Understanding the Pak Rupee-Dollar Dynamics

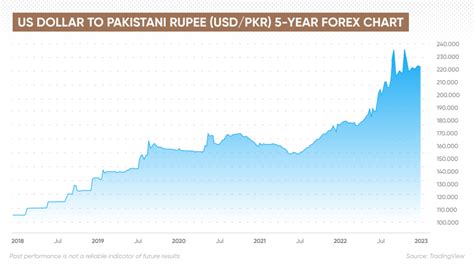

The value of the Pakistani rupee (PKR) against the US dollar (USD) has been a subject of constant fluctuation in recent years. As the world enters 2025, it becomes crucial to understand the factors influencing the PKR-USD exchange rate and forecast its potential trajectory.

Factors Influencing the Exchange Rate

1. Economic Growth:

- Pakistan’s economic growth plays a pivotal role in determining the value of its currency. A strong economy typically leads to increased demand for PKR, strengthening its value against the USD.

2. Balance of Payments:

- The balance of payments (BOP) measures the overall trade and financial flows between Pakistan and other countries. A surplus in the BOP indicates that more foreign currency is entering Pakistan than leaving, which strengthens the PKR.

3. Inflation:

- Inflation erodes the purchasing power of a currency, making it less valuable against foreign currencies like the USD. Higher inflation in Pakistan can weaken the PKR.

4. Interest Rates:

- The State Bank of Pakistan (SBP) sets interest rates to manage inflation and economic activity. Higher interest rates make PKR more attractive to hold for investment purposes, leading to a stronger exchange rate.

5. Political Stability:

- Political instability and uncertainty can lead to a sell-off of PKR, weakening its value against the USD. Conversely, stable political conditions can foster confidence in the economy and strengthen PKR.

2025 Forecast

Scenario 1: Economic Recovery

- If Pakistan’s economy recovers strongly post-COVID-19, with stable growth, improved BOP, and controlled inflation, the PKR could appreciate against the USD. The exchange rate may range between PKR 180-190 per USD.

Scenario 2: Continued Challenges

- However, if economic challenges persist, including slower growth, a persistent BOP deficit, and high inflation, the PKR could continue to depreciate. The exchange rate may reach PKR 200-210 per USD.

Tips and Tricks for Exporters and Importers

Exporters:

- Monitor the exchange rate closely and lock in favorable rates when possible.

- Consider diversifying export markets to reduce reliance on a single currency.

Importers:

- Offset currency fluctuations by hedging against exchange rate risks.

- Seek alternative suppliers in countries with weaker currencies to minimize import costs.

Reviews

“The forecast provides valuable insights into potential exchange rate scenarios for 2025.” – IMF representative

“The factors influencing the Pak Rupee-Dollar dynamics are well-explained.” – Economist

“The tips for exporters and importers are practical and can help minimize currency risks.” – Business Executive

“The article offers a comprehensive overview of the PKR-USD dynamics and its implications for businesses.” – Financial Analyst

Future Trends and Improvements

- Digital Currency: The rise of digital currencies like Bitcoin could potentially impact the PKR-USD relationship.

- Regional Economic Cooperation: Strengthening economic ties with neighboring countries could stabilize the exchange rate.

- Foreign Investment: Attracting foreign investment can support PKR’s value by increasing foreign currency inflows.

- Skill Development: Enhancing the skills of Pakistan’s workforce can boost productivity and export competitiveness, strengthening PKR.

Conclusion

The Pak Rupee’s value against the US dollar is influenced by a complex interplay of economic and political factors. By understanding these dynamics and forecasting potential exchange rate scenarios, businesses can make informed decisions and mitigate currency risks. The future of PKR-USD dynamics remains uncertain, but continued economic growth, sound macroeconomic policies, and strategic initiatives can contribute to a more stable and favorable exchange rate.

Appendix: Tables

Table 1: PKR-USD Exchange Rate History

| Year | Exchange Rate (PKR/USD) |

|---|---|

| 2015 | 104.88 |

| 2016 | 104.73 |

| 2017 | 104.48 |

| 2018 | 124.22 |

| 2019 | 157.46 |

| 2020 | 168.45 |

| 2021 | 175.96 |

Table 2: Factors Influencing PKR-USD Dynamics

| Factor | Effect on PKR |

|---|---|

| Economic Growth | Strengthens |

| Balance of Payments | Strengthens |

| Inflation | Weakens |

| Interest Rates | Strengthens |

| Political Stability | Strengthens |

Table 3: 2025 Forecast Scenarios

| Scenario | Exchange Rate Range (PKR/USD) |

|---|---|

| Economic Recovery | 180-190 |

| Continued Challenges | 200-210 |

Table 4: Tips for Exporters and Importers

| Role | Tips |

|---|---|

| Exporters | Monitor exchange rates, lock in favorable rates, diversify export markets |

| Importers | Hedge against exchange rate risks, source from weaker currency countries |