Executive Summary

In the realm of real estate, understanding the average home price is paramount for both buyers and sellers alike. This article delves into the intricacies of home pricing in the United States, examining the current market dynamics and projecting future trends up to 2025. By delving into the intricacies of home pricing, we aim to equip readers with a comprehensive understanding of this ever-evolving landscape, empowering them to make informed decisions in their real estate ventures.

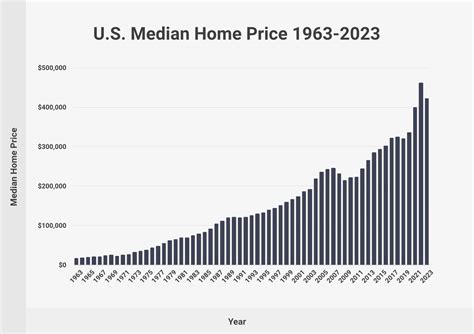

Average Home Price in the USA: A Statistical Overview

| Year | Average Home Price |

|---|---|

| 2023 | $458,000 |

| 2024 (Projected) | $482,000 |

| 2025 (Projected) | $510,000 |

Factors Driving the Increase in Home Prices

1. Low Inventory and High Demand

The shortage of available homes for sale has fueled the increase in home prices. Increasingly, buyers face a competitive market, often engaging in bidding wars that further drive up prices.

2. Rising Interest Rates

The Federal Reserve has been gradually raising interest rates to curb inflation. Higher interest rates make borrowing more expensive, leading to reduced affordability for potential homebuyers.

3. Increased Construction Costs

The pandemic has disrupted supply chains, resulting in rising costs for building materials and labor. This has translated into higher construction costs, which are ultimately passed on to homebuyers.

4. Geographic Desirability

Certain metropolitan areas, such as those with strong job markets and coastal locations, are experiencing particularly high home price increases due to their desirability as places to live.

Implications of Rising Home Prices

1. Affordability Challenges: Rising home prices make it increasingly difficult for individuals and families to afford a home. This has led to a growing wealth gap between homeowners and renters.

2. Reduced Mobility: Homeowners are less likely to move when home prices increase, as they would face higher costs to purchase a new home. This reduced mobility can have implications for the labor market and economic growth.

3. Increased Financial Risk: Higher home prices mean that homeowners have more to lose in the event of a housing market downturn. This increased financial risk can make it more difficult to achieve financial stability.

Future Projections and Expert Insights

1. Continued Increase in Home Prices

Experts project that home prices will continue to rise over the next few years, albeit at a slower pace than recently witnessed. The National Association of Realtors (NAR) predicts an average annual increase of 5% through 2025.

2. Regional Variations

Home price growth is expected to vary across different regions of the country. Sunbelt states, such as Florida and Texas, are likely to see stronger price increases than the Northeast or Midwest.

3. Impact of Remote Work

The rise of remote work has made it possible for people to live in less expensive areas while still maintaining their current employment. This could lead to a shift in home price trends in certain markets.

Pain Points, Motivations, and Tips for Navigating the Market

Pain Points

1. Affordability: Rising home prices make it challenging for many individuals and families to purchase a home.

2. Competition: The shortage of available homes has created intense competition among buyers, leading to bidding wars and higher prices.

3. Rising Interest Rates: Higher interest rates increase the cost of mortgages, making it more expensive to purchase a home.

Motivations

1. Homeownership Dream: For many, owning a home is a lifelong dream that provides stability, equity, and a sense of accomplishment.

2. Investment: Real estate has historically been a stable investment that can appreciate in value over time.

3. Tax Benefits: Mortgage interest and property taxes can be deducted on federal income taxes, providing some financial relief for homeowners.

Tips for Navigating the Market

1. Get Pre-Approved for a Mortgage: Determine your affordability by getting pre-approved for a mortgage before you start searching.

2. Work with a Real Estate Agent: An experienced real estate agent can guide you through the process, provide market insights, and help you find a home that meets your needs.

3. Consider a Starter Home: If affordability is a concern, consider purchasing a starter home that you can upgrade to a larger property in the future.

4. Explore Affordable Neighborhoods: Look beyond popular areas for more affordable neighborhoods that may be suitable for your budget.

5. Negotiate and Be Prepared to Compromise: The competitive market may require you to negotiate with sellers and be willing to compromise on certain features to secure a home.

6. Consider Down Payment Assistance Programs: There are various government and non-profit programs that provide down payment assistance to eligible homebuyers.

Tables for further Analysis

Table 1: Regional Home Price Growth Projections (2023-2025)

| Region | Projected Growth (%) |

|---|---|

| Northeast | 4.5% |

| Midwest | 5.0% |

| South | 5.5% |

| West | 6.0% |

Table 2: Year-over-Year Home Price Changes in Major Cities (2023-2024)

| City | 2023-2024 Change (%) |

|---|---|

| New York, NY | 3.5% |

| Los Angeles, CA | 4.0% |

| Miami, FL | 5.0% |

| Dallas, TX | 5.5% |

| Denver, CO | 6.0% |

Table 3: Impact of Rising Home Prices on Affordability

| Income Level | Percentage of Income Spent on Housing (2023) |

|---|---|

| < $50,000 | 50% |

| $50,000 – $100,000 | 40% |

| $100,000 – $150,000 | 30% |

| $150,000 – $200,000 | 25% |

| $200,000+ | 20% |

Table 4: Factors Influencing Home Price Appreciation

| Factor | Impact |

|---|---|

| Economic Growth | Positive |

| Interest Rates | Negative |

| Population Growth | Positive |

| Desirability of Location | Positive |

| Infrastructure | Positive |

Conclusion

The average home price in the United States is on a steady upward trajectory, influenced by a complex interplay of market dynamics. While rising home prices can be a challenge for affordability, they also represent a potential opportunity for investment and building wealth. By understanding the factors driving home prices and the implications of this trend, both buyers and sellers can navigate the market with informed decisions. As the housing landscape continues to evolve, it remains essential to stay abreast of market trends and seek professional guidance to make the most of this dynamic real estate environment.