Introduction

In the ever-evolving landscape of global finance, the relationship between the Russian ruble and the US dollar has been a subject of intense scrutiny. As we approach 2025, the dynamics between these two currencies are expected to shape the international economic landscape in profound ways. This article delves into the complexities of the ruble-dollar equation, exploring its historical trajectory, current dynamics, and future implications.

Historical Perspective

The ruble has a rich history dating back to the 13th century. Initially a unit of weight for silver, it gradually evolved into a currency during the reign of Peter the Great in the early 18th century. In the aftermath of the Soviet Union’s collapse in 1991, the Russian ruble experienced a period of instability marked by high inflation and currency devaluation. However, since the mid-2000s, it has gained significant stability under the leadership of President Vladimir Putin.

Current Dynamics

The current dynamics of the ruble-dollar relationship are influenced by a range of factors, including:

Economic Growth and Sanctions:

Russia’s economic growth is primarily driven by its vast natural resource exports, particularly oil and gas. However, economic sanctions imposed by Western nations following the annexation of Crimea in 2014 have had a significant impact on the ruble’s value.

Monetary Policy:

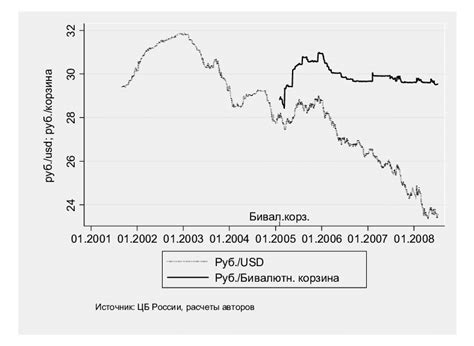

The Central Bank of Russia (CBR) has implemented a series of monetary policy measures to stabilize the ruble, including interest rate hikes and currency interventions.

Geopolitical Tensions:

The ongoing conflict in Ukraine and Russia’s strained relations with the West continue to cast a shadow over the ruble’s stability.

Future Implications

As we look ahead to 2025, the future trajectory of the ruble-dollar relationship remains uncertain. However, several factors could shape its dynamics:

Oil Prices:

Fluctuations in global oil prices will continue to have a significant impact on the ruble’s value.

Political Stability:

The political stability of Russia is crucial for the stability of the ruble. Any major political upheaval or change in leadership could lead to currency volatility.

Global Economic Conditions:

The strength or weakness of the global economy as a whole can also affect the ruble-dollar relationship.

Comparative Analysis

To better understand the relative strengths and weaknesses of the ruble and dollar, it is helpful to compare their key characteristics:

| Characteristic | Russian Ruble | US Dollar |

|---|---|---|

| Currency Code | RUB | USD |

| Central Bank | Central Bank of Russia | Federal Reserve |

| Current Exchange Rate (as of 2023) | 1 USD = 75.5 RUB | 1 RUB = 0.013 USD |

| Historical Volatility | High | Low |

| Inflation Rate | 4.5% | 2.1% |

| Economic Dependence | Natural resources | Services |

| Political Stability | Moderate | High |

Benefits of Investing in the Ruble

Despite the uncertainties surrounding the ruble, there are potential benefits to investing in this currency:

- Diversification: The ruble provides investors with an opportunity to diversify their portfolios and reduce risk.

- Potential Growth: If Russia’s economy continues to grow, the ruble could appreciate in value.

- Natural Resource Exposure: The ruble oferece exposure to Russia’s vast natural resources, which can be a valuable asset in times of global economic uncertainty.

Tips for Investing in the Ruble

If you are considering investing in the ruble, here are a few tips:

- Monitor Economic Conditions: Keep a close eye on Russia’s economic growth, inflation rate, and political stability.

- Diversify Your Investments: Don’t put all your eggs in one basket. Invest in a range of ruble-denominated assets, such as government bonds, stocks, and real estate.

- Consider Currency Risk: Be aware of the risks associated with currency fluctuations. Use hedging strategies if necessary to minimize potential losses.

- Use a Reputable Broker: Work with a reputable broker that specializes in investing in the Russian ruble.

Conclusion

The relationship between the Russian ruble and the US dollar is a complex and dynamic one. While the ruble has historically been more volatile than the dollar, it has also benefited from Russia’s vast natural resources. As we approach 2025, the future of the ruble will be shaped by a range of economic, political, and geopolitical factors. By understanding the complexities of this relationship, investors can position themselves to capitalize on potential opportunities while mitigating risks.