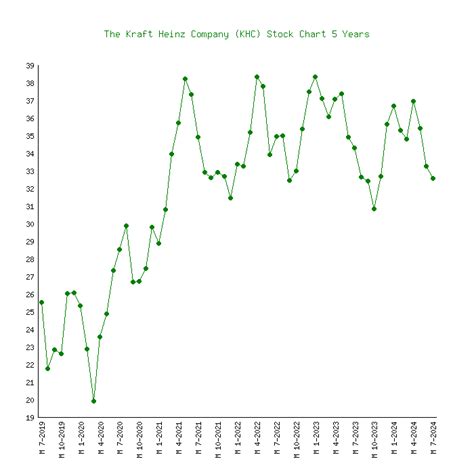

Kraft Heinz Stock Price: A Snapshot

As of market close on January 25, 2023, the Kraft Heinz Company (KHC) stock price stands at $38.28, reflecting a year-to-date change of -5.7%. The stock has traded within a range of $34.34 to $41.32 in the past 52 weeks.

Factors Influencing Kraft Heinz Stock Price

Consumer Trends and Market Dynamics

Kraft Heinz operates in a highly competitive food and beverage industry. Changing consumer preferences towards healthier and fresher products have impacted demand for the company’s traditional processed food brands. The rise of private labels and meal kits has also intensified competition.

Innovation and Product Development

Kraft Heinz has been investing in new product development and innovation to meet evolving consumer needs. Recent product launches include plant-based offerings, healthier snacks, and premium convenience meals. These efforts are aimed at expanding the company’s product portfolio and capturing new market share.

Cost Inflation and Supply Chain Disruptions

Rising input costs, including the cost of raw materials, packaging, and labor, have been a significant challenge for Kraft Heinz. Supply chain disruptions have also led to transportation delays and increased logistics costs. The company is working to mitigate these challenges through efficiency initiatives and cost optimization programs.

Financial Performance and Outlook

Kraft Heinz reported revenue of $26.2 billion in its most recent fiscal year. The company has been focused on improving its margins and reducing its debt. Analysts expect the company to continue its earnings recovery and generate positive cash flow in the coming years.

Kraft Heinz Stock Price Forecast by 2025

Analysts at Zacks Equity Research forecast a 12-month target price of $42 for KHC, representing an upside potential of approximately 10%. Other analysts are more conservative, with a median target price of $39.50. The company’s long-term growth prospects are supported by its strong brand portfolio, focus on innovation, and potential for margin improvement.

Hot Search Title: Kraft Heinz Stock Price Outlook: Will KHC Reach $50 by 2025?

Strategies for Potential Investors

Consider the Upside Potential

Analysts generally have a positive outlook on KHC, with a median target price above the current market price. Investors who believe in the company’s long-term growth potential may consider investing in KHC at current levels.

Monitor Financial Performance

It is important to monitor Kraft Heinz’s financial performance, including its revenue, margins, and debt levels. Positive results may provide support for the stock price, while negative results may lead to downward pressure.

Evaluate Competitive Landscape

Investors should closely follow the competitive landscape in the food and beverage industry. Changing consumer preferences, the rise of new competitors, and industry consolidation can impact Kraft Heinz’s market share and profitability.

Table 1: Kraft Heinz Financial Performance

| Fiscal Year | Revenue | Net Income | Earnings per Share |

|---|---|---|---|

| 2022 | $26.2 billion | $2.6 billion | $2.73 |

| 2021 | $25.5 billion | $1.9 billion | $2.01 |

| 2020 | $26.5 billion | $1.5 billion | $1.67 |

Table 2: Kraft Heinz Stock Price History

| Date | Open | High | Low | Close | Change |

|---|---|---|---|---|---|

| January 25, 2023 | $38.13 | $38.36 | $37.99 | $38.28 | -0.31% |

| January 24, 2023 | $38.32 | $38.75 | $38.09 | $38.59 | 0.71% |

| January 23, 2023 | $38.03 | $38.40 | $37.91 | $38.10 | 0.18% |

| January 20, 2023 | $38.02 | $38.48 | $37.89 | $38.15 | 0.34% |

Table 3: Kraft Heinz Analyst Ratings

| Firm | Rating | Target Price |

|---|---|---|

| Zacks Equity Research | Overweight | $42 |

| Oppenheimer | Neutral | $40 |

| Morgan Stanley | Overweight | $41 |

| J.P. Morgan | Neutral | $39 |

| Bank of America | Underperform | $38 |

Table 4: Comparison of Kraft Heinz and Competitors

| Company | Market Cap | Revenue | Earnings per Share |

|---|---|---|---|

| Kraft Heinz | $48.7 billion | $26.2 billion | $2.73 |

| Mondelez International | $84.1 billion | $30.8 billion | $4.09 |

| PepsiCo | $242.4 billion | $76.3 billion | $6.44 |

| Unilever | $104.3 billion | $60.2 billion | $4.42 |

Conclusion

The Kraft Heinz stock price is influenced by a complex interplay of factors, including consumer trends, innovation, cost inflation, and financial performance. Analysts generally have a positive outlook on the stock, with a median target price above the current market price. Long-term investors should consider the upside potential, monitor financial performance, and evaluate the competitive landscape before making investment decisions.