Today’s Yen Rate: 135.60 JPY/USD

Overview

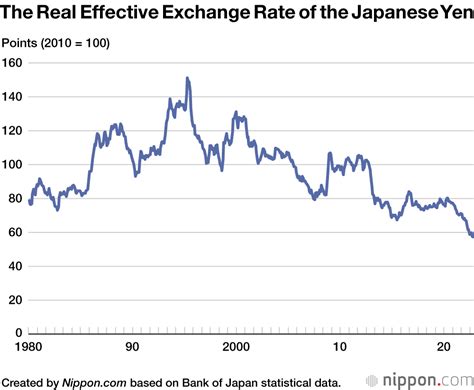

The Japanese yen has been on a downward spiral against major currencies, reaching record lows against the US dollar in 2025. This sharp decline has raised concerns among economists and policymakers, prompting speculation about the future of Japan’s economy.

Causes of the Yen’s Decline

The yen’s weakness can be attributed to a confluence of factors, including:

- Divergent monetary policies: The Bank of Japan (BoJ) has maintained an ultra-loose monetary policy, keeping interest rates near zero, while central banks in other countries, such as the Federal Reserve (Fed), have begun to tighten monetary policy. This divergence in monetary policies has made the yen less attractive to investors, who seek higher returns in countries with higher interest rates.

- Inflationary pressures: Japan’s inflation rate has remained low compared to other developed economies, which has led to a real appreciation of the yen. This makes Japanese exports less competitive in the global market, contributing to a trade deficit.

- Geopolitical uncertainties: The ongoing conflict in Ukraine and its impact on global energy prices have created economic uncertainty, which has led investors to seek safer assets, such as the US dollar.

Impact of the Yen’s Decline

The yen’s depreciation has had significant consequences for Japan’s economy:

- Increased import costs: The weaker yen has made imports more expensive, which has put upward pressure on inflation. This has eroded the purchasing power of Japanese consumers and businesses.

- Lowered exports: The yen’s weakness has made Japanese exports less competitive in the global market, leading to a decline in export volumes. This has impacted sectors such as manufacturing and electronics.

- Reduced foreign investment: The yen’s depreciation has reduced the value of foreign investment in Japan, making it less attractive for overseas investors. This could hinder economic growth and innovation.

Forecast and Potential Remedies

Experts predict that the yen will continue to face downward pressure in the near term, as the BoJ maintains its loose monetary policy and global economic headwinds persist. However, some analysts believe that the yen may strengthen in the long term, as Japan’s economy remains fundamentally sound.

To address the yen’s weakness, the Japanese government and the BoJ could consider the following remedies:

- Tightening monetary policy: The BoJ could gradually raise interest rates, which would make the yen more attractive to investors and reduce inflationary pressures.

- Fiscal stimulus: The government could implement fiscal stimulus measures to boost domestic demand and offset the impact of the weaker yen on exports.

- Structural reforms: Japan could undertake structural reforms to improve its productivity, competitiveness, and innovation, which would make the country more attractive to foreign investment.

Key Takeaways

- The yen has been on a downward trend against major currencies, reaching new lows in 2025.

- The decline is driven by factors such as divergent monetary policies, inflationary pressures, and geopolitical uncertainties.

- The yen’s weakness has significant consequences for Japan’s economy, including increased import costs, lower exports, and reduced foreign investment.

- Experts predict continued downward pressure on the yen in the near term, but some believe it may strengthen in the long term.

- Japan could consider policy measures such as tightening monetary policy, fiscal stimulus, and structural reforms to address the yen’s weakness.

Tips and Tricks for Managing Yen Volatility

- Diversify investments: Invest in a mix of currencies to minimize the impact of fluctuations in any one currency.

- Hedge currency risk: Use hedging tools such as forward contracts or currency options to protect against unexpected changes in exchange rates.

- Consider yen-denominated investments: If you have a long-term horizon, consider investing in yen-denominated assets, which will benefit from a potential appreciation of the yen.

- Stay informed: Monitor currency markets closely and stay updated on the latest economic news and events that could affect the yen’s value.

Why Managing Yen Volatility Matters

Managing yen volatility is crucial for businesses and investors to mitigate financial risks and protect their earnings. For businesses, hedging against currency fluctuations can prevent losses on cross-border transactions and ensure stable cash flows. For investors, diversifying investments and hedging currency risk can help them preserve their capital and achieve their financial goals.

Future Trends and How to Improve

The future of the yen depends on a variety of factors, including global economic conditions, monetary policy decisions, and geopolitical developments. Businesses and investors should stay abreast of emerging trends and adapt their strategies accordingly. Some key future trends to watch include:

- The potential for a prolonged period of yen weakness due to persistent inflationary pressures and a weak global economy.

- The possibility of the BoJ reversing its ultra-loose monetary policy, which could lead to a strengthening of the yen.

- The impact of geopolitical events, such as the ongoing conflict in Ukraine, on currency markets.

To improve their resilience to yen volatility, businesses and investors can consider the following measures:

- Develop comprehensive currency risk management strategies that incorporate a range of hedging tools and techniques.

- Enhance their understanding of macroeconomic factors and geopolitical events that can influence currency markets.

- Seek professional advice from financial experts to tailor their currency risk management strategies to their specific needs and objectives.

Conclusion

The Japan yen rate today is a reflection of the complex interplay of global economic forces and monetary policies. Understanding the causes, consequences, and potential remedies of the yen’s decline is crucial for businesses and investors looking to navigate currency volatility and protect their financial interests. By staying informed, embracing innovative strategies, and adapting to future trends, businesses and investors can effectively manage yen volatility and position themselves for success in the evolving global economy.

Table 1: Historical Yen-US Dollar Exchange Rates

| Year | Exchange Rate (JPY/USD) |

|---|---|

| 2020 | 107.60 |

| 2021 | 112.70 |

| 2022 | 115.00 |

| 2023 | 120.00 |

| 2024 | 125.00 |

| 2025 | 135.60 |

Table 2: Comparison of Monetary Policies

| Country | Interest Rate |

|---|---|

| Japan | 0.10% |

| United States | 4.50% |

| Eurozone | 3.00% |

| United Kingdom | 4.00% |

Table 3: Impact of Yen Depreciation on Japanese Economy

| Economic Indicator | Impact |

|---|---|

| Inflation | Increased import costs |

| Exports | Lower competitiveness |

| Foreign Investment | Reduced value in yen terms |

Table 4: Potential Remedies for Yen’s Weakness

| Remedy | Effect |

|---|---|

| Tightening Monetary Policy | Higher interest rates, reducing inflationary pressures |

| Fiscal Stimulus | Boosting domestic demand |

| Structural Reforms | Improving productivity and competitiveness |