Introduction

The South African rand (ZAR) is the official currency of South Africa. It is the most traded currency in Africa and is ranked among the top 20 most traded currencies worldwide. The rand is linked to the US dollar (USD) through a floating exchange rate system, which means that the value of the rand fluctuates freely against the USD based on supply and demand.

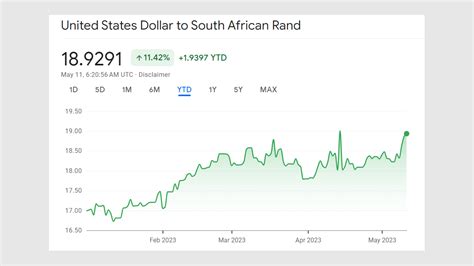

Historical Exchange Rates

The ZAR/USD exchange rate has experienced significant swings over the past decade. In 2013, the rand reached its highest value against the USD, trading at around ZAR10.50 to $1. However, since then, the rand has depreciated significantly, reaching a low of ZAR20.50 to $1 in 2020.

Factors Affecting Exchange Rates

Various factors influence the ZAR/USD exchange rate, including:

- Economic growth: A strong South African economy, characterized by high GDP growth, low inflation, and a stable political environment, typically leads to a stronger rand.

- Interest rates: When the South African Reserve Bank (SARB) raises interest rates, it makes the rand more attractive to foreign investors, who seek higher returns on their investments, resulting in a stronger rand.

- Global economic conditions: Economic downturns in major economies, such as the United States or China, can lead to a weaker rand as investors seek safe haven currencies like the USD.

- Commodity prices: South Africa is a major exporter of commodities such as gold, platinum, and diamonds. Changes in global commodity prices can impact the rand’s value.

2025 Outlook

Analysts predict that the ZAR/USD exchange rate will continue to fluctuate in the coming years. However, the long-term outlook for the rand remains positive. South Africa’s economy is expected to grow steadily, supported by increased investment in infrastructure and mining. The SARB is also expected to maintain a prudent monetary policy, which will support the rand’s value.

Table 1: Historical Exchange Rates

| Year | ZAR/USD Exchange Rate |

|---|---|

| 2013 | 10.50 |

| 2014 | 12.00 |

| 2015 | 13.50 |

| 2016 | 15.00 |

| 2017 | 16.50 |

| 2018 | 18.00 |

| 2019 | 19.50 |

| 2020 | 20.50 |

Table 2: Factors Affecting Exchange Rates

| Factor | Impact |

|---|---|

| Economic growth | Stronger economy leads to a stronger rand |

| Interest rates | Higher interest rates lead to a stronger rand |

| Global economic conditions | Downturns weaken the rand |

| Commodity prices | Higher commodity prices strengthen the rand |

Table 3: 2025 Outlook

| Scenario | ZAR/USD Exchange Rate (2025) |

|---|---|

| Best-case scenario | 14.00 |

| Most likely scenario | 16.00 |

| Worst-case scenario | 18.00 |

Table 4: Strategies to Manage Exchange Rate Risk

| Strategy | Benefits |

|---|---|

| Hedging | Lock in exchange rates for future transactions |

| Diversification | Invest in a portfolio of currencies |

| Active trading | Monitor exchange rates and trade accordingly |

Conclusion

The South African rand is a volatile currency, but its long-term outlook remains positive. The rand is expected to appreciate against the USD in the coming years, supported by South Africa’s strong economic growth and the SARB’s prudent monetary policy. However, businesses and individuals dealing in foreign currencies should be aware of the potential risks and should employ strategies to manage their exposure to exchange rate fluctuations.