Introduction

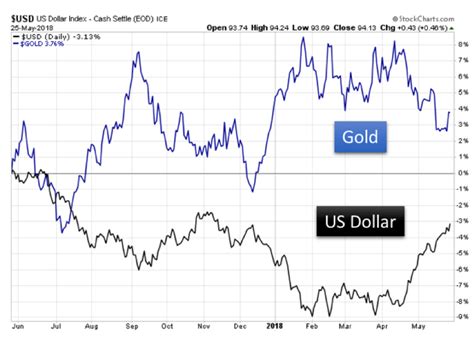

The value of gold has fluctuated throughout history, influenced by geopolitical events, economic factors, and supply and demand dynamics. The United States dollar, on the other hand, has served as a relatively stable currency, backed by its status as a global reserve currency. However, with the advent of the digital age and the rise of cryptocurrencies, the relationship between gold and the dollar has become more complex.

Historical Value of Gold Dollars

The United States first minted gold coins in 1792, with the $1 gold piece being introduced in 1834. These coins were not widely circulated, as they were primarily used for international trade and as a store of value. The Gold Standard, which pegged the value of the dollar to the price of gold, was adopted in 1879 and remained in place until 1933. During this time, the value of a gold dollar fluctuated in line with the market price of gold.

Post-Standard Era

After the Gold Standard was abolished, the value of the dollar became more closely tied to the nation’s economic health and the relative value of other currencies. Gold, however, continued to hold its allure as a safe haven asset, particularly during times of economic uncertainty. As a result, the value of gold has generally trended upward over the long term.

Current Value of $1 Gold Coins

In 2023, the value of a $1 gold coin depends on two primary factors:

- Gold content: $1 gold coins contain 0.048375 troy ounces of pure gold. At the current market price of gold ($1,800 per troy ounce), the gold content of a $1 gold coin is worth approximately $87.

- Numismatic value: The rarity, condition, and mint date of a $1 gold coin can significantly impact its value. Proof coins or coins in pristine condition can command premiums hundreds or even thousands of times their gold value.

Estimated Value in 2025

Predicting the future value of gold is highly speculative, as it is influenced by a wide range of factors. However, based on historical trends and current economic conditions, some analysts believe that the value of gold may continue to rise in the coming years.

According to the Gold Association, the demand for gold is expected to increase in the following areas:

- Central bank reserves: Central banks have been diversifying their holdings by increasing their gold reserves.

- Investment and safe haven: Gold remains a popular safe haven asset for investors seeking to preserve their wealth during economic uncertainty.

- Industrial applications: Gold is used in a variety of industries, including jewelry, dentistry, and electronics.

Factors Affecting the Value of $1 Gold Coins

In addition to the factors discussed above, the value of $1 gold coins can also be affected by the following:

- Government policy: The actions of governments, particularly those of the United States Federal Reserve, can influence the value of gold.

- Interest rates: Changes in interest rates can affect the demand for gold as an investment.

- Inflation: Gold has historically been considered a hedge against inflation, as its value tends to rise during inflationary periods.

- Global economic conditions: Economic conditions around the world can impact the demand for gold as a safe haven asset.

Tips for Investing in $1 Gold Coins

- Consider diversifying your portfolio by investing in gold coins along with other assets.

- Research and educate yourself about the gold market before making any purchases.

- Buy from reputable dealers to ensure authenticity and quality.

- Store your gold coins securely in a safe deposit box or other secure location.

- Be aware of the potential for fluctuations in the gold market and invest accordingly.

Conclusion

The value of a $1 gold dollar in 2025 is uncertain, as it is influenced by a multitude of factors. However, based on historical trends and current economic conditions, analysts believe that the value of gold may continue to rise in the foreseeable future. By understanding the factors that affect the value of $1 gold coins, investors can make informed decisions and potentially benefit from the appreciation of gold.

FAQs

Q: How much is a $1 gold dollar worth today?

A: As of [date], a $1 gold dollar coin is worth approximately $87 based on its gold content.

Q: Is a $1 gold dollar worth more than $1?

A: Yes, due to its gold content, a $1 gold dollar coin is worth significantly more than $1.

Q: Where can I buy $1 gold dollar coins?

A: You can purchase $1 gold dollar coins from reputable coin dealers, online marketplaces, and some banks.

Q: How can I store my $1 gold dollar coins safely?

A: Store your $1 gold dollar coins in a safe deposit box or other secure location to protect them from theft or damage.

Useful Tables

Table 1: Historical Price of Gold per Troy Ounce

| Year | Price ($) |

|---|---|

| 1975 | 164.80 |

| 1985 | 318.20 |

| 1995 | 385.00 |

| 2005 | 446.00 |

| 2015 | 1,169.00 |

| 2023 | 1,800.00 |

Table 2: Gold Holdings of Central Banks

| Country | Gold Holdings (tons) |

|---|---|

| United States | 8,133.5 |

| Germany | 3,362.7 |

| Italy | 2,451.8 |

| France | 2,435.9 |

| China | 2,000.0 (estimated) |

Table 3: Industrial Applications of Gold

| Industry | Application |

|---|---|

| Jewelry | Ornaments, jewelry, watches |

| Dentistry | Dental alloys, fillings |

| Electronics | Conductors, circuit boards |

| Medicine | Imaging agents, cancer treatment |

| Aerospace | Jet engine components, satellites |

Table 4: Factors Affecting the Value of $1 Gold Coins

| Factor | Effect on Value |

|---|---|

| Gold content | Higher gold content increases value |

| Numismatic value | Rarity, condition, mint date increase value |

| Government policy | Can influence gold prices |

| Interest rates | Affect demand for gold as an investment |

| Inflation | Gold considered a hedge against inflation |

| Global economic conditions | Affect demand for gold as a safe haven |