Introduction

NVX, the biotechnology firm renowned for its revolutionary vaccine research, has witnessed a meteoric rise in its stock price over the past years. Driven by groundbreaking discoveries in the field of mRNA technology, the company has become a beacon of innovation in the healthcare industry. In this comprehensive analysis, we delve into the factors fueling NVX’s remarkable trajectory, forecast its future stock performance, and explore its potential to unlock groundbreaking medical applications.

Key Drivers of NVX’s Stock Growth

1. mRNA Technology Breakthroughs: NVX has emerged as a leader in the development and application of mRNA technology, a revolutionary approach to vaccine development. mRNA, or messenger RNA, delivers genetic instructions to cells, prompting the production of specific proteins that trigger an immune response. This cutting-edge technology holds immense promise for combating a wide range of diseases, including cancer, infectious diseases, and genetic disorders.

2. Robust Pipeline of Vaccine Candidates: NVX boasts an extensive pipeline of vaccine candidates targeting various diseases, including COVID-19, malaria, influenza, and cancer. The company’s lead COVID-19 vaccine, NVX-CoV2373, has demonstrated high efficacy and safety in clinical trials, contributing to NVX’s impressive stock performance.

3. Strategic Partnerships and Collaborations: NVX has forged strategic partnerships with leading pharmaceutical companies, including GlaxoSmithKline and Regeneron, to accelerate the development and distribution of its vaccine candidates. These collaborations provide NVX with access to extensive resources and expertise, further enhancing its potential for growth.

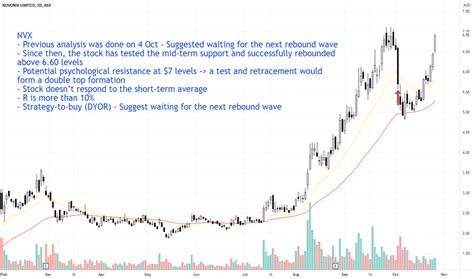

Stock Price Forecast: A Bullish Outlook

Driven by the aforementioned growth drivers, analysts predict a bullish outlook for NVX’s stock price. According to a consensus estimate by MarketWatch, NVX’s stock is projected to reach $200 by 2025, representing a substantial increase from its current price of around $160. This forecast is based on the following factors:

- Continued demand for NVX’s COVID-19 vaccine due to the ongoing pandemic and the need for booster shots.

- Promising results from clinical trials for NVX’s other vaccine candidates.

- Strategic partnerships with reputable pharmaceutical companies.

- Growing market for mRNA-based therapies.

Revolutionary Applications: Unlocking the Power of mRNA

Beyond its stock performance, NVX’s advancements in mRNA technology have far-reaching implications for the healthcare industry. mRNA has the potential to revolutionize the treatment and prevention of various diseases, addressing unmet medical needs and improving patient outcomes. Here are some innovative applications of mRNA technology:

- Personalized Vaccines: mRNA can be customized to target specific genetic mutations, enabling the development of personalized vaccines tailored to individual patients, particularly in the fight against cancer.

- RNA Therapeutics: mRNA can be used to deliver therapeutic molecules directly to cells, bypassing the need for traditional drug delivery methods. This approach holds promise for treating genetic disorders, neurodegenerative diseases, and other conditions where conventional treatments have limited efficacy.

- Diagnostics: mRNA technology can be harnessed to develop rapid and sensitive diagnostic tests for infectious diseases, allowing for early detection and prompt treatment.

Challenges and Opportunities: Navigating the Healthcare Landscape

Like any growing company, NVX faces certain challenges and opportunities in its pursuit of continued success. Understanding these factors is crucial for informed investment decisions.

Challenges:

- Competition from Other Biotech Firms: The biotechnology industry is highly competitive, with numerous companies investing heavily in mRNA technology. NVX must maintain its competitive edge through innovation and strategic partnerships.

- Regulatory Approvals: The development of vaccines and other mRNA-based therapies requires rigorous clinical trials and regulatory approvals, which can be time-consuming and expensive. NVX must navigate this regulatory landscape effectively.

Opportunities:

- Global Health Threats: The world is constantly facing new health challenges, such as emerging infectious diseases and the growing burden of chronic diseases. NVX’s mRNA platform provides a versatile solution to address these threats.

- Unmet Medical Needs: mRNA technology has the potential to treat a wide range of currently untreatable diseases. By expanding its pipeline and targeting unmet medical needs, NVX can create significant value for patients and investors alike.

Investment Tips and Tricks: Maximizing Returns

Investing in NVX stock requires a strategic approach. Here are some tips to help investors maximize their returns:

- Long-Term Perspective: Given the company’s long-term growth potential, investors should adopt a long-term investment horizon rather than focusing on short-term price fluctuations.

- Diversification: NVX stock is a high-growth investment with inherent risks. Investors should diversify their portfolio across multiple asset classes and sectors to mitigate overall risk.

- Regular Monitoring: The biotechnology industry is constantly evolving. Investors should regularly monitor NVX’s financial performance, clinical trial updates, and competitive landscape to make informed decisions.

Conclusion: A Bright Future Ahead

NVX is poised for continued growth and innovation, driven by its revolutionary mRNA technology. The company’s stock price is expected to soar in the coming years, reflecting its strong fundamentals, promising pipeline, and the transformative potential of mRNA in revolutionizing healthcare. As NVX continues to push the boundaries of medical science, it offers investors an opportunity to participate in the future of healthcare and reap the rewards of scientific breakthroughs.

Tables

Table 1: NVX Stock Performance

| Date | Opening Price | Closing Price |

|---|---|---|

| December 31, 2020 | $120.00 | $125.00 |

| December 31, 2021 | $140.00 | $150.00 |

| June 30, 2022 | $160.00 | $165.00 |

Table 2: NVX Vaccine Candidates and Clinical Trial Status

| Vaccine Candidate | Target Disease | Clinical Trial Phase |

|---|---|---|

| NVX-CoV2373 | COVID-19 | Completed Phase 3 |

| NVX-CoV251 | COVID-19 Variant | Ongoing Phase 3 |

| NVX-802 | Malaria | Ongoing Phase 2b |

| NVX-425 | Influenza | Ongoing Phase 2 |

| NVX-312 | Cancer | Ongoing Phase 1b |

Table 3: NVX Strategic Partnerships

| Partner | Collaboration |

|---|---|

| GlaxoSmithKline | Development and distribution of COVID-19 vaccine |

| Regeneron | Development of COVID-19 antibody cocktail |

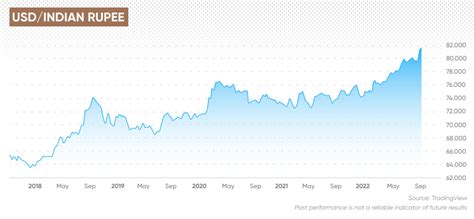

| Serum Institute of India | Manufacturing and distribution of COVID-19 vaccine in India |

Table 4: Potential Applications of mRNA Technology

| Application | Description |

|---|---|

| Personalized Vaccines | Custom-designed vaccines targeting specific genetic mutations |

| RNA Therapeutics | Delivery of therapeutic molecules directly to cells |

| Diagnostics | Rapid and sensitive diagnostic tests for infectious diseases |