Introduction: Understanding the Currency Exchange Market between NT and USD

In today’s globalized economy, currency exchange plays a vital role in facilitating trade and financial transactions between countries. For individuals and businesses engaging in cross-border dealings, understanding the exchange rate between different currencies is essential to ensure favorable terms and avoid potential losses. This article provides a comprehensive guide to the NT (New Taiwanese dollar) to American dollar (USD) exchange rate, offering valuable insights into the factors that influence its fluctuations and practical guidance on how to make informed currency exchange decisions.

Key Factors Influencing the NT to USD Exchange Rate

The exchange rate between NT and USD is influenced by a complex interplay of macroeconomic factors, including:

- Interest Rates: Differences in interest rates between Taiwan and the United States significantly impact the exchange rate. Higher interest rates in Taiwan, for example, attract foreign investment, which increases demand for the NT and strengthens its value against the USD.

- Inflation: Inflation rates in both countries influence the purchasing power of their currencies. If inflation is higher in Taiwan than in the United States, it weakens the NT’s value relative to the USD.

- Economic Growth: Strong economic growth in Taiwan indicates increased demand for its currency, leading to NT appreciation. Conversely, slower economic growth can lead to NT depreciation.

- Political and Economic Stability: Political and economic stability in Taiwan and the United States affect investor confidence and the relative attractiveness of their currencies. Uncertainty in either country can devalue its currency.

- Foreign Currency Reserves: Taiwan’s extensive foreign currency reserves provide it with a financial buffer against short-term fluctuations in the exchange rate. A higher level of reserves typically supports the NT’s stability.

How to Exchange NT to USD

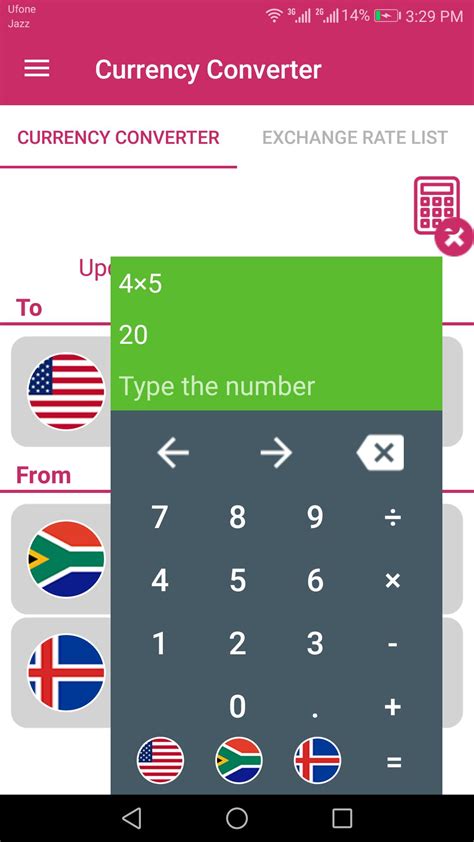

Exchanging NT to USD can be done through various channels:

- Banks: Banks offer competitive exchange rates and a wide range of currency exchange services. However, transaction fees and commissions may apply.

- Currency Exchange Bureaus: Specialized businesses that solely focus on currency exchange. They usually offer convenient locations and competitive rates, but fees can vary.

- Online Exchange Platforms: Online platforms allow individuals to exchange currencies from the comfort of their own homes. They typically offer competitive rates and low transaction fees.

- Peer-to-Peer Exchange: Engaging in direct currency exchange with another individual through platforms or social media, which can offer the most favorable rates but may involve higher risks.

Pain Points in NT to USD Currency Exchange

Individuals and businesses often encounter challenges when exchanging NT to USD, including:

- Unfavorable Exchange Rates: Fluctuating exchange rates can result in unfavorable exchange rates at certain times.

- Transaction Fees and Commissions: Banks and currency exchange bureaus charge fees and commissions on exchange transactions, which can reduce the amount of USD received.

- Hidden Charges and Markups: Some exchange providers may employ hidden charges or apply markups to the exchange rate, which can inflate the overall cost of currency exchange.

- Security Concerns: When engaging in peer-to-peer exchange or using online platforms, concerns about security and fraud can arise.

Motivations for Exchanging NT to USD

There are various motivations for individuals and businesses to exchange NT to USD:

- International Trade and Investment: Businesses involved in international trade or investments often need to exchange NT to USD to settle payments or conduct transactions.

- Tourism and Travel: Individuals traveling to the United States from Taiwan typically exchange NT to USD for expenses such as accommodation, dining, and shopping.

- Education: Students studying in the United States need to exchange NT to USD to cover tuition fees, living expenses, and other costs associated with education.

- Overseas Remittances: Individuals sending money to family or friends in the United States need to convert NT to USD to facilitate remittances.

How to Benefit from NT to USD Exchange

To maximize the benefits of NT to USD exchange, consider the following tips:

- Research and Compare Exchange Rates: Before exchanging currencies, compare exchange rates from multiple providers to secure the most favorable rate.

- Negotiate Fees and Commissions: If possible, negotiate lower transaction fees and commissions with banks or currency exchange bureaus.

- Avoid Hidden Charges and Markups: Carefully review the terms and conditions of exchange providers to ensure no hidden charges or markups are applied.

- Use Online Exchange Platforms Wisely: Leverage online exchange platforms to access competitive rates and low fees, but proceed with caution and ensure the platform is reputable and secure.

- Consider Peer-to-Peer Exchange for Favorable Rates: Explore peer-to-peer exchange options to potentially obtain the most favorable exchange rates, but be vigilant about security measures.

Conclusion: Staying Informed and Making Informed Currency Exchange Decisions

Understanding the dynamics of the NT to USD exchange rate and the factors that influence its fluctuations is crucial for individuals and businesses engaging in currency exchange. By staying informed, comparing exchange rates, and considering the options available, you can minimize transaction costs and make informed decisions that align with your financial objectives. Remember, the NT to USD exchange rate is constantly evolving, so it’s essential to monitor it regularly to make timely and strategic currency exchange decisions.

Additional Resources

- Central Bank of Taiwan: Currency Exchange Rates

- Bank of Taiwan: Foreign Exchange

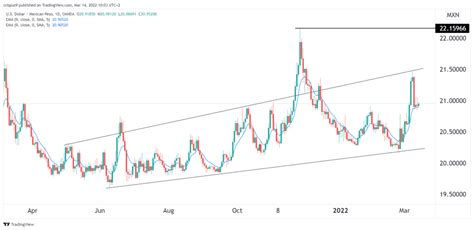

- X-Rates: NT to USD Exchange Rate Chart

Tables

Table 1: Historical Fluctuations of the NT to USD Exchange Rate

| Year | Exchange Rate (NT/USD) |

|---|---|

| 2010 | 30.25 |

| 2015 | 33.20 |

| 2020 | 28.50 |

| 2022 | 27.80 |

Table 2: Exchange Fees Charged by Different Providers

| Provider | Transaction Fee | Commission |

|---|---|---|

| Bank | $5-$10 | 0.5%-1% |

| Currency Exchange Bureau | $2-$5 | 0.2%-0.5% |

| Online Exchange Platform | $0-$2 | 0.1%-0.3% |

Table 3: Benefits of Using Online Exchange Platforms

| Benefit | Description |

|---|---|

| Competitive Rates | Access to real-time exchange rates and competitive spreads |

| Low Fees | Minimal transaction fees and commissions compared to traditional providers |

| Convenience | Exchange currencies from anywhere with an internet connection |

| Fast Transactions | Expedited exchange processes, often within 24 hours |

Table 4: Security Measures for Peer-to-Peer Currency Exchange

| Measure | Description |

|---|---|

| Verify Identity | Inquire about the other party’s identity through social media profiles or exchange platforms |

| Use Escrow Services | Leverage third-party platforms that hold funds until both parties fulfill their obligations |

| Choose Reputable Exchange Platforms | Opt for peer-to-peer exchange platforms that have established a positive reputation and provide security features |

| Report Suspicious Activity | Report any suspicious behavior or concerns to the exchange platform or relevant authorities |