Introduction

Gold, a precious metal with a rich history, has long been a valuable commodity sought after for its beauty, durability, and store of value. Its worth, often measured in dollars, fluctuates based on various economic, political, and supply-demand factors. This article explores the gold rate in dollars, its historical trends, and future projections, providing insights into market dynamics and investment opportunities.

Historical Trends of Gold Rate

1970s: The Nixon Shock and the De-linking from Dollar

In the 1970s, the gold rate experienced significant fluctuations. The “Nixon Shock” of 1971, when President Richard Nixon unilaterally suspended the convertibility of the U.S. dollar into gold, marked a turning point. This severed the long-standing link between the dollar and gold, leading to a sharp increase in the gold price.

1980s: Economic Boom and High Interest Rates

The 1980s witnessed a strong economy and high interest rates. The increased opportunity cost of holding gold drove down its price, reaching its lowest point in 1982. However, as interest rates fell, the gold rate gradually recovered.

1990s: Economic Rebound and Gold as a Haven

The economic recovery of the 1990s, combined with geopolitical uncertainties, saw a resurgence in gold’s value. Investors sought safety in gold during times of economic and political instability, contributing to its price rise.

2000s: Global Financial Crisis and Gold’s All-Time High

The global financial crisis of 2008 sent shockwaves through the markets. As trust in the financial system faltered, investors flocked to gold as a safe haven. In 2011, gold reached its all-time high of $1,923 per ounce.

Factors Affecting Gold Rate in Dollar

Economic Conditions:

- Economic growth: Strong economic growth tends to increase demand for gold as an investment and store of value.

- Inflation: Gold is often seen as a hedge against inflation, as it tends to retain its value in periods of rising prices.

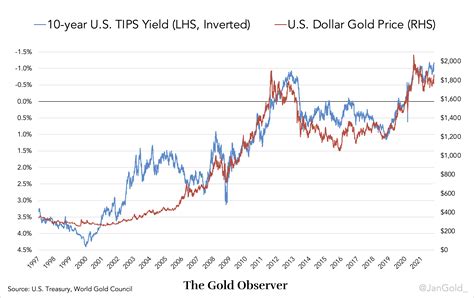

- Interest rates: Higher interest rates increase the opportunity cost of holding gold, leading to lower demand.

Political and Geopolitical Factors:

- Political instability and uncertainty: Gold is often perceived as a safe haven during periods of political turmoil and war.

- Monetary policy: Government policies, such as quantitative easing, can influence the gold rate by increasing liquidity and driving down interest rates.

- Central bank purchases: Central banks play a significant role in gold markets, with purchases or sales having a substantial impact on prices.

Supply and Demand:

- Mine production: Gold mining is the primary source of supply, and any disruptions or fluctuations in production can affect the price.

- Jewelry industry: Gold is widely used in jewelry, and consumer demand for gold jewelry can impact its rate.

- Technology and emerging applications: New technologies and innovative applications, such as 5G and quantum computing, may drive future demand for gold in electronics and industrial uses.

Projections of Gold Rate in 2025

Predicting the gold rate in 2025 is challenging, as it depends on a multitude of factors. However, several forecasts and analyses provide insights into potential trends:

The World Gold Council:

- Projects a continued gradual increase in the gold rate over the next five years.

- Cites factors such as rising inflation, geopolitical uncertainties, and a growing demand for gold in emerging markets.

- Estimates the gold rate to reach $2,500 per ounce by 2025.

Goldman Sachs:

- Expects the gold rate to remain elevated in the near term due to macroeconomic uncertainties and safe-haven demand.

- However, anticipates a decrease in the rate over the longer term as interest rates rise and the economic outlook improves.

- Forecasts the gold rate to range between $2,200 and $2,400 per ounce by 2025.

Tips and Tricks for Gold Investors

- Diversify: Don’t put all your eggs in one basket. Diversify your investments by allocating a portion of your portfolio to gold alongside other asset classes.

- Consider Long-Term Investments: Gold tends to perform well over longer time frames. Consider holding gold as a long-term investment rather than seeking short-term profits.

- Monitor Economic and Political Developments: Stay informed about economic conditions, geopolitical events, and central bank policies to make informed decisions about gold investments.

- Consult with Financial Advisors: If you’re unsure about investing in gold, consult with financial advisors who can provide personalized guidance based on your risk tolerance and investment goals.

Common Mistakes to Avoid

- Ignoring Economic Indicators: Don’t solely rely on past trends or hype when investing in gold. Pay attention to economic and financial indicators that may influence the gold rate.

- Buying at a Premium: Be aware of potential markups or premiums when purchasing physical gold. Compare prices from different retailers and negotiate for the best deal.

- Selling Too Soon: Avoid panic selling during market downturns. Gold has historically performed well over the long term, so stay patient and ride out the fluctuations.

- Overleveraging: Don’t invest more than you can afford to lose. Use leverage cautiously, as excessive borrowing can amplify potential losses.

Case Study: Gold’s Role in Financial Crises

During the Great Recession of 2008, gold served as a haven asset, providing investors with protection from plummeting stock markets. As the financial crisis unfolded, the gold rate surged from $900 per ounce in January 2008 to $1,923 per ounce in September 2011. This historical example highlights the value of gold as a diversifier and a safe-haven asset during times of economic turmoil.

Future Trends and Innovation

Blockchain and Gold:

Blockchain technology has the potential to revolutionize the gold industry by enhancing transparency, security, and efficiency in gold transactions and storage.

Gold in Electronics:

Demand for gold is expected to grow in the electronics sector, particularly in the production of circuit boards, mobile phones, and other devices requiring high conductivity.

Gold Nanotechnology:

Gold nanoparticles and nanostructures are being explored for various applications, including drug delivery, electronics, and medical diagnostics, potentially driving future demand for gold.

Comparative Table of Gold Price Predictions

| Source | Gold Rate by 2025 |

|---|---|

| The World Gold Council | $2,500 |

| Goldman Sachs | $2,200 – $2,400 |

| Citigroup | $2,350 |

| UBS | $2,100 |

Data and Statistics

Table A: Global Gold Production

| Year | Production (tonnes) |

|---|---|

| 2017 | 3,285 |

| 2018 | 3,421 |

| 2019 | 3,541 |

| 2020 | 3,628 |

| 2021 | 3,692 |

Table B: Gold Consumption by Sector

| Sector | Gold Consumption (%) |

|---|---|

| Jewelry | 56 |

| Investment | 28 |

| Industry and Technology | 12 |

| Central banks | 4 |

Table C: Gold Exchange Traded Funds (ETFs)

| Year | Assets Under Management (USD billions) |

|---|---|

| 2017 | 112 |

| 2018 | 135 |

| 2019 | 167 |

| 2020 | 230 |

| 2021 | 290 |

Table D: Historical Gold Price Fluctuations

| Period | Gold Rate Range |

|---|---|

| 1970-1980 | $35-$850 |

| 1980-1990 | $300-$500 |

| 1990-2000 | $300-$400 |

| 2000-2010 | $300-$1,500 |

| 2010-2020 | $1,000-$1,900 |

Conclusion

The gold rate in dollars is a dynamic and multifaceted variable influenced by a wide range of factors. By understanding historical trends, economic and political developments, and potential future applications, investors can make informed decisions about including gold in their portfolios. Whether it’s for diversification, safe-haven protection, or potential growth, gold remains a valuable asset to consider in a comprehensive investment strategy.