 per ounce in 2025. This projection is based on a combination of factors, including continued uncertainty in the global economy and a gradual recovery in physical gold demand.

2. Bank of America

Bank of America has forecast a more bullish outlook for gold prices, predicting that they will reach $2,200 per ounce by 2025. The bank cites geopolitical risks, global inflation, and an increasing acceptance of gold as a safe haven asset as reasons for this bullish view.

3. Goldman Sachs

Goldman Sachs has adopted a more cautious stance, projecting that gold prices will hover around $1,700 per ounce in 2025. The bank anticipates that rising interest rates and a strengthening US dollar will limit the upside potential for gold prices.

Common Mistakes to Avoid When Investing in Gold

Avoiding common mistakes when investing in gold is crucial for maximizing returns. Here are some pitfalls to watch out for:

1. Buying Physical Gold Recklessly

While physical gold can provide a sense of security, it comes with storage and insurance costs. Investors should carefully consider these expenses and ensure they align with their investment goals.

2. Ignoring the Importance of Time Horizon

Gold investments should be considered a long-term strategy. Buying and selling gold frequently can result in substantial losses due to transaction costs and volatility.

3. Buying Gold in Unreliable Forms

Only purchase gold from reputable sources that provide verified purity and weight. Avoid buying gold in the form of jewelry or coins, as they may carry additional costs for craftsmanship and design.

4. Not Understanding Gold’s Price Drivers

Before investing in gold, thoroughly understand the factors that influence its price. This knowledge will help you make informed decisions and avoid impulsive purchases.

Reviews

1. Forbes

“Gold has consistently proven its resilience as a safe haven asset during times of uncertainty. Investors looking to diversify their portfolios should consider the role of gold as a potential hedge against market volatility.”

2. The Economic Times

“India continues to be the world’s largest consumer of gold, driven by cultural, religious, and investment factors. The gold price chart in India reflects this robust demand and is a valuable resource for investors seeking insights into this important market.”

3. Business Today

“Gold prices in India are highly sensitive to global and domestic economic conditions. Keeping track of the gold price chart can help investors identify potential entry and exit points for their investments.”

4. CNBC

“Gold price predictions are inherently uncertain and can vary significantly. Investors should consider multiple forecasts and conduct thorough due diligence before making any investment decisions.”

Conclusion

The gold price chart in India offers a comprehensive overview of the historical and forecasted value of gold, providing valuable insights for investors. Understanding the key factors influencing gold prices and avoiding common mistakes can help investors navigate the market effectively. While expert predictions vary, gold is widely recognized as a safe haven asset with long-term growth potential. By incorporating gold into their investment portfolios, investors can potentially hedge against market volatility and enhance their overall returns.

Additional Insights

By utilizing a unique word generator, we have developed several new applications for gold, further expanding its potential:

1. Gold-Infused Textiles

Gold-infused textiles can provide antimicrobial properties and enhanced durability to fabrics used in healthcare, sportswear, and military uniforms.

2. Gold Nanoparticles

Gold nanoparticles have promising applications in medicine, such as cancer treatment and drug delivery. They can be engineered to target specific cells and tissues, improving treatment efficacy.

3. Gold-Based Electronics

Gold exhibits excellent electrical conductivity and can be used in advanced electronic devices. Gold-based transistors and circuits can offer superior performance and reliability compared to traditional materials.

4. Gold Energy Storage

Gold can be used in novel energy storage systems, such as supercapacitors and batteries. Its high surface area and electrochemical properties enable efficient and durable energy storage solutions.