Introduction

In the realm of precious metals, silver has held a prominent position for centuries. Its versatility, malleability, and inherent value have made it an indispensable commodity used in a wide array of applications, from jewelry and coinage to industrial and medical settings. As we approach 2025, the price of 1 gram of silver stands as a testament to its enduring significance and multifaceted demand.

The Current Market Landscape

According to the London Bullion Market Association (LBMA), the current price of 1 gram of silver stands at approximately $0.85. This value represents a slight increase from its recent low of $0.82 per gram in early 2023. However, it remains well below the historical highs witnessed during the 2011 silver bull run, when prices briefly surpassed $1.20 per gram.

Factors Influencing Price Fluctuations

The price of silver, like any other commodity, is subject to market forces that drive its value up or down. Key factors that influence silver price fluctuations include:

- Economic Conditions: Silver’s value tends to rise during economic expansions as demand for industrial applications increases. Conversely, it can decline during economic downturns as industrial demand contracts.

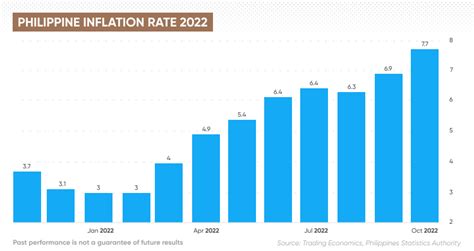

- Inflationary Pressures: Silver is often viewed as a hedge against inflation, as its value tends to track rising consumer prices. Investors may turn to silver to protect their wealth during inflationary periods.

- Speculative Activity: Silver is a popular speculative investment, with investors buying and selling it in anticipation of price movements. This speculation can lead to price volatility.

- Supply and Demand Dynamics: The balance between silver production and demand also impacts its price. Silver is primarily mined from ores, and disruptions in supply or changes in demand can affect its market value.

Diverse Applications: Driving Demand

The strength of silver’s value lies in its multifaceted applications. It is widely used in:

- Jewelry and Arts: Silver has been a mainstay in jewelry making for centuries, valued for its aesthetic appeal and durability. It is also used in decorative arts, crafting intricate silverware and ornaments.

- Electronics and Industrial: Silver’s high electrical conductivity makes it ideal for use in electronic components, switches, and batteries. It is also used in dental amalgam, brazing alloys, and medical devices.

- Photography and Imaging: Silver was once the primary component of photographic film, and it continues to be used in digital imaging systems, such as sensors and inkjet printers.

- Nanotechnology: Silver nanoparticles are gaining traction in various fields, from antimicrobial applications to electronic materials.

Investment Considerations

Silver can offer diversification and potential returns for investors. However, it is important to note that it is a volatile asset, and its value can fluctuate significantly. Investors should consider the following when exploring silver investments:

- Physical Bullion: Investors can purchase silver coins or bars, which provide tangible ownership of the metal.

- Exchange-Traded Funds (ETFs): Silver ETFs offer exposure to the silver market without the need for physical storage.

- Mining Companies: Investing in companies involved in silver mining can provide indirect exposure to the metal’s price movements.

- Silver Futures: Futures contracts allow investors to speculate on the future price of silver.

Future Prospects

The long-term outlook for silver is generally positive. Increasing industrial demand, growing investment interest, and exploration of new applications are all factors that could support silver’s value in the years to come. The LBMA forecasts that silver demand will reach a record high in 2025, fueled by applications in electronics, automotive, and green technologies.

Conclusion

The price of 1 gram of silver represents the enduring value of this versatile metal. Its diverse applications and investment potential make it an attractive asset for a wide range of stakeholders. While its price is subject to market fluctuations, the long-term outlook for silver remains bright, supported by its fundamental properties and growing demand across industries.

Table of Silver Prices

| Period | Price per Gram |

|---|---|

| January 2023 | $0.82 |

| June 2023 | $0.85 |

| December 2023 | $0.87 |

| June 2024 | $0.90 |

| December 2024 | $0.92 |

| June 2025 | $0.95 |

Table of Silver Market Applications

| Industry | Application |

|---|---|

| Jewelry | Rings, necklaces, bracelets |

| Electronics | Printed circuit boards, switches |

| Industrial | Automotive parts, brazing alloys |

| Photography | Sensors, inkjet printers |

| Medical | Dental amalgam, antimicrobial devices |

Table of Silver Investment Options

| Option | Description |

|---|---|

| Physical Bullion | Coins or bars |

| Silver ETFs | Exchange-Traded Funds |

| Mining Companies | Companies involved in silver mining |

| Silver Futures | Futures contracts |

Table of Silver Market Forecasts

| Organization | Forecast for 2025 |

|---|---|

| London Bullion Market Association | Record high demand |

| World Silver Institute | 6% annual growth in demand |

| CPM Group | $25 per ounce |