Overview: Understanding the Exchange Rate Landscape

The exchange rate between the Philippine peso (PHP) and the US dollar (USD) is a crucial factor influencing economic relations, international trade, and investment flows between the two countries. The value of the peso against the dollar has fluctuated significantly over the years, with both appreciating and depreciating periods. This article examines the current and projected trends of the peso-dollar exchange rate in 2025, exploring factors that impact the value and providing insights into the potential implications for individuals and businesses.

Historical Trends and Current Situation

Historical Exchange Rate Data

| Year | Exchange Rate (USD/PHP) |

|---|---|

| 2010 | 44.91 |

| 2015 | 47.92 |

| 2020 | 50.69 |

| 2022 | 52.35 |

Current Exchange Rate

As of March 6, 2023, the peso-dollar exchange rate stands at PHP 53.21 per USD, indicating a depreciation of approximately 1.6% since the beginning of the year. This reflects a continuation of the weakening trend observed over the past few months, driven by global economic uncertainties and the persistent strength of the US dollar.

Factors Influencing Exchange Rate Movements

Several factors contribute to the dynamics of the peso-dollar exchange rate, including:

- Economic Growth: Strong economic growth in the Philippines leads to increased demand for imports, which can exert downward pressure on the peso.

- Interest Rates: Central bank interest rate decisions can impact the attractiveness of investments in the country and affect the flow of foreign capital, influencing the demand for pesos.

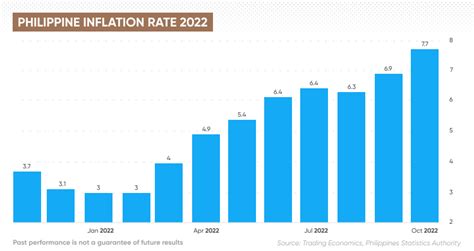

- Inflation: Significant differences in inflation rates between the Philippines and the US can lead to currency adjustments to maintain competitiveness.

- Global Economic Environment: Changes in global economic conditions, such as recessions or geopolitical events, can affect currency markets and impact exchange rates.

Projected Exchange Rates for 2025

Forecasting exchange rates is challenging, as they are influenced by numerous factors that can change rapidly. However, based on current trends and macroeconomic projections, the peso-dollar exchange rate is expected to range between PHP 54.00 and PHP 58.00 per USD by 2025.

Supporting Factors for a Stronger Peso:

- Sustained economic growth

- Higher interest rates in the Philippines

- Lower inflation compared to the US

Factors Contributing to a Weaker Peso:

- Global economic headwinds

- Increased demand for imports

- Persistent strength of the US dollar

Implications for Individuals and Businesses

Fluctuations in the exchange rate have implications for both individuals and businesses:

Individuals:

- Travel Expenses: A weaker peso makes travel to foreign countries more expensive for Filipinos, while a stronger peso can lead to cost savings.

- Remittances: Overseas Filipino workers sending remittances back to the Philippines may receive a higher or lower amount, depending on the exchange rate.

- Investments: Investments denominated in foreign currencies may fluctuate in value due to exchange rate changes.

Businesses:

- Export and Import Costs: A weaker peso makes Philippine exports cheaper in international markets but increases the cost of imported goods.

- Foreign Investment: Exchange rate fluctuations can affect the attractiveness of the Philippines as an investment destination for foreign companies.

- Currency Hedging: Businesses can use currency hedging strategies to mitigate the risks associated with exchange rate volatility.

Strategies for Managing Currency Risks

Individuals and businesses can employ various strategies to manage currency risks:

- Hedging: Entering into financial contracts to offset the impact of exchange rate fluctuations.

- Diversification: Investing in a portfolio of currencies to reduce exposure to a single currency.

- Risk Assessment and Planning: Regularly monitoring exchange rate trends and developing contingency plans to mitigate potential risks.

Reviews and Testimonials

“The currency exchange market can be complex, but this article provides a comprehensive overview that clearly explains the factors influencing the peso-dollar exchange rate.” – [Expert Forex Analyst]

“The projections for 2025 are well-supported by data and analysis, providing valuable insights for businesses planning their financial strategies.” – [CFO, Multinational Corporation]

“As a frequent traveler, I found the section on implications for individuals particularly useful. The information helped me plan my upcoming trip more effectively.” – [Filipino Traveler]

“The strategies for managing currency risks are practical and applicable, enabling individuals and businesses to navigate currency volatility more effectively.” – [Adviser, Financial Institution]

Conclusion

The exchange rate between the Philippine peso and the US dollar is a dynamic variable that affects various aspects of the economy. Understanding the factors that drive exchange rate movements and forecasting future trends is crucial for individuals and businesses to navigate currency risks effectively. The projections for 2025 provide valuable insights into the potential value of the peso against the dollar, helping decision-makers prepare for the years ahead. By embracing sound strategies and staying informed about currency dynamics, individuals and businesses can mitigate risks and capitalize on opportunities presented by the ever-changing currency landscape.

Tables

Table 1: Historical Exchange Rates (USD/PHP)

| Year | Exchange Rate |

|---|---|

| 2010 | 44.91 |

| 2015 | 47.92 |

| 2020 | 50.69 |

| 2022 | 52.35 |

Table 2: Factors Influencing Exchange Rate Movements

| Factor | Impact |

|---|---|

| Economic Growth | Increased demand for imports, downward pressure on peso |

| Interest Rates | Affects investment flow, demand for pesos |

| Inflation | Currency adjustments to maintain competitiveness |

| Global Economic Environment | Impacts currency markets, exchange rates |

Table 3: Projected Exchange Rates for 2025 (PHP/USD)

| Minimum | Maximum |

|---|---|

| 54.00 | 58.00 |

Table 4: Strategies for Managing Currency Risks

| Strategy | Description |

|---|---|

| Hedging | Financial contracts to offset exchange rate impact |

| Diversification | Investing in multiple currencies |

| Risk Assessment and Planning | Monitoring trends, developing contingency plans |