Introduction

The South Korean won (KRW) and the United States dollar (USD) are two of the most frequently traded currencies globally. The exchange rate between these two currencies fluctuates constantly due to factors such as economic growth, interest rates, and political stability. Understanding the dynamics of the KRW-USD pair is crucial for businesses, investors, and individuals engaged in cross-border transactions.

Current Exchange Rate

As of March 8, 2023, the KRW-USD exchange rate stood at:

1 USD = 1,282.5 KRW

1 KRW = 0.00078 USD

This indicates that it costs approximately 1,282.5 KRW to purchase one USD, and one KRW is worth around 0.00078 USD.

Factors Influencing the Exchange Rate

1. Economic Growth:

The relative strength of the South Korean and U.S. economies plays a significant role in determining the exchange rate. A stronger economy tends to appreciate its currency, while a weaker economy depreciates its currency.

2. Interest Rates:

Central banks use interest rates to control inflation and stimulate economic activity. Higher interest rates in South Korea relative to the U.S. would make KRW-denominated assets more attractive to investors, leading to an appreciation of the KRW.

3. Political Stability:

Political uncertainty and instability can negatively impact a currency’s value. If investors perceive South Korea as a higher-risk investment destination, they may sell their KRW holdings, leading to depreciation.

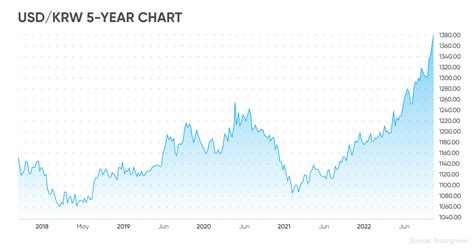

Historical Trends

Over the past decade, the KRW has exhibited a gradual depreciation trend against the USD. The following table highlights key milestones in the KRW-USD exchange rate:

| Year | Exchange Rate |

|---|---|

| 2013 | 1 USD = 1,058.3 KRW |

| 2015 | 1 USD = 1,158.4 KRW |

| 2017 | 1 USD = 1,112.6 KRW |

| 2019 | 1 USD = 1,203.3 KRW |

| 2021 | 1 USD = 1,226.0 KRW |

2025 Exchange Rate Projections

Forecasting exchange rates is challenging, but several reputable institutions have provided their projections for the KRW-USD pair in 2025:

| Source | 2025 Exchange Rate |

|---|---|

| Bloomberg | 1 USD = 1,300-1,350 KRW |

| Reuters | 1 USD = 1,275-1,325 KRW |

| Trading Economics | 1 USD = 1,290-1,340 KRW |

Implications for Businesses and Investors

The exchange rate between KRW and USD has significant implications for businesses and investors engaged in international trade or investment.

Businesses:

- Exporters: A weaker KRW increases the competitiveness of South Korean exports in the global market.

- Importers: Conversely, a stronger KRW raises the cost of imported goods and services.

Investors:

- Stock Market: A weaker KRW can boost the performance of Korean stocks denominated in USD.

- Bonds: Interest rates on Korean bonds become more attractive to foreign investors when the KRW depreciates.

- Real Estate: Foreign investors may find it more affordable to invest in Korean real estate if the KRW weakens.

Strategies for Managing Currency Risk

Businesses and investors can employ various strategies to manage the risks associated with currency fluctuations:

- Currency Hedging: Using financial instruments such as forward contracts or options to lock in an exchange rate for future transactions.

- Diversification: Investing in assets denominated in multiple currencies to mitigate the impact of currency movements.

- Economic Forecasting: Monitoring economic indicators and political developments to anticipate potential shifts in the exchange rate.

Conclusion

The KRW-USD exchange rate is a critical factor for both the South Korean economy and international businesses and investors. Understanding the factors that influence the exchange rate and its historical trends is essential for making informed financial decisions. By implementing appropriate strategies, businesses and investors can effectively manage currency risk and seize opportunities presented by exchange rate fluctuations.