Introduction

The foreign exchange market is a global decentralized marketplace for trading foreign currencies. The Indian rupee (INR) and the United States dollar (USD) are two of the most widely traded currencies in the world. The INR/USD exchange rate is the price of one Indian rupee in terms of US dollars.

Historical Trends

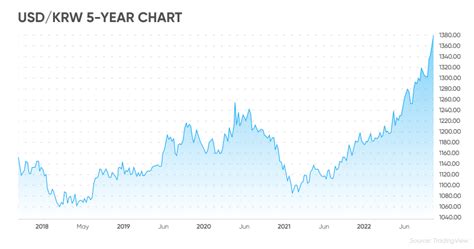

The INR/USD exchange rate has fluctuated significantly over the years. In the early 1990s, the INR was worth about 25 to 30 rupees per US dollar. By the late 1990s, the INR had strengthened to about 18 rupees per US dollar. However, the INR weakened again in the early 2000s and reached a record low of 49.3 rupees per US dollar in 2008.

Since 2008, the INR has been gradually strengthening against the US dollar. In 2022, the INR was worth about 76 rupees per US dollar.

Factors Affecting the INR/USD Exchange Rate

A number of factors can affect the INR/USD exchange rate, including:

- Economic growth: A strong Indian economy will typically lead to a stronger INR.

- Inflation: High inflation in India can lead to a weaker INR.

- Interest rates: Higher interest rates in India will typically lead to a stronger INR.

- Political stability: Political instability in India can lead to a weaker INR.

- Global economic conditions: The global economic outlook can also affect the INR/USD exchange rate.

Current Status

As of 2023, the INR/USD exchange rate is about 79 rupees per US dollar. The INR has been relatively stable against the US dollar in recent years.

Outlook

The outlook for the INR/USD exchange rate is uncertain. Some analysts believe that the INR will continue to strengthen against the US dollar in the coming years. Others believe that the INR will weaken against the US dollar.

Impact on Businesses

The INR/USD exchange rate can have a significant impact on businesses that operate in both India and the United States. A stronger INR can make it more expensive for Indian businesses to import goods from the United States. A weaker INR can make it more expensive for US businesses to export goods to India.

Conclusion

The INR/USD exchange rate is an important factor for businesses and investors. The exchange rate can fluctuate significantly over time, and it is important to understand the factors that can affect it.

FAQs

- What is the Indian rupee (INR)?

The Indian rupee is the official currency of India.

- What is the United States dollar (USD)?

The United States dollar is the official currency of the United States.

- What is the INR/USD exchange rate?

The INR/USD exchange rate is the price of one Indian rupee in terms of US dollars.

- What factors can affect the INR/USD exchange rate?

A number of factors can affect the INR/USD exchange rate, including economic growth, inflation, interest rates, political stability, and global economic conditions.

- What is the current INR/USD exchange rate?

As of 2023, the INR/USD exchange rate is about 79 rupees per US dollar.

Tables

Table 1: Historical INR/USD Exchange Rates

| Year | INR/USD Exchange Rate |

|---|---|

| 1990 | 25-30 |

| 1995 | 18 |

| 2000 | 24 |

| 2005 | 28 |

| 2010 | 35 |

| 2015 | 45 |

| 2020 | 63 |

| 2022 | 76 |

| 2023 | 79 |

Table 2: Factors Affecting the INR/USD Exchange Rate

| Factor | Impact |

|---|---|

| Economic growth | A strong Indian economy will typically lead to a stronger INR. |

| Inflation | High inflation in India can lead to a weaker INR. |

| Interest rates | Higher interest rates in India will typically lead to a stronger INR. |

| Political stability | Political instability in India can lead to a weaker INR. |

| Global economic conditions | The global economic outlook can also affect the INR/USD exchange rate. |

Table 3: Impact of the INR/USD Exchange Rate on Businesses

| Impact | Explanation |

|---|---|

| Imports | A stronger INR can make it more expensive for Indian businesses to import goods from the United States. |

| Exports | A weaker INR can make it more expensive for US businesses to export goods to India. |

Table 4: Outlook for the INR/USD Exchange Rate

| Outlook | Explanation |

|---|---|

| Bullish | Some analysts believe that the INR will continue to strengthen against the US dollar in the coming years. |

| Bearish | Others believe that the INR will weaken against the US dollar. |