Overview: The Indian Rupee’s Journey

The Indian rupee (INR) has embarked on a dynamic journey against the US dollar (USD) over the years. The rupee’s value has fluctuated amidst global economic conditions, monetary policies, and domestic factors. As India strives towards economic growth and stability, understanding the dynamics of the rupee-dollar exchange is crucial.

Factors Influencing the Rupee-Dollar Exchange

Numerous factors influence the rupee-dollar exchange rate, including:

- Inflation: High inflation erodes the purchasing power of the rupee, affecting its value against other currencies.

- Interest Rates: The Reserve Bank of India (RBI) sets interest rates to control inflation and economic growth. Higher interest rates make the rupee more attractive to investors, strengthening its value.

- Foreign Investment: Inflows and outflows of foreign direct investment (FDI) and foreign institutional investments (FII) can impact the rupee’s demand and supply, thereby affecting its exchange rate.

- Global Economic Conditions: Economic growth, interest rates, and inflation in major economies like the US, Eurozone, and China influence the global demand for the dollar, which in turn affects the rupee-dollar exchange.

- Trade Balance: India’s trade balance, the difference between exports and imports, can impact the rupee’s value. A positive trade balance strengthens the rupee, while a negative balance weakens it.

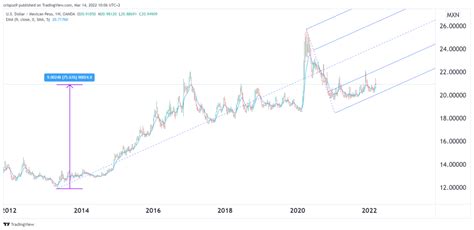

Historical Trends and Future Projections

Historical Trends:

- In recent years, the rupee has generally depreciated against the dollar due to factors such as high inflation, rising oil prices, and global economic uncertainty.

- In 2020, the rupee hit a record low of INR 76.92 against the dollar due to the COVID-19 pandemic.

- In 2021, the rupee recovered to around INR 73.50 but remained volatile.

Future Projections:

- The RBI projects that the rupee is likely to stabilize around INR 75-76 against the dollar in 2023.

- However, global economic conditions, geopolitical tensions, and domestic factors could influence the rupee’s trajectory.

- Some economists believe that the rupee may strengthen towards INR 70-72 in the long term as India’s economy grows and stabilizes.

Impact on Indian Economy

The rupee-dollar exchange rate has significant implications for the Indian economy:

- Imports and Exports: A weaker rupee makes imports more expensive and exports more competitive.

- Foreign Exchange Reserves: The RBI maintains foreign exchange reserves to stabilize the rupee. A strong rupee builds up reserves, while a weak rupee depletes them.

- Inflation: A weaker rupee can lead to higher inflation as imported goods become more expensive.

- Investment: A stable rupee attracts foreign investment and supports economic growth.

Strategies for Managing Exchange Rate Fluctuations

To mitigate the impact of exchange rate fluctuations, businesses and individuals can employ several strategies:

- Hedging: Using financial instruments like forward contracts or options to lock in exchange rates for future transactions.

- Diversification: Investing in assets denominated in different currencies to reduce currency risk.

- Appropriate Import and Export Strategies: Adjusting import and export volumes or sourcing from alternative countries to minimize currency exposure.

- Contingency Planning: Preparing for potential exchange rate fluctuations by building contingency funds or adjusting financial plans.

Tips and Tricks for Navigating the Rupee-Dollar Exchange

- Monitor exchange rate news and analysis regularly.

- Stay informed about global economic conditions and geopolitical events.

- Use online tools and platforms to track exchange rates and identify trends.

- Consult with financial experts to develop appropriate hedging strategies.

- Be patient and avoid making impulsive decisions based on short-term fluctuations.

Standing Out in a Fluctuating Currency Environment

Businesses and individuals can stand out in a fluctuating currency environment by:

- Leveraging Real-Time Data: Utilizing real-time exchange rate data to make informed decisions and adjust strategies quickly.

- Embracing Technology: Using online platforms and applications to automate currency conversion and track transactions.

- Customizing Financial Solutions: Working with financial institutions to develop tailored solutions that meet specific currency requirements.

- Developing Global Partnerships: Establishing relationships with global partners to reduce currency risk and access new markets.

Conclusion

The Indian rupee-dollar exchange rate is a dynamic and complex factor that influences the Indian economy. By understanding the factors that affect the exchange rate and employing appropriate strategies, businesses and individuals can navigate currency fluctuations and position themselves for success in the evolving global market. As India continues on its path towards economic growth and stability, the rupee-dollar exchange is likely to remain a key indicator of the country’s economic health.

Tables

Table 1: Historical Rupee-Dollar Exchange Rates (2015-2022)

| Year | INR per USD |

|---|---|

| 2015 | 66.14 |

| 2016 | 67.93 |

| 2017 | 64.11 |

| 2018 | 69.52 |

| 2019 | 71.97 |

| 2020 | 76.92 |

| 2021 | 73.50 |

| 2022 | 79.20 |

Table 2: Factors Influencing Rupee-Dollar Exchange Rate

| Factor | Impact |

|---|---|

| Inflation | Depreciation |

| Interest Rates | Appreciation |

| Foreign Investment | Appreciation |

| Global Economic Conditions | Appreciation / Depreciation |

| Trade Balance | Appreciation / Depreciation |

Table 3: Strategies for Managing Exchange Rate Fluctuations

| Strategy | Description |

|---|---|

| Hedging | Using financial instruments to lock in exchange rates |

| Diversification | Investing in assets denominated in different currencies |

| Import/Export Adjustments | Modifying import and export volumes or sourcing from alternative countries |

| Contingency Planning | Preparing for potential exchange rate fluctuations |

Table 4: Tips for Navigating Rupee-Dollar Exchange

| Tip | Description |

|---|---|

| Monitor Exchange Rates | Track exchange rate news and analysis |

| Stay Informed | Be aware of global economic conditions and geopolitical events |

| Use Technology | Utilize online tools and platforms to track exchange rates |

| Consult Financial Experts | Seek advice on appropriate hedging strategies |

| Avoid Impulsive Decisions | Make informed decisions based on long-term trends |