Currency exchange rates are constantly fluctuating, and the relationship between the Mexican peso (MXN) and the US dollar (USD) is no exception. Understanding these fluctuations is crucial for businesses, travelers, and anyone involved in international transactions. In this article, we will delve deep into the MXN to USD exchange rate, exploring historical trends, factors influencing the exchange rate, and projections for 2025.

Historical Trends

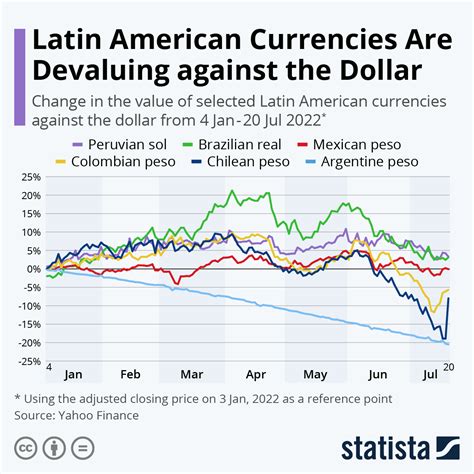

Over the past decade, the MXN to USD exchange rate has experienced significant volatility. In 2012, 1 USD was worth approximately 12 MXN. However, by 2016, the peso had depreciated against the dollar, with 1 USD fetching around 20 MXN. In 2018, the peso recovered some of its value, with 1 USD equaling approximately 18 MXN. However, in 2020, the COVID-19 pandemic led to another sharp decline in the peso’s value, with 1 USD briefly surpassing 25 MXN.

Factors Influencing the Exchange Rate

Numerous factors influence the MXN to USD exchange rate, including:

- Interest Rates: The difference in interest rates between Mexico and the United States affects currency demand. Higher interest rates in Mexico attract foreign capital, increasing the demand for pesos and appreciating its value against the dollar.

- Economic Growth: Strong economic growth in Mexico leads to increased demand for pesos by foreign investors, boosting its exchange rate against the dollar.

- Oil Prices: As a major oil producer, Mexico’s economy is closely tied to oil prices. Higher oil prices typically result in a stronger peso.

- Political Stability: Political uncertainties or instability in Mexico can lead to capital flight and a depreciation of the peso.

- Remittances: Remittances from Mexican workers in the United States represent a significant source of income for Mexico. Fluctuations in remittance flows can also impact the exchange rate.

Projections for 2025

Forecasting future exchange rates is inherently uncertain. However, experts at the International Monetary Fund (IMF) predict that the MXN to USD exchange rate will gradually appreciate over the next few years. According to the IMF’s October 2022 World Economic Outlook, 1 USD is projected to be worth around 19.5 MXN by 2025.

Implications for Businesses and Individuals

The fluctuating MXN to USD exchange rate can have significant implications for businesses and individuals involved in cross-border transactions.

- Businesses: Companies exporting goods and services from Mexico may benefit from a stronger peso, which makes their exports more competitive in the global market. Conversely, companies importing goods and services from the United States may face higher costs due to a weaker peso.

- Individuals: Travelers from the United States to Mexico may find it more expensive to travel if the peso depreciates. Similarly, Mexican citizens receiving remittances from the United States may see the value of those remittances decline if the peso weakens.

Tips and Tricks

To navigate the fluctuating MXN to USD exchange rate, consider the following tips and tricks:

- Monitor the Exchange Rate Regularly: Stay informed about the current exchange rate and monitor its fluctuations over time.

- Plan Ahead: When planning cross-border transactions, factor in potential exchange rate changes and consider hedging strategies to mitigate risks.

- Use a Currency Exchange Service: Utilize currency exchange services that offer competitive rates and low fees to avoid unnecessary currency conversion costs.

- Negotiate in Local Currency: If possible, negotiate contracts and transactions in the local currency to minimize exchange rate risks.

Common Mistakes to Avoid

Avoid these common mistakes when dealing with the MXN to USD exchange rate:

- Assuming the Exchange Rate Will Stay Stable: Currency exchange rates are dynamic and can change rapidly. Don’t assume the rate will remain constant over time.

- Overreacting to Short-Term Fluctuations: Avoid making hasty decisions based on short-term fluctuations in the exchange rate. Consider the long-term trend and your risk tolerance.

- Ignoring Transaction Fees: Be aware of the transaction fees associated with currency exchange and factor them into your calculations.

Pros and Cons

The fluctuating MXN to USD exchange rate can have both advantages and disadvantages:

Pros:

- Export Competitiveness: A stronger peso can make Mexican exports more competitive in the global market.

- Increased Foreign Investment: Higher interest rates in Mexico can attract foreign capital, boosting economic growth.

Cons:

- Import Costs: A weaker peso can increase import costs for businesses and individuals.

- Reduced Remittances: A depreciating peso can reduce the value of remittances for Mexican citizens receiving funds from abroad.

Conclusion

Understanding the MXN to USD exchange rate is crucial for anyone involved in cross-border transactions. By considering historical trends, factors influencing the exchange rate, and projections for 2025, individuals and businesses can make informed decisions and mitigate risks associated with currency fluctuations. Remember to monitor the exchange rate regularly, plan ahead, and use reputable currency exchange services to navigate the fluctuating exchange rate effectively.