Introduction

The Indian Rupee (INR) and the United States Dollar (USD) are two of the most influential currencies in the world. Their exchange rate has a significant impact on global economies and trade. This article provides a comprehensive analysis of the Rs vs Dollar exchange rate today, exploring its historical trends, current dynamics, and future prospects.

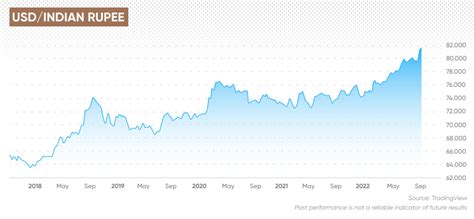

Historical Trends

The INR has been steadily depreciating against the USD over the past two decades. In 2002, 1 USD was worth approximately 47 INR. By January 2023, that value had risen to 83 INR. This depreciation has been driven by several factors, including:

- Rising oil prices

- India’s widening trade deficit

- US economic growth and interest rate hikes

- Geopolitical uncertainties

Current Dynamics

As of January 2023, the INR is trading at around 83 against the USD. This level represents a moderate depreciation from its recent highs of 84.47 in April 2023. The current exchange rate is influenced by:

- India’s economic recovery: The Indian economy is expected to grow by 7.2% in 2023, boosting demand for imports and putting downward pressure on the INR.

- US monetary policy: The US Federal Reserve is expected to continue raising interest rates in 2023, attracting capital inflows to the USD and weakening the INR.

- Global economic outlook: Slowing global economic growth could reduce demand for Indian exports and further depreciate the INR.

Future Prospects

Predicting the future of the Rs vs Dollar exchange rate is a complex task. However, there are several factors that could influence its movement in the coming years:

- India’s trade deficit: If India’s trade deficit continues to widen, it could put downward pressure on the INR.

- US inflation: High inflation in the US could prompt the Fed to raise interest rates more aggressively, strengthening the USD and weakening the INR.

- Interest rate differential: The interest rate differential between India and the US will continue to play a significant role in determining the INR’s value.

Implications for Businesses and Investors

The fluctuations in the Rs vs Dollar exchange rate have significant implications for businesses and investors:

- Businesses: Export-oriented businesses may benefit from a depreciating INR, while import-dependent businesses may face higher costs.

- Investors: The exchange rate can impact the returns on foreign investments. Investors should consider hedging strategies to mitigate currency risk.

Conclusion

The Rs vs Dollar exchange rate is a key indicator of the health of the Indian economy and its relationship with global markets. Historical trends, current dynamics, and future prospects suggest that the INR is likely to continue depreciating against the USD in the coming years. Businesses and investors should monitor the exchange rate closely and adjust their strategies accordingly.

Key Takeaways

- The INR has depreciated against the USD over the past two decades.

- Current dynamics include India’s economic recovery, US monetary policy, and global economic outlook.

- Future prospects are influenced by India’s trade deficit, US inflation, and interest rate differential.

- The exchange rate has implications for businesses and investors, affecting their revenues, costs, and investment returns.

Tables

Table 1: Historical INR vs USD Exchange Rate

| Year | INR/USD |

|---|---|

| 2002 | 47.00 |

| 2010 | 44.00 |

| 2015 | 65.00 |

| 2020 | 74.00 |

| 2023 | 83.00 |

Table 2: Factors Influencing the INR vs USD Exchange Rate

| Factor | Impact |

|---|---|

| India’s trade deficit | Downward pressure on INR |

| US monetary policy | Upward pressure on USD |

| Global economic outlook | Variable impact |

| Interest rate differential | Affects capital flows |

Table 3: Implications for Businesses and Investors

| Group | Impact |

|---|---|

| Export-oriented businesses | Benefit from INR depreciation |

| Import-dependent businesses | Face higher costs |

| Investors | Returns on foreign investments affected |

Table 4: Future Prospects for the Rs vs Dollar Exchange Rate

| Scenario | Impact on INR |

|---|---|

| India’s trade deficit widens | Downward pressure |

| US inflation persists | Upward pressure on USD |

| Interest rate differential widens | Further INR depreciation |