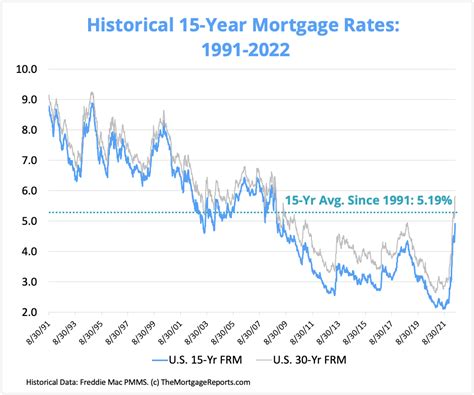

Considering the U.S. Federal Reserve’s recent moves to raise interest rates in an effort to curb inflation, it’s timely to revisit the history of interest rates and their impact on the economy.

Interest Rates History Chart

| Year | Federal Funds Rate |

|---|---|

| 1971 | 3.50% |

| 1980 | 11.20% |

| 1990 | 6.64% |

| 2000 | 6.50% |

| 2010 | 0.25% |

| 2015 | 0.50% |

| 2020 | 0.08% |

| 2022 | 4.75% |

The Impact of Interest Rates on the Economy

Interest rates play a crucial role in the economy, influencing various aspects such as:

- Economic Growth: Higher interest rates can slow down economic growth by making it more expensive for businesses to borrow and invest.

- Inflation: Interest rates are a tool used by central banks to manage inflation. By raising interest rates, central banks can reduce inflation by discouraging borrowing and spending.

- Consumer Spending: Higher interest rates make it more expensive for consumers to borrow, which can reduce their spending and slow down economic growth.

- Business Investment: Businesses may delay investment projects if interest rates are high, as it increases the cost of capital.

Interest Rates VS Inflation

The relationship between interest rates and inflation is complex. In general, when inflation is high, central banks raise interest rates to curb inflation. However, if inflation is too low, it can lead to deflation, which is also undesirable.

The Future of Interest Rates

The future path of interest rates is uncertain. The U.S. Federal Reserve has indicated that it will continue to raise rates in the near term to bring inflation under control. However, it is difficult to predict how high rates will go and how long they will stay high.

Conclusion

Interest rates are a powerful tool used by central banks to influence the economy. Understanding the history of interest rates and their impact on the economy can help individuals, businesses, and investors make informed decisions.