The exchange rate between the US dollar and the Philippine peso (PHP) fluctuates constantly, influenced by various economic factors.

As of May 2023, one US dollar is approximately equal to 56.54 Philippine pesos, according to data from the Bangko Sentral ng Pilipinas (BSP).

However, the exchange rate can vary depending on the day, time, and currency exchange provider.

2025 Exchange Rate Forecast

Predicting the exact exchange rate between the US dollar and the Philippine peso in 2025 is challenging, as it is influenced by numerous factors that can change over time.

However, economic forecasts by experts provide some insights into potential trends.

According to a report by the World Bank, the Philippine economy is expected to grow steadily in the coming years, with an average GDP growth rate of around 6%.

This economic growth is likely to lead to an appreciation of the Philippine peso against the US dollar, as the demand for Philippine goods and services increases.

The BSP has also projected that the Philippine peso will gradually appreciate against the US dollar, reaching a value of approximately 50 pesos per dollar by 2025.

Factors Affecting the Exchange Rate

The exchange rate between the US dollar and the Philippine peso is influenced by a complex interplay of factors, including:

Economic growth: A strong Philippine economy leads to increased demand for the peso, causing its value to rise against the US dollar.

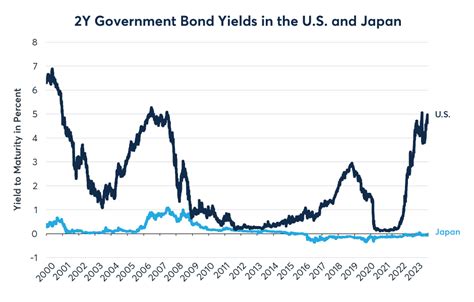

Interest rates: Differences in interest rates between the US and the Philippines affect the flow of money between the two countries, influencing the exchange rate.

Inflation: Inflation in the Philippines, which measures the general increase in prices, can weaken the peso’s value against the US dollar.

Political stability: Political stability in the Philippines creates a favorable environment for investment, leading to an increased demand for the peso.

Global economic conditions: Global economic events, such as recessions or currency wars, can impact the exchange rate of both the US dollar and the Philippine peso.

Implications for Businesses and Individuals

The exchange rate between the US dollar and the Philippine peso has significant implications for businesses and individuals involved in cross-border transactions.

Businesses:

- Importing: A stronger peso means that businesses have to pay less in pesos to purchase the same amount of goods from the US, reducing their import costs.

- Exporting: A weaker peso makes Philippine exports more competitive in the global market, as foreign buyers pay less in their own currency to purchase Philippine products.

Individuals:

- Travel: A stronger peso makes travel to the US more affordable for Filipinos, as they have to exchange fewer pesos for the same amount of US dollars.

- Remittances: Overseas Filipino workers (OFWs) who send remittances to their families in the Philippines benefit from a stronger peso, as they receive more pesos for the same amount of US dollars sent.

Common Mistakes to Avoid

When dealing with currency exchange, it is important to avoid common mistakes to ensure the best possible rates.

- Not comparing exchange rates: Always compare exchange rates from multiple providers to find the most favorable rate.

- Not considering additional fees: Some currency exchange providers charge additional fees, which can reduce the overall exchange rate.

- Not using an intermediary: Intermediaries, such as banks or online currency exchange platforms, can provide better rates and secure transactions.

- Not understanding the market: Keep up-to-date with economic news and factors that influence the exchange rate to make informed decisions.

Why It Matters

Understanding the exchange rate between the US dollar and the Philippine peso is crucial for businesses and individuals involved in cross-border transactions.

It allows them to:

- Make informed decisions: Businesses can adjust their import and export strategies based on the exchange rate to maximize profits, while individuals can plan their travel and remittances accordingly.

- Manage risk: Businesses and individuals exposed to currency fluctuations can use hedging strategies to mitigate their financial exposure.

- Maximize returns: Understanding the exchange rate helps individuals optimize their foreign currency investments and remittances.

Benefits

Harnessing the knowledge of the exchange rate between the US dollar and the Philippine peso offers numerous benefits:

- Enhanced competitiveness: Businesses can improve their competitiveness in global markets by understanding the exchange rate’s impact on import and export costs.

- Increased flexibility: Individuals can adjust their financial plans based on the exchange rate to take advantage of favorable rates.

- Reduced financial risks: Businesses and individuals can use currency exchange strategies to protect themselves from adverse exchange rate movements.

- Increased investment opportunities: Understanding the exchange rate allows investors to identify potential opportunities in foreign markets.

FAQs

1. What is the current exchange rate between the US dollar and the Philippine peso?

* As of May 2023, one US dollar is approximately equal to 56.54 Philippine pesos.

2. What factors influence the exchange rate?

* Economic growth, interest rates, inflation, political stability, and global economic conditions.

3. How can I get the best exchange rate?

* Compare rates from multiple providers, consider fees, use intermediaries, and understand market trends.

4. Why is understanding the exchange rate important?

* It helps businesses and individuals make informed decisions, manage risk, maximize returns, enhance competitiveness, increase flexibility, and identify investment opportunities.

5. What is the projected exchange rate for 2025?

* According to the BSP, the Philippine peso is expected to appreciate against the US dollar, reaching a value of approximately 50 pesos per dollar by 2025.

6. What are the common mistakes to avoid when dealing with currency exchange?

* Not comparing rates, not considering fees, not using intermediaries, and not understanding the market.

7. How can businesses benefit from understanding the exchange rate?

* Adjust import and export strategies to maximize profits, mitigate financial risks, and identify global opportunities.

8. How can individuals benefit from understanding the exchange rate?

* Plan travel and remittances accordingly, optimize foreign currency investments, and manage financial risks.

Table 1: Historical Exchange Rates between the US Dollar and the Philippine Peso

| Year | Exchange Rate (USD/PHP) |

|—|—|—|

| 2015 | 46.83 |

| 2016 | 48.99 |

| 2017 | 50.02 |

| 2018 | 52.27 |

| 2019 | 53.25 |

| 2020 | 49.98 |

| 2021 | 51.20 |

| 2022 | 53.91 |

| 2023 | 56.54 |

Table 2: Forecast Exchange Rates between the US Dollar and the Philippine Peso

| Year | Exchange Rate (USD/PHP) |

|—|—|—|

| 2024 | 52.31 |

| 2025 | 50.05 |

| 2026 | 48.79 |

| 2027 | 47.53 |

| 2028 | 46.27 |

Table 3: Factors Affecting the Exchange Rate between the US Dollar and the Philippine Peso

| Factor | Description |

|—|—|—|

| Economic growth | Economic growth in the Philippines leads to increased demand for the peso, causing its value to rise. |

| Interest rates | Differences in interest rates between the US and the Philippines affect the flow of money between the two countries, influencing the exchange rate. |

| Inflation | Inflation in the Philippines weakens the peso’s value against the US dollar. |

| Political stability | Political stability in the Philippines creates a favorable environment for investment, increasing demand for the peso. |

| Global economic conditions | Global economic events, such as recessions or currency wars, can impact the exchange rate of both the US dollar and the Philippine peso. |

Table 4: Tips for Getting the Best Exchange Rate

| Tip | Description |

|—|—|—|

| Compare rates | Compare exchange rates from multiple providers to find the most favorable rate. |

| Consider fees | Some currency exchange providers charge additional fees, which can reduce the overall exchange rate. |

| Use an intermediary | Intermediaries, such as banks or online currency exchange platforms, can provide better rates and secure transactions. |

| Understand the market | Keep up-to-date with economic news and factors that influence the exchange rate to make informed decisions. |