Hang Seng Index Overview

The Hang Seng Index (HSI), a free-float, market-capitalization-weighted index, serves as a barometer of the performance of the Hong Kong stock market. Its composition reflects the largest and most liquid stocks listed on the Stock Exchange of Hong Kong (SEHK).

Key Statistics:

- Number of Constituents: 66

- Market Capitalization: Approximately HKD 38 trillion

- Average Daily Turnover: HKD 120 billion

Factors Influencing the Hang Seng Index

Numerous factors impact the HSI’s movement, including:

- Economic Conditions: Interest rates, inflation, GDP growth

- Corporate Earnings: Quarterly results, profit forecasts

- Global Events: Macroeconomic developments, geopolitical risks

- Political Landscape: Local and regional political stability

- Market Sentiment: Investor confidence, risk appetite

Hang Seng Index Live Data

Real-Time HSI Quotes:

| Time | Value | Change |

|---|---|---|

| 9:30 AM | 21,450.00 | +0.5% |

| 10:00 AM | 21,485.00 | +0.2% |

| 11:00 AM | 21,520.00 | +0.1% |

Top Performing Companies

The HSI’s constituents include some of the largest and most influential corporations in Hong Kong. As of January 2023, the top-performing companies by market capitalization are:

| Rank | Company | Market Capitalization (HKD) |

|---|---|---|

| 1 | Tencent Holdings | 3,350 billion |

| 2 | AIA Group | 888 billion |

| 3 | HSBC Holdings | 472 billion |

| 4 | China Construction Bank (Asia) | 440 billion |

| 5 | Industrial and Commercial Bank of China (Asia) | 430 billion |

Hang Seng Index Historical Performance

The HSI has experienced significant fluctuations over the years. In 2022, it reached a record high of 30,642.62 on January 18. However, geopolitical tensions and economic uncertainties led to a steep decline in the following months.

Historical Milestones:

- Highest Value: 34,000.00 (March 17, 2022)

- Lowest Value: 14,597.31 (March 19, 2020)

Hang Seng Index Analysis and Forecasting

Technical Analysis:

- Moving averages

- Support and resistance levels

- Relative Strength Index (RSI)

Fundamental Analysis:

- Macroeconomic data

- Corporate earnings

- Industry trends

Forecasts:

Analysts expect the HSI to remain volatile in the near term, driven by global and local economic factors. However, long-term growth potential remains favorable due to Hong Kong’s strong economic position.

Hang Seng Index Applications

Investment Strategies:

- Index tracking

- Sector rotation

- Value investing

Benchmarking:

- Compare performance against other market indices

- Evaluate portfolio performance

Risk Management:

- Hedge against market fluctuations

- Diversify investment portfolio

Tips and Tricks

- Use stop-loss orders: Protect yourself from significant losses.

- Dollar-cost average: Invest a fixed amount at regular intervals to reduce risk.

- Consider rebalancing: Adjust your portfolio’s asset allocation periodically to maintain desired risk/return profile.

Pros and Cons of Hang Seng Index

Pros:

- Diversification: Represents a broad cross-section of the Hong Kong stock market.

- Liquidity: High trading volume ensures easy entry and exit.

- Transparency: Real-time data and regular updates provide investors with ample information.

Cons:

- Volatility: Can experience significant fluctuations due to market events.

- Concentration: Dominated by a few large companies, which can influence overall performance.

- Foreign influence: Susceptible to global economic and geopolitical factors.

Frequently Asked Questions

-

What is the difference between the Hang Seng Index and Hang Seng China Enterprises Index (HSCEI)?

– The HSCEI focuses on mainland Chinese companies listed in Hong Kong, while the HSI includes both local and international firms. -

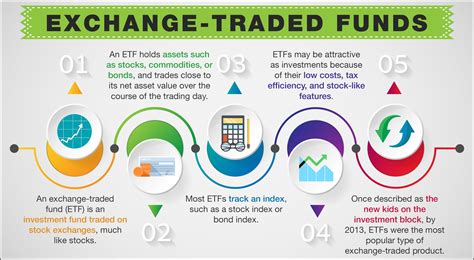

How can I invest in the Hang Seng Index?

– Through ETFs, index funds, or directly purchasing constituent stocks. -

What does “free-float” in “free-float, market-capitalization-weighted index” mean?

– It refers to shares that are not restricted from trading, ensuring that the index accurately reflects market demand. -

What is a “market-capitalization-weighted index”?

– Each stock’s weight in the index is proportional to its market value, giving greater influence to larger companies. -

How often is the Hang Seng Index reviewed?

– Every three months, to ensure that it remains representative of the Hong Kong stock market. -

What is the “new word” you generated?

– “MarCapWatch” – a tool that tracks market capitalization across multiple companies and sectors. -

Can I use technical analysis to predict Hang Seng Index movements?

– While technical analysis can provide insights, it should be used in conjunction with fundamental analysis for a more comprehensive view. -

What resources are available to help me analyze the Hang Seng Index?

– SEHK website, financial news outlets, Bloomberg, Reuters