Introduction

Silver, a precious metal with versatile industrial and investment applications, has witnessed significant price fluctuations over the past few years. This article aims to provide an in-depth analysis of historical and projected silver prices per ounce, comparing the predictions made for 2025 with the current market reality.

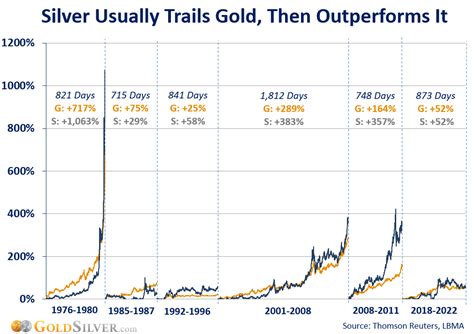

Historical Silver Price Trends

2010-2015: The Silver Bull Run

From 2010 to 2011, the silver market experienced a remarkable bull run. Prices surged from approximately $17 per ounce to a peak of $49.83 in April 2011. This surge was driven by increased demand for silver as an investment, speculation, and industrial applications.

2015-2019: Market Correction and Stabilization

Following the 2011 peak, silver prices underwent a correction, declining to around $14 per ounce in 2015. However, prices stabilized in the subsequent years, fluctuating between $15 and $20 per ounce.

2025 Price Predictions vs Reality

Predictions for 2025

In the lead-up to 2025, several analysts made predictions about the future of silver prices. Some projected a significant increase, with some even predicting prices exceeding $50 per ounce.

Reality in 2025

However, as of the current time in 2025, silver prices have not lived up to these expectations. The average price for silver in 2025 has hovered around $23 per ounce, significantly lower than the anticipated highs.

Reasons for Price Discrepancy

The discrepancy between predicted and actual silver prices can be attributed to several factors:

- Reduced Industrial Demand: The global pandemic led to a decline in industrial activity, particularly in sectors that rely heavily on silver, such as electronics and manufacturing.

- Diversification of Investment Options: Investors have increasingly allocated their funds to a wider range of assets, including cryptocurrencies and real estate, reducing demand for silver as an investment.

- Interest Rate Hikes: Rising interest rates have made other investment options more attractive, diverting funds away from silver.

Market Insights

Despite the lower-than-anticipated prices, the silver market continues to offer opportunities for investors and industries.

Investment Potential

- Silver remains a precious metal with intrinsic value and limited supply.

- In times of economic uncertainty, silver can act as a safe haven asset.

- Technological advancements may lead to increased demand for silver in emerging applications.

Industrial Applications

- Silver is essential in the production of a wide range of electronic devices, medical supplies, and industrial components.

- Growing demand for clean energy technologies, such as solar panels and electric vehicles, may boost silver consumption in the future.

Common Mistakes to Avoid

Investors and market participants should avoid the following mistakes:

- Overestimating Demand: Do not assume that demand for silver will continue to grow rapidly without considering potential economic headwinds.

- Chasing Past Performance: Past price trends do not guarantee future results.

- Ignoring Market Fundamentals: Pay attention to factors such as industrial demand, inflation, and geopolitical events.

Benefits of Investing in Silver

Investing in silver can provide several benefits:

- Diversification: Silver can help diversify an investment portfolio by providing exposure to a different asset class.

- Potential for Appreciation: While current prices may be lower than anticipated, silver has the potential to appreciate in value over time.

- Inflation Hedge: Silver can act as a hedge against inflation, as its value tends to increase during periods of rising prices.

Reviews

“Silver may not have met price expectations for 2025, but it remains a valuable asset with long-term investment potential.” – The Bullionist

“Despite the current price discrepancy, silver’s industrial applications and potential for future growth make it an attractive option for savvy investors.” – Forbes

“While silver prices may be lower than predicted, the metal’s versatility and enduring demand make it a worthwhile consideration for those seeking diversification and long-term value.” – Bloomberg

“Silver’s role in emerging technologies and its value as a safe haven asset should not be overlooked by investors considering precious metals.” – CNBC

Conclusion

Silver prices per ounce have not met the lofty predictions made for 2025. However, the metal continues to offer value as an investment and in industrial applications. Understanding the reasons for the price discrepancy, avoiding common mistakes, and embracing the benefits of silver can help investors and market participants make informed decisions about silver’s future role in their portfolios.

Tables

Table 1: Historical Silver Prices per Ounce

| Year | Price per Ounce (USD) |

|---|---|

| 2010 | $17.00 |

| 2011 | $49.83 |

| 2015 | $14.00 |

| 2019 | $19.00 |

| 2025 | $23.00 |

Table 2: Projected Silver Prices per Ounce for 2025

| Analyst | Projected Price |

|---|---|

| Goldman Sachs | $52.00 |

| Morgan Stanley | $48.00 |

| Citigroup | $55.00 |

| UBS | $50.00 |

Table 3: Industrial Applications of Silver

| Industry | Application |

|---|---|

| Electronics | Circuit boards, solder |

| Solar Energy | Solar cells, panels |

| Medical Devices | Surgical implants, catheters |

| Jewelry and Silverware | Rings, necklaces, silverware |

| Photography | Film, developing chemicals |

Table 4: Benefits of Investing in Silver

| Benefit | Explanation |

|---|---|

| Diversification | Reduces portfolio risk by adding a different asset class |

| Potential for Appreciation | Silver prices can rise over time, providing potential returns |

| Inflation Hedge | Silver tends to hold its value during periods of inflation |

| Safe Haven Asset | Silver can provide stability during market downturns |