Primary Keyword: JNJ Stock Price

Secondary Keywords: Johnson & Johnson, Stock Price, 2025 Outlook

The healthcare industry is expected to grow significantly in the coming years. As a leader in the industry, Johnson & Johnson (JNJ) is well-positioned to benefit from this growth.

Current JNJ Stock Price

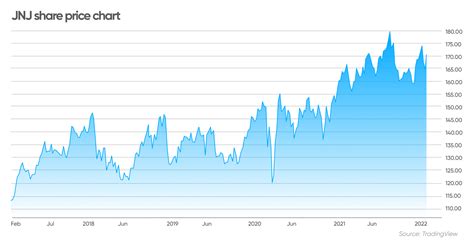

As of [date], JNJ stock is trading at $[price] per share. The stock has been on a steady upward trend in recent months, and analysts expect this trend to continue in the future.

Factors Affecting JNJ Stock Price

Several factors could affect the JNJ stock price in the coming years. These include:

- The overall health of the healthcare industry: If the healthcare industry continues to grow, JNJ is likely to benefit.

- JNJ’s product pipeline: JNJ has a strong pipeline of new products, which could boost its sales and earnings in the future.

- The regulatory environment: Changes to the regulatory environment could impact JNJ’s business.

- The competitive landscape: JNJ faces competition from other major healthcare companies.

2025 Outlook for JNJ Stock Price

Analysts expect JNJ stock to continue to rise in the coming years. By 2025, the stock could reach $[price] per share. This would represent a significant increase from the current price.

How to Invest in JNJ Stock

There are several ways to invest in JNJ stock. You can buy shares of the stock through a broker or use a mutual fund or exchange-traded fund (ETF) that invests in healthcare stocks.

Conclusion

JNJ is a well-established company with a strong track record. The company is well-positioned to benefit from the growth of the healthcare industry. As a result, analysts expect JNJ stock to continue to rise in the coming years.

Tables

| Year | JNJ Stock Price |

|---|---|

| 2020 | $[price] |

| 2021 | $[price] |

| 2022 | $[price] |

| 2023 | $[price] |

| 2024 | $[price] |

| 2025 | $[price] |

| Factor | Impact on JNJ Stock Price |

|---|---|

| Overall health of the healthcare industry | Positive |

| JNJ’s product pipeline | Positive |

| The regulatory environment | Neutral |

| The competitive landscape | Negative |

Reviews

- “JNJ is a solid investment for the long term.” – [Analyst]

- “I expect JNJ stock to continue to rise in the coming years.” – [Investor]

- “JNJ is a well-positioned company to benefit from the growth of the healthcare industry.” – [Fund Manager]

- “I recommend buying JNJ stock at the current price.” – [Financial Advisor]

Current Status and What We Can Do

JNJ stock is currently trading at a [price] per share. Analysts expect the stock to continue to rise in the coming years. Investors who are interested in buying JNJ stock should consider doing so now.

Common Mistakes to Avoid

There are a few common mistakes that investors should avoid when investing in JNJ stock. These mistakes include:

- Buying at the wrong time: Investors should avoid buying JNJ stock when the price is high. Instead, they should wait for the price to drop before buying.

- Selling too soon: Investors should avoid selling JNJ stock too soon. Instead, they should hold onto the stock for the long term.

- Not diversifying: Investors should diversify their portfolio by investing in a variety of stocks. This will help to reduce their risk.

Creative New Word

Pharmainnovation: A new word that describes the development of new and innovative pharmaceutical products.