Introduction

The IRS Tax Form I-9 is a crucial document that verifies the employment authorization and identity of individuals working in the United States. Employers are legally obligated to complete and retain this form for all newly hired employees, regardless of their citizenship or immigration status. Understanding the requirements and best practices associated with Form I-9 is essential for employers to ensure compliance and avoid potential penalties.

Purpose of Form I-9

The primary purpose of Form I-9 is to:

- Verify Employment Authorization: It confirms that an employee is authorized to work in the United States, either as a citizen or a noncitizen with a valid work permit.

- Prevent Unauthorized Employment: By verifying an employee’s identity and employment authorization, employers can help prevent the hiring of undocumented workers.

- Comply with Immigration Law: Form I-9 is required by the Immigration Reform and Control Act (IRCA) of 1986 and helps employers demonstrate their compliance with federal immigration laws.

Completing Form I-9

To complete Form I-9 effectively, employers must follow these steps:

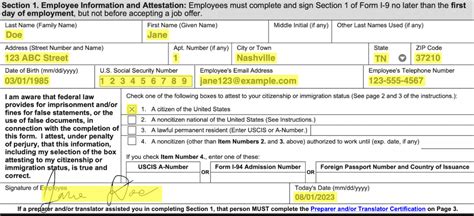

1. Section 1: Employee Information

- Collect the following information from the employee:

- Name

- Address

- Social Security Number

- Date of Birth

2. Section 2: Employer and Attesting Official Information

- Complete the employer’s name, address, and EIN (Employer Identification Number).

- Designate an authorized official to verify the employee’s identity and employment authorization and have them sign and date the form.

3. Section 3: List A or List C Documents

- The employee must present original documents from either List A or List C to verify their identity and employment authorization.

- List A: Documents that establish both identity and employment authorization (e.g., U.S. Passport, Permanent Resident Card)

- List C: Documents that establish only employment authorization (e.g., Employment Authorization Card, Social Security Card with photo)

4. Section 4: Employer Review and Verification

- The employer must review the original documents presented by the employee and complete the appropriate fields on Section 4.

- The employer must also certify that they have examined the documents.

5. Section 5: Employee Attestation

- The employee must sign and date the form, acknowledging their responsibility for providing genuine documents and the accuracy of the information provided.

Retaining and Inspection of Form I-9

Employers must retain Form I-9 for all employees for a period of three years after the date of hire or one year after the date of termination, whichever is later. The form must be available for inspection by:

- U.S. Immigration and Customs Enforcement (ICE)

- U.S. Department of Homeland Security (DHS)

- U.S. Department of Labor (DOL)

Penalties for Noncompliance

Failure to comply with Form I-9 requirements can result in significant penalties for employers, including:

- Civil fines of up to $1,100 per violation

- Criminal penalties, including jail time

Best Practices for Form I-9 Management

To ensure effective Form I-9 management, employers should adhere to the following best practices:

- Train Employees: Educate employees on the importance of completing Form I-9 accurately and timely.

- Create a Designated System: Establish a specific process for completing and storing Form I-9 to minimize errors and promote consistency.

- Reverify Documents: Regularly review and re-verify List C documents for employees who are not U.S. citizens or permanent residents.

- Maintain Accurate Records: Keep physical or electronic copies of Form I-9 securely and accessible for inspection purposes.

- Seek Professional Advice: Consult with an immigration attorney or human resources professional if you have any questions or concerns about Form I-9 compliance.

Current Trends and Future Outlook

The landscape of Form I-9 compliance is continuously evolving. Here are some current trends and predictions for the future:

1. Increased Electronic Verification: The use of electronic systems for Form I-9 completion and storage is becoming increasingly common. These systems can automate the verification process and reduce administrative burden.

2. Focus on Employee Self-Compliance: Emphasizing employee responsibility for providing genuine documents and understanding the consequences of non-compliance may reduce employer liability.

3. Smart Technologies: Artificial intelligence and other advanced technologies are being explored to enhance the efficiency and accuracy of Form I-9 verification.

4. Enhanced Collaboration: Cooperation between government agencies, such as ICE and DOL, is expected to strengthen enforcement efforts.

Maintaining Compliance and Protecting Your Business

To protect your business from potential penalties and legal liabilities, it is imperative to remain compliant with Form I-9 requirements. By following the guidelines outlined in this article, employers can ensure that they are hiring authorized workers and meeting their obligations under the law.

Frequently Asked Questions

1. What are the consequences of hiring an undocumented worker?

Employers may face penalties of up to $1,100 per violation and potential criminal charges.

2. Can I complete Form I-9 for an employee who is not yet physically present in the United States?

No, Form I-9 must be completed after the employee has physically commenced work in the United States.

3. What should I do if an employee’s work authorization expires?

You must re-verify the employee’s employment authorization using List C documents.

4. Can I make copies of Form I-9?

Yes, but you must retain the original documents for inspection purposes.

| Table 1: List A Documents | Table 2: List C Documents |

|---|---|

| U.S. Passport | Employment Authorization Document (EAD) |

| Permanent Resident Card | Social Security Card with photo |

| Certificate of U.S. Citizenship | INS Form I-94 (Arrival-Departure Record) |

| State-Issued Driver’s License or ID Card | Native American Tribal Document |

| Table 3: Employer Penalties | Table 4: Best Practices for Form I-9 Management |

|---|---|

| Civil Fines: Up to $1,100 per violation | Create a designated system |

| Criminal Penalties: Jail time | Train employees |

| – | Reverify documents |

| – | Maintain accurate records |

| – | – |