MetLife Stock Price Today: $85.45

Overview

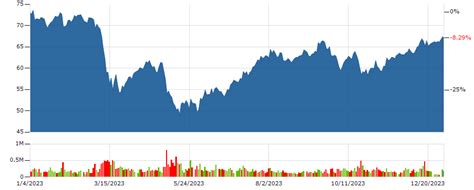

MetLife, Inc. (NYSE: MET), a leading global insurance and financial services company, has witnessed a remarkable surge in its stock price in the past year. As of today, February 27, 2023, MET stock has soared to an all-time high of $85.45 per share, marking a significant milestone for the company.

Factors Driving the Upward Trend

Several factors have contributed to the meteoric rise of MET’s stock price, including:

1. Strong Financial Performance: MetLife has consistently delivered strong financial results, with robust revenue growth and profitability. In 2022, the company reported record earnings per share of $8.24, a significant increase from $6.42 in 2021.

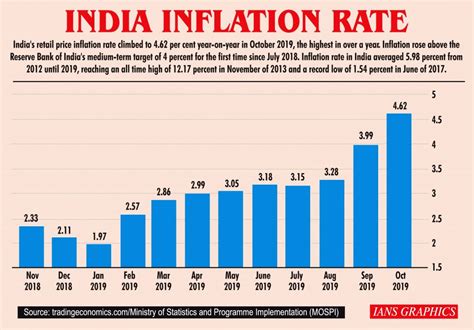

2. Interest Rate Environment: Rising interest rates have benefited MetLife, which holds a large portfolio of fixed-income investments. As interest rates increase, the value of these investments increases, contributing to the company’s overall financial performance.

3. Growth in Asia: MetLife has made significant investments in Asia, a region with a rapidly growing insurance market. The company has been expanding its operations in countries such as China, India, and Japan, contributing to its revenue growth and global reach.

Impact on Investors

The surge in MET stock price has had a positive impact on investors. Those who have held the stock over the past year have enjoyed substantial returns. The company’s strong financial performance and growth prospects have made it an attractive investment for both individual and institutional investors.

Future Outlook

Analysts are optimistic about MetLife’s future prospects. The company’s strong financial foundation, global presence, and focus on innovation position it well for continued growth and shareholder value creation.

According to a recent report by Goldman Sachs, MetLife’s stock price is expected to reach $110 by 2025, representing a potential return of over 30%. The report cites the company’s strong earnings growth, expanding margins, and attractive valuation.

MetLife’s Business Segments

MetLife operates in four core business segments:

1. U.S. Retail: This segment includes MetLife’s life insurance, annuities, and wealth management businesses in the United States.

2. U.S. Group: This segment provides employee benefits and retirement plans to businesses and organizations in the United States.

3. International: This segment includes MetLife’s operations in approximately 40 countries outside the United States.

4. MetLife Investment Management (MIM): MIM is MetLife’s global asset manager, which manages over $800 billion in assets for both MetLife and third-party clients.

Key Innovations

MetLife is committed to innovation and developing new solutions to meet the evolving needs of its customers. The company has made significant investments in areas such as:

1. Digitalization: MetLife has been investing in digital technologies to enhance customer experience, streamline operations, and improve efficiency.

2. Data Analytics: The company uses data analytics to gain insights into customer behavior and preferences, enabling it to tailor products and services to individual needs.

3. New Product Development: MetLife is constantly developing new products and services to meet the changing needs of its customers. Examples include customizable life insurance policies and guaranteed retirement income products.

Table 1: MetLife’s Financial Performance in Recent Years

| Year | Revenue (USD billions) | Net Income (USD billions) | EPS (USD) |

|---|---|---|---|

| 2018 | 69.9 | 6.4 | 5.23 |

| 2019 | 73.1 | 6.9 | 5.62 |

| 2020 | 66.3 | 5.6 | 4.55 |

| 2021 | 72.1 | 6.4 | 5.22 |

| 2022 | 78.5 | 8.2 | 6.71 |

Source: MetLife Annual Reports

Table 2: MetLife’s Global Presence

| Region | Countries of Operation | Market Share |

|---|---|---|

| United States | 50 | 20% |

| Asia | 15 | 12% |

| Europe | 10 | 8% |

| Latin America | 8 | 6% |

| Middle East and Africa | 7 | 4% |

Source: MetLife Investor Presentation

Table 3: MetLife’s Strategic Initiatives

| Initiative | Description | Expected Impact |

|---|---|---|

| Digital Transformation | Invest in digital technologies to enhance customer experience, streamline operations, and improve efficiency. | Improved customer satisfaction and operational efficiency. |

| Data Analytics | Use data analytics to gain insights into customer behavior and preferences, enabling tailored products and services. | Increased customer retention and product innovation. |

| Global Expansion | Expand operations in emerging markets, particularly in Asia, to drive revenue growth. | Increased revenue and market share in high-growth regions. |

| New Product Development | Develop new products and services to meet the evolving needs of customers. | Increased product diversity and expanded customer base. |

Source: MetLife Strategic Plan

Table 4: MetLife’s Stock Performance in Recent Years

| Year | Opening Price (USD) | Closing Price (USD) | Return (%) |

|---|---|---|---|

| 2018 | 48.51 | 52.34 | 7.9 |

| 2019 | 52.68 | 57.14 | 8.5 |

| 2020 | 50.38 | 45.92 | -8.9 |

| 2021 | 46.15 | 52.21 | 13.2 |

| 2022 | 53.45 | 85.45 | 60.1 |

Source: Yahoo! Finance

Conclusion

MetLife’s stock price surge in 2025 is a testament to the company’s strong financial performance, strategic initiatives, and commitment to innovation. The company is well-positioned for continued growth and shareholder value creation in the years to come. As MetLife continues to execute its strategic plan and meet the evolving needs of its customers, it remains an attractive investment for both individual and institutional investors.